Good evening,

Please enjoy this week’s edition of the Event-Driven Edge newsletter- the most comprehensive weekly recap of event-driven and thematic activity in the US stock market.

Note: To access the source material/ articles for any update below, click on the link on each company name to be routed to the company page on ListingTrack.io where you will find our Curated Feed, which has links to all the source articles (for Pro users only).

Thanks,

Nick

Market Performance & News

Tariff Threats are Back

U.S. equities plunged on Friday after President Trump said on Truth Social that he may cancel his planned meeting with China’s president and is considering a “massive increase in tariffs” on Chinese imports, reigniting fears of a renewed trade war. The S&P 500 fell 2.7% and the Nasdaq Composite dropped 3.6%, marking their worst session since April, while the Dow Jones Industrial Average slid nearly 900 points (-1.9%), erasing weekly gains across major indexes. Trump later announced he would impose an additional 100% tariff on Chinese goods starting November 1, intensifying investor concern that escalating trade frictions could weigh on growth and risk tipping the economy toward recession.

Then China’s Ministry of Commerce said Sunday that the country “is not afraid of” a trade war with the United States, escalating tensions after President Trump vowed to impose 100% retaliatory tariffs on Chinese imports. In a statement, the ministry accused Washington of applying a “textbook double standard” and “abusing export controls” after Beijing announced new restrictions on rare earth mineral exports—materials critical to advanced manufacturing and defense industries. The ministry defended China’s export curbs as a “legitimate measure under international law” intended to strengthen oversight and “safeguard world peace and regional stability.” It also noted that the U.S. Commerce Control List includes over 3,000 restricted items, compared with roughly 900 on China’s own list, portraying Washington as the aggressor in an ongoing cycle of economic confrontation.

Despite the escalation, Trump struck a conciliatory tone on Truth Social, saying, “Don’t worry about China, it will all be fine! ... The U.S.A. wants to help China, not hurt it!!!” The renewed trade conflict has roiled Wall Street, hit Big Tech stocks, and raised concerns for foreign manufacturers dependent on China’s rare earth processing, while also casting doubt on a planned Trump–Xi summit later this month.

ListingTrack Theme Performance

This week’s ListingTrack Theme Performance table: SPAC Churchill Capital X (CCCX), which is merging with quantum company Infleqtion, surged 55% this week on the back of a strong appetite for quantum stocks. UiPath (PATH) +32% led the AI cohort, while just-listed SMR De-SPAC Terra Inovatum (NKLR) +28% was the top gainer among Nuclear stocks. Kodiak (KDK) +22%, AST SpaceMobile (ASTS) +21%, and Rocket Lab (RKLB) +14% led the way for the Next Wave AI, New Space, and Defense theme cohorts, respectively. On the downside, PDYN (-16%), AppLovin (APP) (-17%), BABA (-15%), KULR (-13%), ULH (-13%), RDW (-19%), AMTM (-10%), and IONQ (-4%) marked the week’s biggest laggards.

For a detailed company-by-company breakdown, including recent M&A activity, listing plans and rumors, pre-IPO fundraising, upcoming earnings reports, and event-driven news, users can visit each theme page to explore in-depth analysis and the latest developments. See all our theme coverage on our Theme Hub.

Index Performance

Earnings & Major Events

All Earnings Above $5B Market Cap:

Thursday, Oct 16

American Express Com (AXP -7.44% Wkly, $220.08B MC)

Ally Financial (ALLY -7.97% Wkly, $11.38B MC)

Huntington Bancshares (HBAN -10.45% Wkly, $22.76B MC)

Comerica (CMA 9.29% Wkly, $9.75B MC

HDFC Bank Limited (HDB 1.96% Wkly, $59.44B MC)

Fifth Third Bancorp (FITB -8.72% Wkly, $27.45B MC)

Regions Financial (RF -9.28% Wkly, $21.56B MC)

Schlumberger Limited (SLB -10.70% Wkly, $47.39B MC)

Truist Financial Cor (TFC -8.06% Wkly, $54.56B MC)

