Good evening,

Please enjoy this week’s edition of the Event-Driven Edge newsletter- the most comprehensive weekly recap of event-driven and thematic activity in the US stock market.

Note: To access the source material/ articles for any update below, click on the link on each company name to be routed to the company page on ListingTrack.io where you will find our Curated Feed, which has links to all the source articles (for Pro users only).

Thanks,

Nick

Market Performance & News

U.S. stocks extended their rebound, closing the week at fresh record highs across all major indexes despite economic uncertainty from a government shutdown and postponed data releases. The S&P 500 rose 1.09%, the Nasdaq gained 1.32%, and the Russell 2000 led with a 1.72% advance, while defensive flows drove gold to a 6.7% weekly surge and Treasuries rallied again.

ListingTrack Theme Performance

This week’s ListingTrack Theme Performance table offers a snapshot of sector trends and innovation leadership. Quantum saw Rigetti Computing (RGTI) up 28%, Nuclear's top gainer was KULR Technology Group (KULR) at 28%, and Defense was paced by BlackSky Technology (BKSY) surging 30%. In Core AI / Infra, SanDisk (SNDK) rallied 32%, Pagaya Technologies (PGY) dropped 15%. Next Wave AI saw Richtech Robotics (RR) soar 47% and Klaviyo (KVYO) fall 16%. New Space's top mover was AST SpaceMobile (ASTS), up 38%, while Firefly Aerospace (FLY) sank 24%. Big Tech was led by NVIDIA (NVDA) up 5%, and Netflix (NFLX) off 5%. Logistics/LogTech featured Symbotic (SYM) up 15% and Forward Air (FWRD) down 12%.

For a detailed company-by-company breakdown, including recent M&A activity, listing plans and rumors, pre-IPO fundraising, upcoming earnings reports, and event-driven news, users can visit each theme page to explore in-depth analysis and the latest developments. See all our theme coverage on our Theme Hub.

Index Performance

Earnings & Major Events

All Earnings Above $5B Market Cap:

