Two SoftBank-backed tech companies, Better (merging with AURC) and Grab (merger with AGC approved today), are about to receive a major capital infusion.

Better, announced it reworked its merger agreement to give the company access to $750M bridge financing now while Grab is set to close its SPAC merger tomorrow, giving the Southeast Asian “super-app” an estimated $4.5B in cash proceeds.

Discover and track all of the SPACs at spactrack.net.

If you haven’t subscribed to this Free nightly newsletter, you can do so below.

The Stats:

The Deals:

1) Adit EdTech Acquisition Corp. (ADEX: warrants +1.77%) & Griid Infrastructure

Merger Partner Description:

GRIID, an American infrastructure company, is a vertically integrated bitcoin self-mining company that owns and operates a growing portfolio of bitcoin mining facilities across the United States. Founded in 2018 and headquartered in Cincinnati, Ohio, GRIID has secured one of the largest and lowest-cost power pipelines in the industry with a focus on carbon-free generation partners. With its unique vertically integrated business model and power pipeline, GRIID is leading the global effort to support the Bitcoin network and carbon-free energy markets.

Valuation: $3.3B EV

PIPE: No PIPE

Merger Votes/ Completions:

Merger Vote Set: Roman DBDR Tech Acquisition Corp. (DBDR) & CompuSecure: 12/23

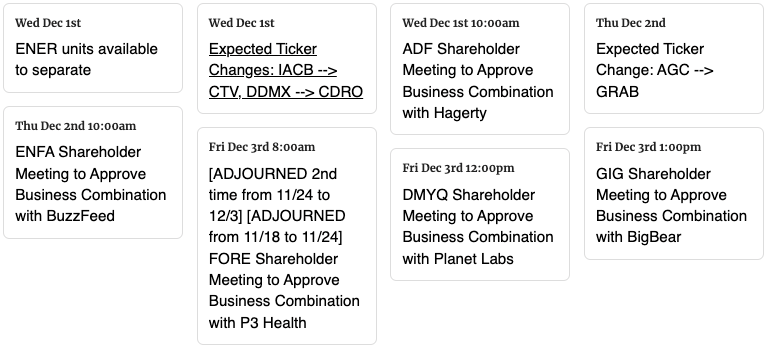

DD3 Acquisition Corp. II (DDMX) completes its merger with Codere Online. Will trade as CDRO starting tomorrow

The transaction raised appx $116M after an estimated ~61% of public shares were redeemed

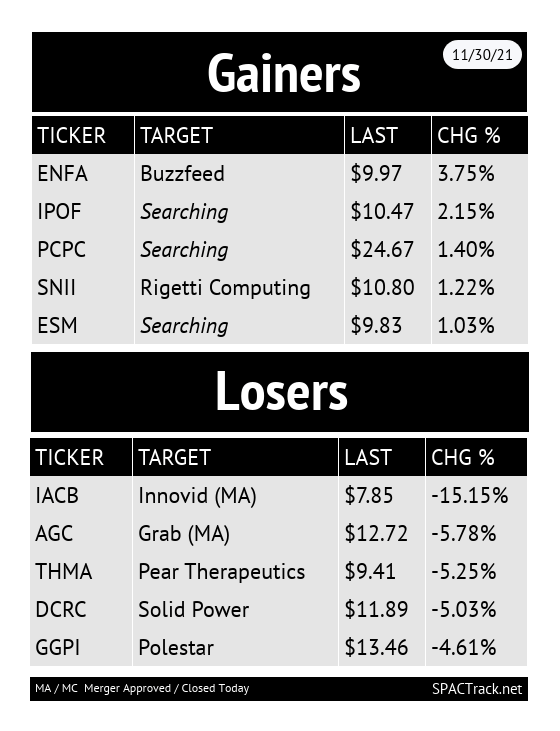

ION Acquisition Corp 2, Ltd. (IACB) shareholders approved its merger with Innovid

Closing is expected to be tomorrow, 11/30, with the ticker change to CTV on 12/1

The transaction raised appx $251M after 19.6M shares were redeemed (an estimated ~77% of the public shares)

Thimble Point Acquisition Corp. (THMA) shareholders approved its merger with Pear Therapeutics

Altimeter Growth Corp. (AGC) shareholders approved its merger with Grab

Closing is expected to be on 12/1, with the ticker change to GRAB on 12/2

8.5k shares were redeemed or 0.02% of the public shares

TPG Pace Solutions Corp. (TPGS) shareholders approved its merger with Vacasa

If you find this newsletter useful, feel free to share it with a friend and suggest they subscribe:

Tracking De-SPAC S-1s (including PIPE resale registrations):

No activity.

Quick News:

GigCapital4, Inc. (GIG) lowers the valuation of BigBear.ai by 15% to $1.05B to “reflect current market conditions” and enters into a $75M backstop agreement with AE Industrial Partners

Aurora Acquisition Corp. (AURC) announces it has reworked the PIPE/backstop financing for its merger with Better

The commitment for up to $1.78B that Better was to receive from SoftBank (existing investor and PIPE investor) and Novator (SPAC sponsor) in the form of a $1.5B PIPE and $278M backstop has been replaced by an up to $1.5B commitment from SoftBank and Novator that includes a $750M bridge financing funded immediately (will convert into common equity upon closing) and an additional $750M convertible note at Better’s option after closing

Under the previous arrangement, $950M of the up to $1.78B commitment was to be used to purchase shares from existing Better shareholders.

Under the new arrangement, all of the $1.5B proceeds will “go directly to Better’s balance sheet (i.e., no secondary purchase from existing Better shareholders) to accelerate growth”.

IPOs to begin trading tomorrow*:

1) Roth CH Acquisition V Co. Announces Pricing of $100 Million Initial Public Offering (ROCL-U)

2) Capitalworks Emerging Markets Acquisition Corp Announces Pricing of $200 Million Initial Public Offering (CMCA-U)

*Priced as of this writing

New S-1s:

None today

Upcoming Dates:

This Week’s Announced Shareholder Meetings, Unit Splits, Warrant Redemptions, Earnings, and Expected Ticker Changes

See the full calendar here.

Thanks for reading,