Autoliv (ALV -7.67% Wkly, $8.88B MC)

Webster Financial (WBS -6.83% Wkly, $9.27B MC)

State Street (STT -4.07% Wkly, $31.49B MC)

Friday, Oct 17

M&T Bank (MTB -9.64% Wkly, $28.26B MC)

F.N.B. (FNB -6.03% Wkly, $5.48B MC)

Bank OZK (OZK -6.13% Wkly, $5.54B MC)

Marsh & McLenna (MMC 3.74% Wkly, $101.78B MC)

KeyCorp (KEY -8.95% Wkly, $18.86B MC)

U.S. Bancorp (USB -8.41% Wkly, $70.46B MC)

Travelers (TRV -2.75% Wkly, $60.81B MC)

CSX Corporation (CSX 4.35% Wkly, $66.16B MC)

Charles Schwab (SCHW -3.67% Wkly, $166.93B MC)

Commercial Metals (CMC -2.91% Wkly, $6.38B MC)

Glacier Bancorp (GBCI -7.43% Wkly, $5.48B MC)

Interactive Brokers (IBKR 4.37% Wkly, $116.77B MC)

IPOs & Other Public Listing Recap

IPO/ Listing Action

Past week

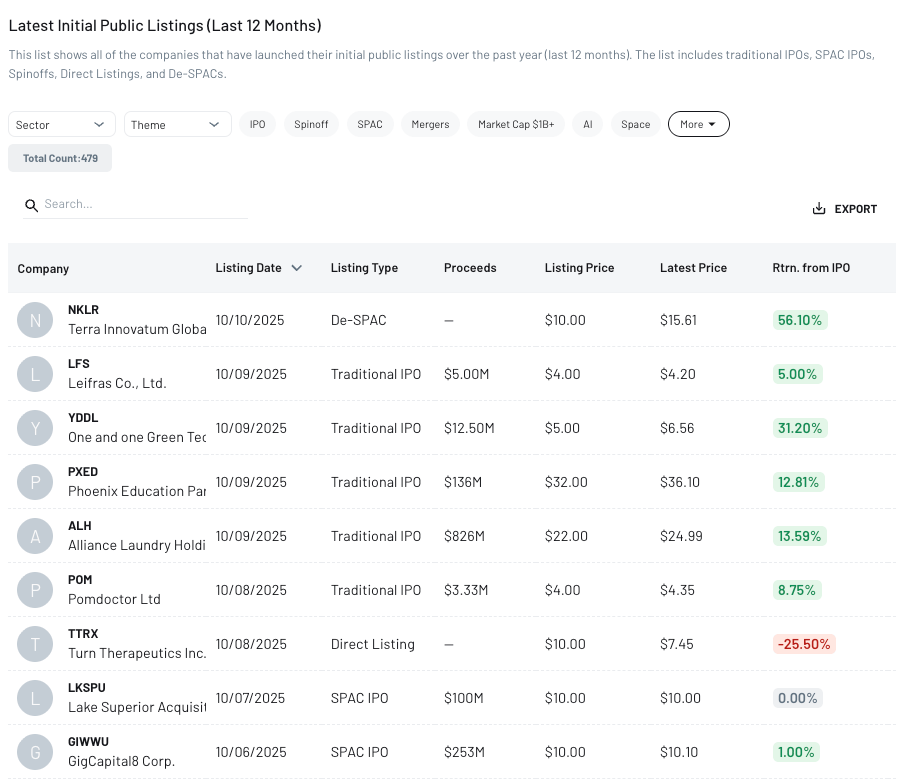

This week, there were 9 listings. See the breakdown below and filter by listing type, sector, theme, and more on our Latest Listings page.