IPOs & Other Public Listing Recap

IPO/ Listing Action

Past week

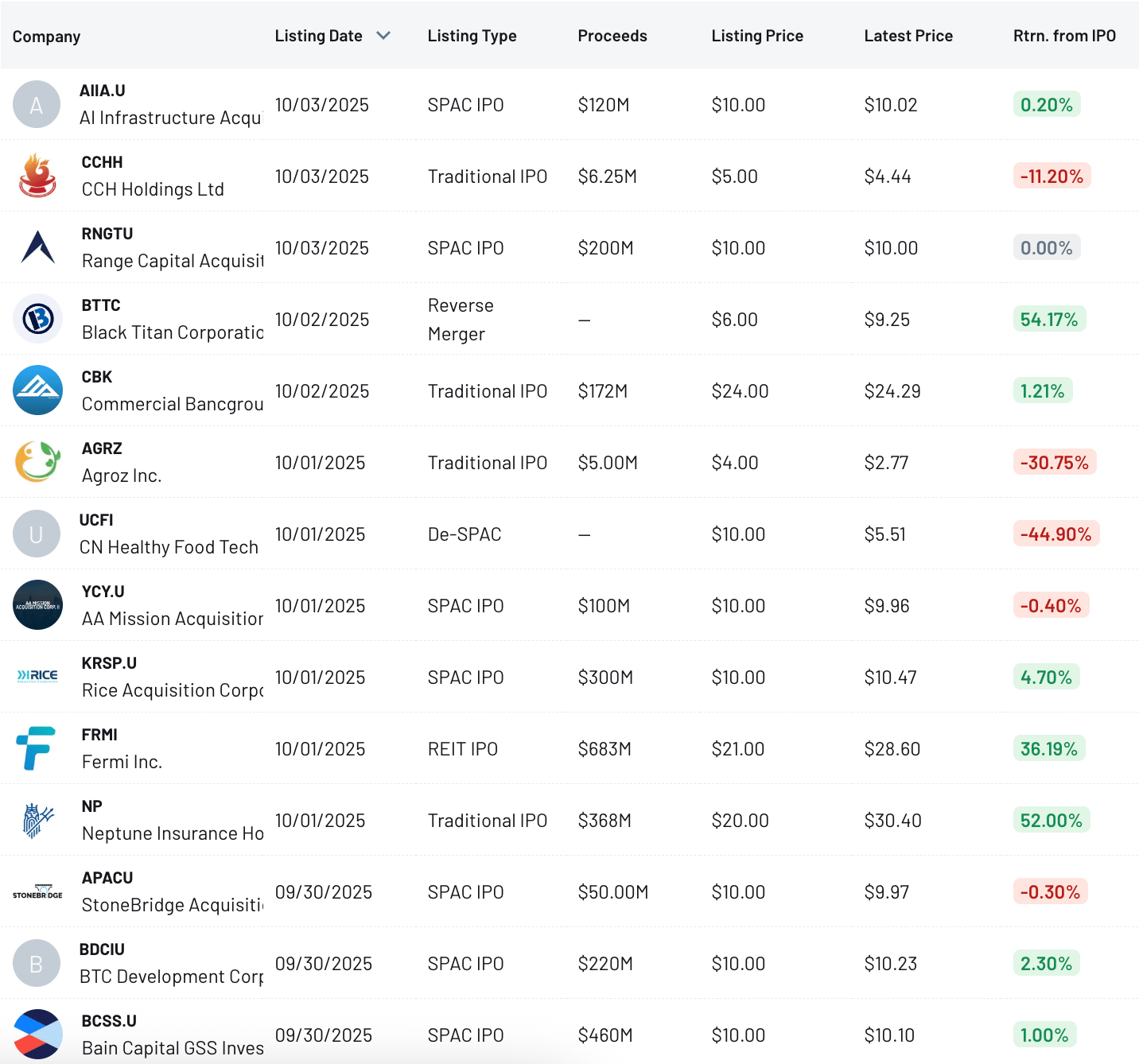

This week, there were 15 listings:

6 Traditional IPOs led by Neptune Insurance (NP), Commercial Bancgroup (CBK), CCH Holdings (CCHH), and Knorex (KNRX)

1 REIT IPO from Fermi Inc. (FRMI)

6 SPAC IPOs

1 De-SPAC and 1 Reverse Merger listing

See more: Latest Listings

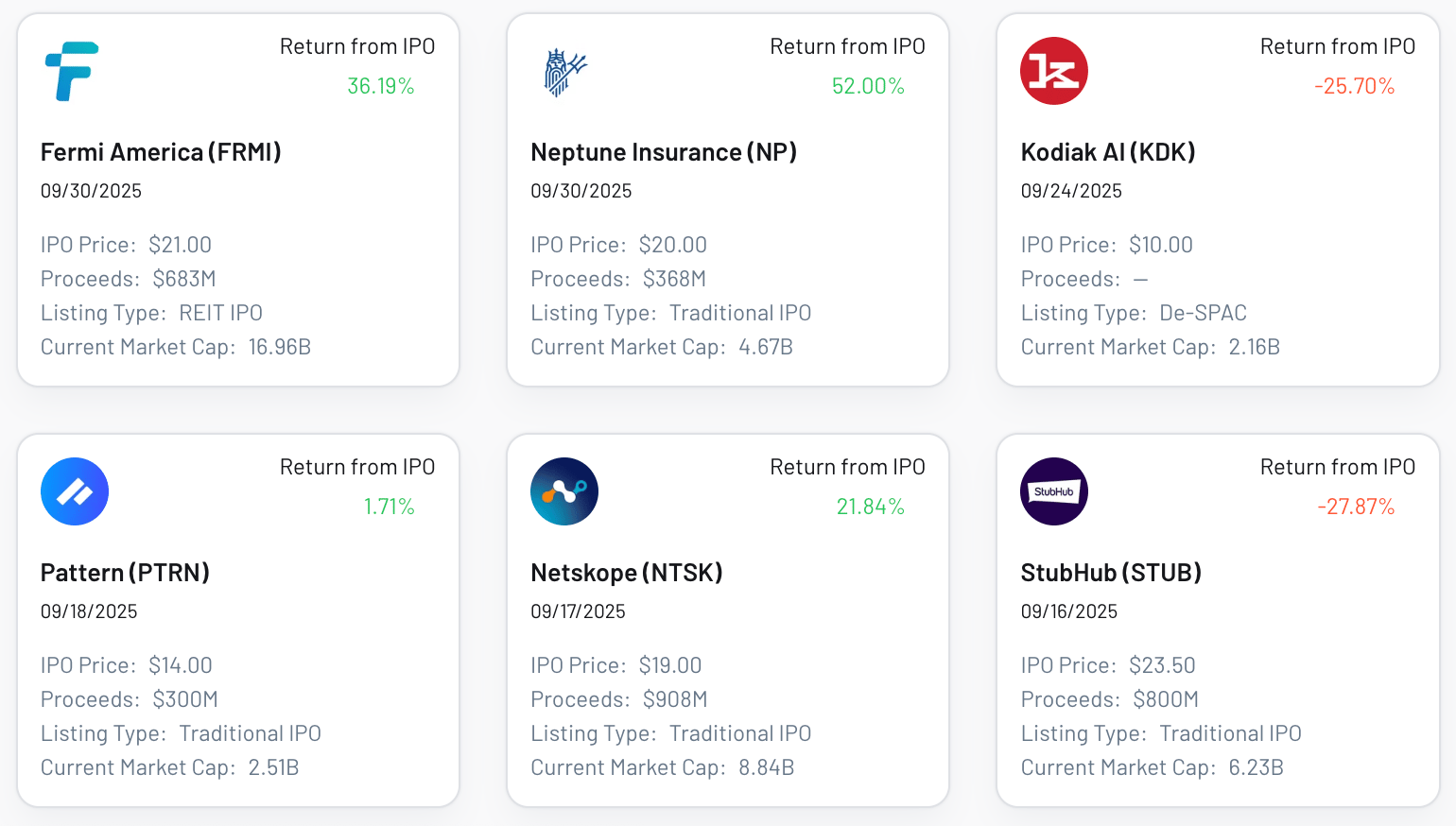

Checking in on the last 6 listings above $2B market cap:

3 New Listings Expected Listings This Week:

See the calendar here: Listing Calendar

Industry/Theme Recap

AI, Deep Tech (Robotics, Quantum, Nuclear), Aerospace/Defense, Consumer, Crypto, Energy/Materials/Industrials, Financials/Real Estate, Healthcare, Logistics/Transport/Automotive, Media/Telecom

AI

Live Coverage: Core AI & Infrastructure theme page, Next Wave AI theme page

Listings - Launches/ Plans / Rumors:

Knorex (KNRX -25% Wkly, $82.47M MC): Knorex (KNRX) priced its $12 million IPO at $4 per share. Est. market cap at IPO of $121.7 million. Lead Left underwriter: Craft Capital Management.

Fermi America (FRMI 36% Wkly, $16.95B MC): Fermi (FRMI), a next-generation electric grids and AI-driven energy infrastructure firm -founded by Rick Perry, priced its $650 million IPO at $21 per share. Est. market cap at IPO of $11.86 billion. Lead Left underwriter: UBS Investment Bank.

Cerebras Systems withdrew its IPO plans after raising $1.1 billion at an $8.1 billion valuation privately. The AI chipmaker, challenging Nvidia, cited outdated prospectus given rapid AI sector developments, but still hopes to list. CEO Andrew Feldman states it's a timing issue, not a shift from public markets. Cerebras also shifted its business model to cloud-based AI services.

Pre-IPO Financings (Series D+ and Prominent):

Cohere secured an additional $100 million, boosting its valuation to $7 billion, to accelerate global adoption of its enterprise AI technology. This funding supports scaling operations across North America, APAC, and EMEA, and coincides with the launch of Command A, a new suite of frontier models optimized for multilingual, agentic business applications. Cohere also deepened partnerships with Dell, RBC, Bell, Fujitsu, SAP, and AMD, and welcomed new investors BDC and Nexxus Capital.

OpenAI completed a $6.6 billion secondary share sale, valuing the company at $500 billion, making it the world's most valuable private company ahead of SpaceX. The sale, which allowed employees to sell shares, saw about two-thirds of the authorized $10.3 billion sold. Lower participation is seen internally as a sign of confidence. This follows a $1.5 billion SoftBank-led tender, reflecting strong investor demand and sharply higher valuations.

Rebellions, a South Korean AI chip startup, raised $250 million in a Series C round at a $1.4 billion valuation. The funding, led by Arm with participation from Samsung Ventures and others, will be used to mass-produce its REBEL-Quad chip and accelerate development, positioning Rebellions to expand in the growing AI infrastructure market amid competition with Nvidia and AMD.

Black Forest Labs, an AI image generation startup, is in early talks to raise $200-$300 million at a potential $4 billion valuation. Founded in August 2024, the company develops proprietary AI models that generate realistic images from text and adapt existing pictures, highlighting continued investor interest in advanced AI platforms.

Supabase, a Postgres development platform, raised $100 million in a Series E at a $5 billion valuation, led by Accel and Peak XV, with participation from Figma Ventures and existing backers. This brings their total funding to over $500 million, just four months after their Series D. Serving over 100,000 customers, including PwC, McDonald's, and Github Next, Supabase plans to allocate a portion of the round for community investment, solidifying its position as a preferred backend for AI-driven development, utilized by over 4 million developers.

Vercel, the company behind v0, Next.js, and the AI Cloud, secured a $300M Series F funding round, achieving a post-money valuation of $9.3 billion. A secondary tender offer of approximately $300M for employees and early investors will close in November. The round was led by Accel and GIC, with new investors including BlackRock, StepStone, Khosla Ventures, Schroders, Adams Street Partners, and General Catalyst. Existing investors GV, Notable Capital, Salesforce Ventures, and Tiger Global also participated.

Feedzai, an AI-native RiskOps platform focused on financial crime prevention, secured $75 million in new funding from Lince Capital, Iberis Capital, Explorer Investments, and existing backers Oxy Capital and Buenavista Equity Partners, raising its valuation to over $2 billion.

Other Industry Activity:

Aligned Data Centers: BlackRock's GIP is in advanced negotiations to acquire Aligned Data Centers for around $40 billion, driven by surging AI demand. Mubadala's MGX is also expected to participate. This deal, if finalized, would be one of the year's largest and a significant bet on AI infrastructure, positioning GIP as a key player in hyperscale data centers. (Deal Page)

CoreWeave secured a $14.2 billion deal with Meta Platforms to provide computing power through 2031, with an option to extend to 2032. This agreement, giving Meta access to Nvidia's GB300 systems, is one of CoreWeave's largest, following OpenAI commitments. CoreWeave's stock jumped nearly 16% on the news, diversifying its customer base beyond Microsoft, which previously contributed 71% of its revenue. CoreWeave's stock has more than tripled since its March IPO.