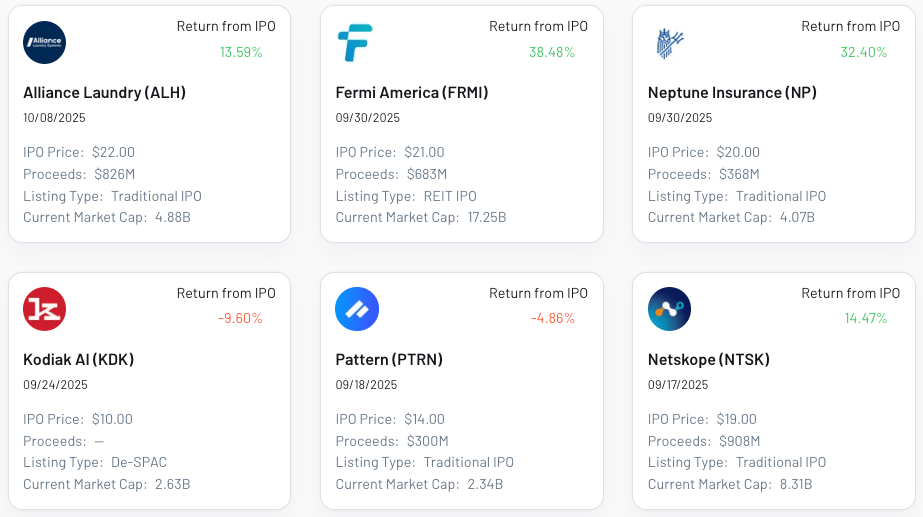

Checking in on the last 6 listings above $2B market cap:

Coming up this week:

1 New Listing Expected. See the calendar here: Listing Calendar

Industry/Theme Recap

AI, Deep Tech (Robotics, Quantum, Nuclear), Aerospace/Defense, Consumer, Crypto, Energy/Materials/Industrials, Financials/Real Estate, Healthcare, Logistics/Transport/Automotive, Media/Telecom

AI / Robotics

Live Coverage: Core AI & Infrastructure theme page, Next Wave AI theme page

Listings - Launches/ Plans / Rumors:

Cerebras Systems: Cerebras CEO Andrew Feldman admitted mishandling communication regarding its IPO withdrawal, clarifying it was to update its prospectus with major business changes since its 2024 filing. Cerebras still plans to go public after a $1.1 billion funding round ($8.1B valuation), refiling with refreshed financials. It's expanding beyond AI training chips into cloud services.

Public M&A:

Core Scientific (CORZ 11.43% Wkly, $5.65B MC): CoreWeave CEO Michael Intrator rejected calls to raise its $9 billion all-stock bid for Core Scientific (CORZ), despite shareholder opposition. Intrator stated the $20.40 per share offer would not be revised, citing it as fair value and highlighting ~1GW data center capacity. Core Scientific shares fell 8.4% to $16.41. A shareholder vote is on October 30. (Deal Page)

Pre-IPO Financings (Series D+ and Prominent):

xAI is raising $20 billion, doubling its latest financing round, using a hybrid equity-and-debt structure tied to its Colossus 2 data center. The round includes $7.5 billion in equity and up to $12.5 billion in debt. Nvidia is investing up to $2 billion in equity, with Apollo Global Management and Diameter Capital Partners participating in debt, and Valor Capital leading equity.

EvenUp, an AI platform for personal injury law, raised a $150 million Series E round led by Bessemer Venture Partners with participation from RELX’s venture arm REV, B Capital, SignalFire, Adams Street, Bain Capital, HarbourVest, Lightspeed, and Broadlight Capital, bringing total funding to $385 million and more than doubling its valuation to over $2 billion in less than a year. This marks the company’s fourth financing round in two years, all preempted by investors, underscoring its strong growth trajectory and market confidence in its mission.

Harvey, an AI-powered legal services platform, secured a €50 million ($59 million) strategic investment from EQT Growth to accelerate international expansion, extending its $300 million Series E round led by Kleiner Perkins and Coatue that valued the company at $5 billion, with existing backers including Sequoia, Google Ventures, Elad Gil, OpenAI’s Startup Fund, and RELX Ventures.

Reflection AI, a one-year-old startup founded by former Google DeepMind researchers, has raised $2 billion at an $8 billion valuation. It aims to be an open-source alternative to OpenAI and Anthropic, and a Western counterpart to Chinese AI giants. The company plans to release a frontier LLM next year, trained on trillions of tokens, to counter a shift in AI leadership.

N8n, a Berlin-based AI automation startup, raised $180M led by Accel, with Nvidia's NVentures, valuing it at $2.5B. This reflects surging AI capital inflows ($192.7B VC funding this year). N8n's platform allows businesses to deploy AI agents and automate workflows with a low-code interface, integrating with tools like Slack and Google Docs.

Other Industry Activity:

Advanced Micro Devices (AMD 36.45% Wkly, $348.52B MC): AMD surged 24% after a landmark deal with OpenAI for 6 gigawatts of GPUs, positioning it as a serious AI infrastructure challenger. OpenAI can acquire up to 160 million AMD shares at $0.01 if milestones are met. This boosted AMD's market cap by $63.4 billion to $330.6 billion, surpassing major companies.

Meta Technologies (META -9.39% Wkly, $1.77T MC): Andrew Tulloch, an AI researcher and co-founder of Mira Murati’s Thinking Machines Lab, has rejoined Meta Platforms after leaving OpenAI and Thinking Machines. This move is part of Meta CEO Mark Zuckerberg’s recruitment push for top AI talent. Tulloch's compensation package was reportedly up to $1.5 billion, though Meta disputed the figure.

SoftBank (OTC:SFTBY): ABB will divest its Robotics division to SoftBank for $5.375 billion, generating $5.3 billion in net cash and a $2.4 billion pre-tax book gain.

Aerospace/ Defense

Live Coverage: Defense theme page

Listings - Launches/ Plans / Rumors:

Inflection Point IV (fka Bleichroeder I) (BACQ 5.13% Wkly, $366.49M MC): ListingTrack published a deep dive on Merlin Labs, a developer of cost-effective, takeoff-to-touchdown autonomy for both legacy and next-generation airborne systems, SPAC Inflection Point IV's (fka Bleichroeder I) (BACQ) merger partner.

Pre-IPO Financings (Series D+ and Prominent):

Stoke Space Technologies secured $510M in Series D funding and a $100M debt facility, bringing total capital to nearly $1B. This accelerates Nova launch vehicle development for reusable, high-frequency orbital missions. The funding follows a U.S. Space Force contract, highlighting Stoke's role in commercial and defense space infrastructure.

Other Industry Activity:

AST SpaceMobile (ASTS 81.88% Wkly, $24.50B MC): Verizon and AST SpaceMobile signed a commercial agreement to provide space-based direct-to-device cellular broadband in the continental US, starting in 2026. The partnership integrates Verizon's 850 MHz spectrum with AST SpaceMobile's low Earth orbit satellite network, enabling connectivity to standard smartphones. This builds on their May 2024 partnership.

Velo3D (VELO 39.06% Wkly, $88.56M MC): ListingTrack published a deep dive on Velo3D (VELO), a 3D printing company in the aerospace/defense sector.

Red Cat (RCAT 25.29% Wkly, $1.31B MC): Short seller Fuzzy Panda Research published a report targeting Red Cat (RCAT) titled 'FOIAs Reveal Key Army Contract Way Smaller Than Claimed'.

⚡ Featured Partner

Your career will thank you.

Over 4 million professionals start their day with Morning Brew—because business news doesn’t have to be boring.

Each daily email breaks down the biggest stories in business, tech, and finance with clarity, wit, and relevance—so you're not just informed, you're actually interested.

Whether you’re leading meetings or just trying to keep up, Morning Brew helps you talk the talk without digging through social media or jargon-packed articles. And odds are, it’s already sitting in your coworker’s inbox—so you’ll have plenty to chat about.

It’s 100% free and takes less than 15 seconds to sign up, so try it today and see how Morning Brew is transforming business media for the better.