OpenAI: Stripe partnered with OpenAI to enable in-app purchases through ChatGPT, starting with Etsy and soon Shopify. ChatGPT will act as a digital personal shopper, leveraging Stripe's payments infrastructure. This marks OpenAI's entry into e-commerce, following a similar PayPal-Google AI-payments tie-up. The announcement boosted Etsy shares by 16% and Shopify by over 6%.

Meta (META -8.71% Wkly, $1.79T MC): Meta Platforms is acquiring AI chip startup Rivos to accelerate semiconductor development and reduce reliance on Nvidia GPUs. Rivos was developing its own GPU. Meta already has an internal chip program (Meta Training and Inference Accelerator) but spends billions annually on Nvidia hardware. CEO Mark Zuckerberg aims to speed up internal chip progress for Meta's “superintelligence” initiative. The acquisition aims to strengthen Meta’s control over its AI infrastructure and accelerate custom silicon efforts.

Aerospace/ Defense

Live Coverage: Defense theme page

Listings - Launches/ Plans / Rumors:

Beta Technologies, a U.S. electric aircraft maker, filed for an IPO, highlighting its ALIA CTOL electric aircraft. The company emphasizes 42% lower operating costs versus conventional planes due to its simplified design. Beta also develops propulsion systems, charging infrastructure, and components for the emerging electric aviation sector.

Other Industry Activity:

Palantir (PLTR -5.11% Wkly, $393.61B MC): An internal U.S. Army memo warned that the new battlefield communications network NGC2, developed by Anduril, Palantir, Microsoft, and others under a $100 million contract, has “fundamental security” flaws, including unrestricted access to classified data, no user activity logging, and unvetted third-party vulnerabilities, though issues are reportedly being fixed. This highlights tensions between Silicon Valley's rapid development and critical defense systems. Palantir shares fell 7.5% on the disclosure.

⚡ Featured Partner

Looking for unbiased, fact-based news? Join 1440 today.

Join over 4 million Americans who start their day with 1440 – your daily digest for unbiased, fact-centric news. From politics to sports, we cover it all by analyzing over 100 sources. Our concise, 5-minute read lands in your inbox each morning at no cost. Experience news without the noise; let 1440 help you make up your own mind. Sign up now and invite your friends and family to be part of the informed.

Consumer & Retail

Listings - Launches/ Plans / Rumors:

Agroz (AGRZ -31% Wkly, $60.04M MC): Agroz (AGRZ), a vertically integrated agricultural technology company, priced its $5 million IPO at $4 per share. Est. market cap at IPO of $90.3 million. Lead Left underwriter: US Tiger Securities.

Phoenix Education (University of Phoenix): Phoenix Education Partners (PXED Wkly, $0.00M MC) launched its IPO roadshow, aiming to raise $132-$140 million by selling 4.25 million shares at $31-33 each, valuing the company at $1.14 billion at the midpoint. The IPO is expected to price on Oct 7 and begin trading on NYSE on Oct 8. Lead underwriters include Morgan Stanley, Goldman Sachs, BMO Capital Markets, and Jefferies.

Park Dental Partners (PARK) launched its IPO roadshow, aiming to raise $18-21 million by selling 1.5 million shares at $12-14 each. The market cap at pricing midpoint is $54 million. IPO is expected to price on Oct 1 and trade on NASDAQ on Oct 2, with Northland Capital Markets and Craig-Hallum as lead underwriters.

Etsy (ETSY 11.37% Wkly, $7.17B MC): Etsy is moving its stock listing from Nasdaq to the NYSE, with trading starting October 13. Shares rose nearly 41% year-to-date, closing up 15.8% on Monday at $74.34, the highest since February 2024. This follows a partnership with OpenAI for instant checkout on ChatGPT and stronger-than-expected Q2 results driven by demand for handcrafted goods.

Corteva Seed Spinoff: Corteva plans to split its seed and crop protection businesses into two public companies by H2 2026 to allow independent growth. Shares fell 7% on the news. The crop protection unit will handle environmental liabilities, including PFAS claims. In 2024, seeds were 57% of revenue. This breakup follows six years of cost cuts since Corteva formed from DowDuPont's 2019 split.

Iron Horse (IROH -59.70% Wkly, $36.27M MC): Iron Horse Acquisitions (IROH) completed its business combination with Rosey Sea, parent of Zhong Guo Liang Tou Group (d/b/a China Food Investment, or CFI). The combined entity will operate as CN Healthy Food Tech Group and begin trading on Nasdaq under the tickers UCFI (common stock) and UCFIW (warrants) starting October 1, 2025. The merger was approved by Iron Horse shareholders on June 20, 2025. CFI, based in Hong Kong, focuses on food biotech and healthy product R&D, production, and sales.