Consumer & Retail

Listings - Launches/ Plans / Rumors:

Phoenix Education (University of Phoenix) (PXED, $1.29B MC): Phoenix Education Partners, (PXED) priced its $136 million IPO at $32 per share. Est. market cap at IPO of $1.14 billion. Lead Left underwriter: Morgan Stanley.

Leifras (LFS $109.87M MC): Leifras , (LFS), a sports and social business company, priced its $5 million IPO at $4 per share. Est. market cap at IPO of $104.6 million. Lead Left underwriter: Kingswood Capital Partners.

Pre-IPO Financings (Series D+ and Prominent):

1Password founders have sold a $75 million stake to the Halo Fund, an investment vehicle launched earlier this year by Utah Jazz owner Ryan Smith and Accel partner Ryan Sweeney, as part of a $100 million secondary sale that also included participation from Flume Ventures and other investors. The transaction maintains 1Password’s valuation at $6.8 billion.

Crypto

Listings - Launches/ Plans / Rumors:

Cantor Equity Partners II (CEPT 15.86% Wkly, $373.08M MC): Securitize, a blockchain company specializing in tokenizing traditional investments, is reportedly in talks to go public via a merger with SPAC Cantor Equity Partners II, potentially valuing Securitize at over $1 billion. Backed by BlackRock and Morgan Stanley, Securitize hosts BlackRock's tokenized fund BUIDL. The deal would mark a major public listing in the blockchain tokenization space.

Gemini (GEMI -3.48% Wkly, $984.59M MC): Gemini Space Station, founded by the Winklevoss twins, debuted in September and is trading over 11% below its $446.3 million offering price, erasing its 14% post-IPO pop. Analysts cite competition and lack of profitability as risks. Goldman Sachs, Citigroup, and Morgan Stanley issued hold ratings. Gemini's weak performance contrasts with sector peers like Circle Internet Group (+370%) and Bullish (+75%).

Other Industry Activity:

Bitmine (BMNR -14.39% Wkly, $9.09B MC): Short seller Kerrisdale Capital published a report targeting Bitmine (BMNR) titled 'DAT Ain’t No Strategy'.

Energy, Materials, and Industrials

Listings - Launches/ Plans / Rumors:

Alliance Laundry (ALH $4.27B MC): Alliance Laundry (ALH), the world’s largest designer and manufacturer of commercial laundry systems, priced its $826 million IPO at $22 per share. The estimated market cap at IPO is $4.29 billion. The company sold 65% of the shares, raising $537 million, while selling shareholders sold the remaining 35% for $290 million. Lead Left underwriter: BofA Securities.

One and one (YDDL $290.58M MC): One and One Green Technologies. (YDDL), a waste materials and scrap metal recycling company, priced its $12.5 million IPO at $5 per share. Est. market cap at IPO of $272.5 million. Lead Left underwriter: The Benchmark Company.

Solstice Advanced Materials (Honeywell spinoff): Honeywell (HON) will spin off Solstice Advanced Materials (SOLS Wkly, $0.01M MC), distributing 1 SOLS share for every 4 HON shares as of the Oct 17, 2025 record date, with distribution on Oct 30, 2025. Nasdaq will begin when-issued trading (HONIV and SOLSV) on Oct 20, 2025, before Solstice transitions to its permanent ticker.

Terra Innovatum (NKLR $954.14M MC): Terra Innovatum Global N.V., a developer of micro-modular nuclear reactors, completed its business combination with GSR III Acquisition and will begin trading on Nasdaq as NKLR on October 10, 2025.

Haymaker Acquisition III: SunTx Capital Partners' portfolio company, Concrete Partners Holding (Suncrete), will go public on the NYSE in Q1 2026 through a business combination with Haymaker Acquisition 4 (HYAC 0.80% Wkly, $329.68M MC). The combined company, named Suncrete, has an estimated pro forma enterprise value of $972.6 million and includes $82.5 million in PIPE commitments.

Public M&A:

Metals Acquisition: MAC Copper announced its acquisition by Harmony Gold (Australia) closed on October 10, 2025. Payments for the acquisition are scheduled for October 27–31. (Deal Page)

Civitas Resources (CIVI -4.29% Wkly, $2.73B MC): Civitas Resources and SM Energy are discussing a merger of equals worth at least $14 billion, including debt. The deal, without a premium, would combine Civitas's Permian Basin acres with SM's Midland Basin and other holdings, ranking among this year's largest US oil and gas deals, and reflecting ongoing Permian Basin consolidation. (Deal Page)

ReNew Energy Global (RNW 4.73% Wkly, $2.89B MC): A consortium, including Sumant Sinha, CPPIB, Platinum Hawk, and Masdar, offered $8.15/share to acquire outstanding shares of ReNew Energy Global (RNW), aiming to take the company private. This "best and final" non-binding proposal, an increase over previous terms, requires due diligence and approvals. The consortium currently controls ~64.8% of ReNew's shares. (Deal Page)

Pre-IPO Financings (Series D+ and Prominent):

Base Power secured $1 billion in Series C financing from new and existing investors. The company is focused on strengthening America's power grid by delivering reliable, affordable electricity through distributed storage technology, benefiting homeowners and the broader grid. This raise highlights investor confidence in Base's role in modernizing U.S. energy infrastructure.

Other Industry Activity:

Critical Metals Corp. (CRML 108.64% Wkly, $1.40B MC): Trump administration officials are in discussions about taking a $50 million equity stake in Critical Metals (Nasdaq: CRML), which would give the U.S. government a direct ownership interest in the Tanbreez rare earth deposit in Greenland. A senior Trump administration official confirmed broad interest in critical mineral projects but said “there is absolutely nothing close with this company at this time.”

ESS Tech (GWH 171.90% Wkly, $59.21M MC): ListingTrack published a deep dive on long-duration energy storage company ESS Tech (GWH).

Enterprise Software, Cybersecurity

Listings - Launches/ Plans / Rumors:

Navan, a business travel and expense software company, is seeking to raise up to $960 million in its IPO, valuing it at $9.2 billion. Founded in 2015, Navan reported $329.4 million in revenue and a $99.9 million net loss for the first six months of 2025. It serves over 10,000 enterprise customers, using AI for travel booking, expense management, and corporate payments.

Public M&A:

Heidrick & Struggles International (HSII 16.80% Wkly, $1.21B MC): Heidrick & Struggles (HSII) will be acquired by Advent International and Corvex Private Equity for $1.3 billion ($59.00 per share), a 26% premium. The all-cash deal, unanimously approved by Heidrick’s board, is expected to close by Q1 2026, after which the company will become privately held and delist from Nasdaq. (Deal Page)

Dayforce (DAY -1.00% Wkly, $10.88B MC): T. Rowe Price Group, owning 15.5% of Dayforce, publicly opposed Thoma Bravo's proposed acquisition of Dayforce. In an open letter on October 8, 2025, and a Schedule 13D filing, T. Rowe Price stated its intent to vote against the deal at the November 12, 2025 shareholder meeting, arguing it undervalues Dayforce. (Deal Page)

More on the deal: Thoma Bravo secured $5.5B in debt financing for its $12.3B acquisition of HR software provider Dayforce. This marks 2025’s largest buyout loan, with tighter pricing at SOFR+300 bps. The seven-year loan, led by Goldman Sachs, supports Thoma Bravo’s $70-per-share all-cash deal for Minneapolis-based Dayforce.

Confluent (CFLT 13.42% Wkly, $7.84B MC): Confluent is reportedly exploring a potential sale after receiving interest from private equity and technology companies. The company, known for its real-time data streaming platform, has hired an investment bank to advise on the early-stage process. Shares surged 11%, valuing Confluent at about $7.9 billion, highlighting its strategic appeal in AI-driven data infrastructure. However, a deal is not certain, and the company may remain independent. (Deal Page)

Fintech & Financial Services, Insurance, Real Estate

Listings - Launches/ Plans / Rumors:

PicPay, a Brazilian mobile banking and payments app backed by the Batista family, plans a U.S. IPO to raise up to $500 million. Citigroup, RBC, and Bank of America are managing the potential listing, which could occur later this year, though timing may be affected by the U.S. government shutdown. PicPay, founded in 2012, is a leading digital finance platform in Brazil.