Public M&A:

Electronic Arts (EA 15.95% Wkly, $50.21B MC): Electronic Arts (EA) is being acquired by a consortium including Saudi Arabia’s Public Investment Fund (PIF), Silver Lake, and Affinity Partners for $55 billion in an all-cash deal, the largest sponsor-led take-private ever. Shareholders get $210/share, a 25% premium. PIF rolls over its 9.9% stake, with $36 billion equity and $20 billion debt financing. EA remains in Redwood City, led by CEO Andrew Wilson, with a Q1 FY27 close expected. (Deal Page)

More: S&P Global Ratings expects to downgrade Electronic Arts (EA) to junk status after its $55 billion buyout by Saudi Arabia’s Public Investment Fund, Silver Lake, and Affinity Partners closes. The downgrade is due to an additional $20 billion in new debt financing. EA is currently rated BBB+ by S&P, but the leveraged buyout will heavily increase its debt. JPMorgan committed to the $20 billion financing package. Moody's and Fitch may also follow with similar downgrades once the deal is completed in mid-2026.

WK Kellogg Co: Ferrero Group completed its acquisition of WK Kellogg , with shareholders receiving $23.00 per share in cash; WK Kellogg has ceased trading on the NYSE, and the deal expands Ferrero’s North American presence by adding iconic cereal brands like Frosted Flakes, Rice Krispies, and Froot Loops to its portfolio. (Deal Page)

Big 5 Sporting Goods (BGFV) merged with Worldwide Golf and Capitol Hill Group, with shareholders receiving $1.45 per share (36% premium). Big 5 is now a wholly owned subsidiary of Capitol Hill Group, delisted from Nasdaq, and will operate independently while leveraging the partnership's combined resources. (Deal Page)

Inspirato (ISPO 2.39% Wkly, $37.41M MC): Inspirato (ISPO) reaffirmed its independent strategy after reviewing unsolicited acquisition interest, with its board concluding a sale was not in shareholders’ best interests and citing trailing 12-month EBITDA profitability achieved in Q2 2025.

Energy, Materials, and Industrials

Listings - Launches/ Plans / Rumors:

GigCapital4 (GIG): Hadron Energy, a light water micro modular reactor (MMR) technology developer, will merge with SPAC GigCapital7 (GIG 1.06% Wkly, $350.00M MC) to go public under ticker HDRN at a $1.2 billion pro forma valuation. Hadron shareholders will roll 100% equity for 100 million GIG shares. The combined company expects $200 million in trust cash. Hadron's management will continue to lead, with closing slated for early 2026. This positions their nuclear technology to meet rising electricity demand from AI and data centers.

Diversified Energy (DEC -2.28% Wkly, $1.07B MC): Diversified Energy (DEC) is shifting its primary listing to the New York Stock Exchange, while keeping a secondary London listing. This move is driven by its U.S.-based assets, management, and majority U.S. shareholder base (over 65% as of June). The Birmingham, Alabama-based producer, first listed in London in 2017 and NYSE in 2023, sees the U.S. as its natural long-term listing venue due to stronger capital market conditions.

Qnity (DuPont Electronics spinoff): DuPont (DD) said the SEC declared effective the Form 10 registration statement for Qnity Electronics, its electronics business spin-off, marking one of the final milestones ahead of the planned separation into two independent public companies on November 1, 2025, pending customary conditions and board approval.

Solstice Advanced Materials: Honeywell will spin off Solstice Advanced Materials, with a record date of October 17, 2025, and distribution on October 30, 2025. Shareholders get one Solstice share for every four Honeywell shares. Solstice will trade on Nasdaq under SOLS. A "when-issued" period (SOLS WI) starts October 20. An Investor Day is set for October 8 in NYC.

3M Industrials Spinoff: 3M is considering selling businesses within its safety and industrials unit, which generated about $11 billion in revenue last year. This is part of an effort to shed low-growth operations, with Goldman Sachs engaged for review. No final decision has been made. Assets under consideration include aftermarket auto products, personal safety equipment, industrial adhesives, and tapes, as 3M aims to streamline its portfolio and focus on higher-growth opportunities.

Rice 3 (RAC III) (KRSP.U 5% Wkly): SPAC Rice Acquisition 3 (KRSP.U) priced its $300 million IPO at $10 per unit. Units include 1 common share, 1/6 Warrant. Focus: Energy Value Chain (Upstream O&G, Power, Infrastructure, Critical Metals). Lead Left underwriter: Barclays.

Public M&A:

Cool Company (CLCO 22.38% Wkly, $512.70M MC): CoolCo, an LNG carrier operator, will be acquired by EPS Ventures for $9.65 per share in cash. This represents a 26% premium to the September 22, 2025 close. EPS already owns 59.3% of CoolCo. The transaction is expected to close in Q4 2025 or Q1 2026, pending approvals. (Deal Page)

Civitas Resources (CIVI 13.21% Wkly, $3.23B MC): Civitas Resources, an oil and gas explorer, is exploring a sale to gain scale. The Denver-based company is considering a tie-up with a similarly sized or larger peer. Civitas has over $5 billion in debt from recent acquisitions and has been selling assets to pay it down. The company also recently announced CEO Chris Doyle's departure. (Deal Page)

Veeco Instruments (VECO 10.72% Wkly, $1.90B MC): Axcelis Technologies and Veeco Instruments announced a $4.4 billion all-stock merger, creating a leading semiconductor equipment company. Veeco shareholders will own 42% of the combined entity, with Axcelis shareholders holding 58%. Pro forma 2024 figures show $1.7 billion in revenue, 44% non-GAAP gross margin, and $387 million in adjusted EBITDA. The merger aims to enhance R&D, broaden portfolios, and achieve synergies. Both boards unanimously approved the deal. (Deal Page)

Atkore (ATKR 6.05% Wkly, $2.15B MC): Atkore is conducting a strategic review to focus on its core electrical infrastructure business. This includes evaluating divestitures of non-core assets like its HDPE pipe unit and implementing cost-saving measures such as workforce reductions and facility consolidation by 2026. The company, which generated $3.2 billion in FY 2024 revenue, aims to streamline operations, improve cost structure, and enhance shareholder value. (Deal Page)

The AES (AES 11.72% Wkly, $10.38B MC): Global Infrastructure Partners (GIP), owned by BlackRock, is nearing a $38 billion deal to acquire AES, a major U.S.-listed utility. AES, with operations in 14 countries and $29 billion in debt, is an attractive target due to its investments in renewable energy grids supplying hyperscale data centers for Microsoft, Meta, and Alphabet, amid soaring AI energy demand. This acquisition would be one of the largest infrastructure takeovers and expand GIP's portfolio, positioning infrastructure funds at the center of AI-driven energy expansion. (Deal Page)

Allete (ALE 5.02% Wkly, $3.90B MC): BlackRock's Global Infrastructure Partners received Minnesota Public Utilities Commission approval for its $6B acquisition of Allete, a Duluth-based utility. This deal, including regulatory conditions, advances BlackRock's strategy to expand its U.S. power infrastructure ownership. Allete expects stable long-term capital and reduced public market volatility, while regulators emphasized oversight for reliable and affordable service to Minnesota customers. (Deal Page)

Other Industry Activity:

Atkore (ATKR 6.05% Wkly, $2.15B MC): Irenic Capital Management has disclosed a 2.5% stake in Atkore (ATKR) and is pressuring the Harvey, Illinois-based electrical manufacturing company to explore a sale, according to people familiar with the matter. The activist investor has been engaging privately with Atkore’s board and management and argues that a sale to private equity would deliver the best outcome for shareholders.

Wolfspeed (WOLF 992.83% Wkly, $3.81B MC): Wolfspeed (WOLF) completed Chapter 11 restructuring, strengthening its balance sheet by reducing debt by ~70% and extending maturities to 2030, cutting annual cash interest by ~60%. The company has ample liquidity and a self-funded plan to continue supplying silicon carbide solutions and leverage its 200mm manufacturing footprint for sustainable growth. Wolfspeed also performed a stock merger where shareholders will receive 0.008352 shares of WOLF and a contingent value right (CVR) for each share previously held.

Enterprise Software, Cybersecurity

Other Industry Activity:

Workiva (WK 10.22% Wkly, $4.92B MC): Irenic Capital Management has acquired a ~2% stake in Workiva, pressuring the company to boost efficiency, improve governance, and consider a sale. The activist hedge fund advocates for collapsing the dual-class share structure, annual director elections, and appointing new board members, including Irenic's Krishna Korupolu. Irenic believes new oversight will enable Workiva to review strategic alternatives, citing strong private equity interest in financial software. Workiva reportedly had PE interest three years ago.

Fintech & Financial Services, Insurance, Real Estate

Listings - Launches/ Plans / Rumors:

Sony Financial Group surged 36% in its Tokyo Stock Exchange debut after spinning off from Sony Group, valuing the financial arm (including Sony Life Insurance, Sony Assurance, and Sony Bank) at about 1 trillion yen ($6.7 billion).

Neptune Insurance (NP 52% Wkly, $2.88B MC) priced its $368.4 million IPO at $20 per share. Est. market cap at IPO of $3.07 billion. Lead Left underwriter: Morgan Stanley.

Wealthfront, a robo-advisor, filed for a U.S. IPO, planning to list on Nasdaq as WLTH. It reported $88.2 billion in AUM and 1.3 million customers as of July 31, 2025, with $194.4 million in net income on $308.9 million in revenue for fiscal 2025. CEO David Fortunato leads the company, which confidentially filed in June. A prior $1.4 billion acquisition by UBS in 2022 failed due to rising interest rates impacting fintech valuations.