Public M&A:

Comerica (CMA 8.60% Wkly, $9.75B MC): Fifth Third Bancorp is acquiring Comerica in a $10.9 billion all-stock deal. Comerica shareholders will receive 1.8663 Fifth Third shares, valuing each Comerica share at $82.88 (a 20% premium). The combined company will be the 9th largest U.S. bank with $288B in assets. (Deal Page)

SWK (SWKH 15.61% Wkly, $204.00M MC): Runway Growth Finance is acquiring SWK for approximately $220 million in a NAV-for-NAV merger, with consideration including $75.5 million in Runway Growth shares and $145 million in cash. Runway Growth Capital will also contribute an extra $9 million to SWK shareholders. This expands Runway Growth's specialty finance into life sciences, diversifying its lending portfolio. (Deal Page)

Pre-IPO Financings (Series D+ and Prominent):

Kalshi, a regulated prediction market platform, has raised over $300 million at a $5 billion valuation, more than doubling its valuation in three months. The round was led by Sequoia Capital and Andreessen Horowitz, with participation from Paradigm Ventures, CapitalG, and Coinbase Ventures. The platform is on track to reach $50 billion in annualized trading volume.

Polymarket: Intercontinental Exchange (ICE) invested up to $2 billion in Polymarket, valuing the prediction market at $8 billion pre-money. This move establishes ICE in event-based data and sentiment analytics. ICE will distribute Polymarket's data and collaborate on tokenization, advancing its digital asset infrastructure and predictive analytics.

Healthcare

Listings - Launches/ Plans / Rumors:

Pomdoctor (POM), an online medical services platform in China, priced its $3.3 million IPO at $4 per share. Est. market cap at IPO of $79 million. Lead Left underwriter: Joseph Stone Capital.

BillionToOne, a molecular diagnostics company, filed for a U.S. IPO to list on Nasdaq under the ticker BLLN. The company reported $125.5M in revenue and a $4.2M net loss for the six months ending June 30, 2025, narrowing losses from $15.2M on $69.1M revenue a year earlier.

MapLight Therapeutics is proceeding with a $250.8 million IPO despite a government shutdown. They've fixed the share price at $17 and used a tactic to allow automatic registration effectiveness after 20 days, bypassing the SEC. This approach suits biotech deals reliant on existing shareholders and institutional investors. MapLight expects to debut on October 27 if the shutdown continues.

Public M&A:

Essa Pharma: ESSA Pharma was acquired by XenoTherapeutics, with shares purchased for US$0.1242 each, plus one CVR per share. Each CVR offers up to US$0.14 per share (approx. US$6.7M total), contingent on resolving certain liabilities and expenses. (Deal Page)

Akero Therapeutics (AKRO 19.15% Wkly, $4.31B MC): Novo Nordisk is acquiring Akero Therapeutics for $54 per share in cash, totaling $4.7 billion, plus a potential $6 per share CVR (up to $0.5 billion) upon U.S. regulatory approval of Akero’s lead drug, efruxifermin (EFX), for MASH. This deal strengthens Novo Nordisk's pipeline in metabolic diseases. (Deal Page)

STAAR Surgical Company (STAA -2.06% Wkly, $1.32B MC): Defender Capital opposes STAAR Surgical's proposed $28/share acquisition by Alcon, calling it "significantly undervalued." Defender criticized STAAR's board for accepting an offer less than half of Alcon's previous $58/share bid, arguing STAAR's growth outlook justifies independence and the deal is an "ill-advised transaction." (Deal Page)

Protagonist Therapeutics (PTGX 39.87% Wkly, $5.41B MC): Johnson & Johnson is in talks to acquire Protagonist Therapeutics to expand its immunology and oncology portfolio. The deal would deepen an existing partnership, giving J&J full ownership of rusfertide, a promising late-stage therapy for polycythemia vera, and strengthening its position in immunology and cancer treatments. (Deal Page)