SPAC Bain Capital GSS (BCSS.U 1% Wkly): Bain Capital GSS Investment (BCSS.U) priced its $400 million IPO at $10 per unit. Units include 1 common share and 1 right (1/5th of a share). Focus: N/A. Lead Left underwriter: Citigroup.

Public M&A:

Rocket Mortgage (RKT -13.21% Wkly, $4.55B MC): Rocket Companies (RKT) announced it has completed its $14.2 billion acquisition of Mr. Cooper Group, uniting the country’s largest home loan originator with the largest mortgage servicer. The combined company now manages a servicing portfolio covering nearly 10 million homeowners, marking one of the most significant consolidations in the U.S. mortgage industry. (Deal Page)

Commercial Bancgroup (CBK 1.2% Wkly, $332.72M MC): Commercial Bancgroup (CBK) priced its upsized IPO of 7,173,092 shares at $24.00, with trading beginning Oct 2, 2025. The company is selling 1,458,334 shares, and selling shareholders are selling 5,714,758 shares. Underwriters have a 30-day option for 1,075,963 additional shares. Commercial expects to raise $35 million to repay debt, redeem debentures, and for general corporate purposes, not receiving proceeds from selling shareholders. Hovde Group is the sole book-running manager.

Guaranty Bancshares: Glacier Bancorp (GBCI) completed its acquisition of Guaranty Bancshares (GNTY -1.99% Wkly, $553.20M MC), forming Guaranty Bank & Trust, Division of Glacier Bank, with 33 locations across Texas and adding $3.1B in assets, $2.1B in loans, and $2.7B in deposits as of June 30, 2025. (Deal Page)

Other Industry Activity:

Global Payments (GPN 1.63% Wkly, $21.34B MC): Global Payments appointed Patricia Watson and Archana Deskus as independent directors, expanding its board to 12 members. They also agreed with Elliott Investment Management to add a third mutually approved independent director by the 2026 annual meeting and established an Integration Committee for the Worldpay acquisition.

Healthcare

Listings - Launches/ Plans / Rumors:

AstraZeneca (AZN 11.84% Wkly, $264.45B MC): AstraZeneca plans to switch its U.S. listing from Nasdaq ADRs to common shares on the NYSE to broaden its investor base and simplify its global listing structure. This move, driven by tax considerations and increased attractiveness of common shares to U.S. institutions, aims to boost liquidity and valuation. Shareholders will vote in November. AstraZeneca will maintain primary listings in London and Stockholm.

Starry Sea Acquisition (SSEA) plans to merge with Forever Young International, a China-based health industry company. The proposed transaction values Forever Young at $750–900 million.

Cortigent: Vivani Medical (VANI) said it will temporarily withdraw the previously announced record date for the planned spin-off of its brain implant subsidiary, Cortigent, citing delays tied to the ongoing U.S. federal government shutdown.

AnaptysBio Biopharma Co: AnaptysBio plans to split into two public companies by year-end 2026: Royalty Management (managing Jemperli royalties from GSK and imsidolimab from Vanda) and Biopharma (developing immunology therapeutics like rosnilimab, ANB033, and ANB101). This aims to align investors with distinct business models and growth strategies.

Clywedog Therapeutics: Barinthus Biotherapeutics and Clywedog Therapeutics announced an all-stock reverse merger to form Clywedog Therapeutics (CLYD), focusing on metabolic and autoimmune diseases. The transaction is expected to close in 1H 2026.

Public M&A:

Merus (MRUS 38.21% Wkly, $7.13B MC): Genmab A/S is acquiring Merus N.V. for $8.0 billion ($97.00/share), a 41% premium, with closing aimed for early Q1 2026. This all-cash tender offer, approved by both boards, adds Merus’ late-stage oncology asset petosemtamab to Genmab’s pipeline, accelerating its shift to a fully owned model and supporting multiple drug launches by 2027. Financing includes cash on hand and $5.5 billion in committed debt from Morgan Stanley. (Deal Page)

Tourmaline Bio (TRML 0.36% Wkly, $1.23B MC): Novartis has commenced a tender offer through its subsidiary Torino Merger Sub to acquire all outstanding shares of Tourmaline Bio (TRML) for $48 per share in cash, with the offer set to expire at 11:59 p.m. on October 27. (Deal Page)

scPharmaceuticals (SCPH 0.71% Wkly, $302.20M MC): MannKind (MNKD) is acquiring scPharmaceuticals (SCPH) via a tender offer set to expire October 6, 2025, with merger closure by market open October 7. SCPH shares will be halted October 6 after-hours, remain halted October 7, and suspended October 8. Shareholders receive $5.35 cash plus one CVR per share. (Deal Page)

Bright Health Group: NeueHealth (NEUE 0.49% Wkly, $60.94M MC) closed its $1.465B sale to an affiliate of New Enterprise Associates, with shareholders receiving $7.33 per share in cash while NEA, preferred holders, and management rolled equity into the new private entity. (Deal Page)

Theratechnologies (TSX: TH, Nasdaq: THTX) completed its acquisition by CB Biotechnology, an affiliate of Future Pak, under a Québec plan of arrangement, with shareholders receiving $3.01 in cash plus one CVR per share valued at $0.80 and payable up to $1.19 if milestones are achieved. (Deal Page)

Pre-IPO Financings (Series D+ and Prominent):

Thyme Care, a Nashville-based startup improving cancer patient experience, raised $97M in new funding at a $1B valuation, more than doubling last year's $480M. Now profitable and managing over $5B in oncology spending, Thyme Care has raised $275M to date. Backers include CVS Health, Humana, Memorial Hermann, Texas Oncology, and Morgan Health.

Star Therapeutics raised $125M in an oversubscribed Series D round, led by Sanofi Ventures and Viking Global Investors, with participation from Janus Henderson, Frazier Life Sciences, GordonMD Global, OrbiMed, RA Capital, Redmile, and QIA. The funds will advance its pipeline, including VGA039, a monoclonal antibody for bleeding disorders, now in a pivotal Phase 3 trial for von Willebrand disease.

Cartography Biosciences closed a $67M Series B, led by Pfizer Ventures, with participation from LG, Amgen, and existing investors. Michael Baran (Pfizer) joined the board, and Troy Wilson was named chairman. Proceeds will advance CBI-1214 into the clinic for colorectal cancer and accelerate other oncology programs from its ATLAS and SUMMIT platforms.

Other Industry Activity:

Acadia Healthcare (ACHC 22.58% Wkly, $2.51B MC): Khrom Capital, a 5.5% shareholder in Acadia Healthcare (ACHC), urged a strategic review, including a potential sale, due to years of underperformance, governance failures, and eroding investor confidence. Khrom criticized entrenched directors, delayed reforms, executive bonuses amid a DOJ probe, and missteps like the failed UK expansion and rising leverage, calling the past decade "lost" for shareholders compared to peers HCA and Tenet Healthcare.

Logistics, Transportation & Travel, Autos

Live Coverage: Logistics theme page

Pre-IPO Financings (Series D+ and Prominent):

Alvys, an AI-powered TMS provider, closed a $40 million Series B round, bringing total funding to $77 million. This raise reflects strong customer adoption and demand for intelligent freight automation, with Alvys reporting customer achievements like 28% higher monthly loads, 9% revenue growth, 90% faster accounting, and 80% less data entry, boosting carrier and broker efficiency.

Einride, a provider of digital, electric, and autonomous freight solutions, raised $100M in a Series D round from investors including EQT Ventures and IonQ. This funding, bringing total funding for the round to $100M, will support scaling autonomous freight deployments, deepening technology development, and expanding global operations.

ListingTrack Pro Spotlight

LTSheets: Structured datasets in one central spreadsheet

» LTSheets give you easy-to-use, filterable spreadsheets across various datasets:

Active Public M&A dashboard tracking all live mergers with US-listed targets, including deal terms, materials, ++

List of Pre-IPO companies along with filing information and expected IPO details

AI stocks dashboard filterable by our curated AI categories (Chips, Data Center, Specialized AI Software, ++)

Logistics stocks dashboard filterable by our curated categories (Parcel, FTL, LTL, Rail, LogTech, ++)

Robust Active SPACs tab including our curated SPAC data points along with commons, warrants, and units trading

SPAC merger progress

Separated SPAC Rights and SPAC Warrants tabs

Copy the sheet to your own account, and you’ll be able to easily sort and filter data, making your analysis process much more efficient.

Analysis of event-driven and theme-driven data has never been easier with LTSheets!

Media & Entertainment/ Communications

Listings - Launches/ Plans / Rumors:

Black Titan (TalenTec) (BTTC 54% Wkly, $47.46M MC): Malaysian HR tech software distributor Black Titan completed its reverse merger with Titan Pharmaceuticals (TTNP) on October 1, 2025.

Other Industry Activity:

Paramount Skydance (PSKY 0.90% Wkly, $12.80B MC): Paramount Skydance is set to acquire The Free Press for $150 million. Founder Bari Weiss is expected to become editor-in-chief of CBS News, reporting to CEO David Ellison. This acquisition signifies Ellison's plan to refresh CBS News and integrate new voices into Paramount's media empire, which includes MTV, Nickelodeon, and Paramount Pictures.

Thanks for reading. We welcome feedback on this newsletter and sponsorship opportunities at [email protected].

The team at ListingTrack

Market Data and Coverage: All market data presented is based on the stock prices at the close of the previous trading day. We cover the US market only at this time.

DISCLAIMER: The information provided in this newsletter is for informational purposes and for your convenience only and is not intended to be treated as financial, investment, tax, or other advice. The author or guest authors may have positions in any of the stocks discussed. ListingTrack and its parent, CommonFi, do not make any guarantees, representations, or warranties as to, and shall have no liability for, the timeliness, truthfulness, sequence, quality, completeness, or accuracy of any of the information or data provided in this newsletter or on the ListingTrack website.