Monogram Technologies ‘(MGRM 2.74% Wkly, $243.52M MC) acquisition by Zimmer Biomet (ZBH) close on October 7. Shareholders will receive $4.04 cash plus one CVR per share. (Deal Page)

Verona Pharma: Merck acquired Verona Pharma for $10 billion, paying $107 per ADS. Verona is now a Merck subsidiary, and its ADSs are delisted from Nasdaq. This deal expands Merck's respiratory medicine portfolio with Verona's drug ensifentrine for COPD. (Deal Page)

Other Industry Activity:

Klotho Neurosciences (KLTO 5.98% Wkly, $30.82M MC): Klotho Neurosciences' Letter of Intent with Turn Biotechnologies expired by mutual agreement. Klotho decided the transaction didn't align with its long-term strategy and will now focus on its anti-aging protein research and therapeutic development, remaining committed to the longevity medicine sector with its proprietary human Klotho protein platform.

Logistics, Transportation & Travel, Autos

Live Coverage: Logistics theme page

Listings - Launches/ Plans / Rumors:

FedEx (FDX -3.07% Wkly, $53.00B MC): FedEx appointed Marshall Witt as SVP and CFO of FedEx Freight, completing the leadership team for its planned spin-off. Witt joins John A. Smith (President and CEO) and R. Brad Martin (Chairman of the Board). This is a key milestone as FedEx prepares to spin off FedEx Freight into an independent, publicly traded company.

Pre-IPO Financings (Series D+ and Prominent):

DiDi (OTC:DIDIY): DiDi Global's autonomous driving unit raised $281 million in Series D funding, bringing its total to $1.4 billion since 2019. This funding will accelerate AI investment and Level 4 robotaxi rollout, with deliveries starting this year and pilot operations in Beijing and Guangzhou. The company aims for a $5 billion valuation and positions itself as a key contender in China's autonomous mobility sector.

ListingTrack Pro Spotlight

LTSheets: Structured datasets in one central spreadsheet

» LTSheets give you easy-to-use, filterable spreadsheets across various datasets:

Active Public M&A dashboard tracking all live mergers with US-listed targets, including deal terms, materials, ++

List of Pre-IPO companies along with filing information and expected IPO details

AI stocks dashboard filterable by our curated AI categories (Chips, Data Center, Specialized AI Software, ++)

Logistics stocks dashboard filterable by our curated categories (Parcel, FTL, LTL, Rail, LogTech, ++)

Robust Active SPACs tab including our curated SPAC data points along with commons, warrants, and units trading

SPAC merger progress

Separated SPAC Rights and SPAC Warrants tabs

Copy the sheet to your own account, and you’ll be able to easily sort and filter data, making your analysis process much more efficient.

Analysis of event-driven and theme-driven data has never been easier with LTSheets!

Media & Entertainment/ Communications

Listings - Launches/ Plans / Rumors:

Comcast (CMCSA -6.74% Wkly, $108.49B MC): Goldman Sachs is marketing a $2.1 billion leveraged loan for Comcast's Versant Media Group spin-off. The total financing package is $2.75 billion, including a bond offering and a $750 million credit facility. Proceeds will fund a $2.25 billion payment to Comcast. Versant will become a publicly traded company with MSNBC, CNBC, and USA Network, while Comcast retains NBC, Bravo, and Peacock.

LA Times Media Group (LATMG) announced it has created a unified media and technology platform, integrating the LA Times, LA Times Studios, NantStudios, and NantGames. LATMG also launched a private placement for accredited investors, planning a Regulation A public offering and NYSE listing under "LAT" for up to $500 million.

Public M&A:

Warner Bros. Discovery (WBD -11.54% Wkly, $42.34B MC): Warner Bros. Discovery rejected a $49 billion takeover bid from Paramount Skydance, valuing WBD at $20/share, deeming it too low. Paramount's CEO is exploring options to raise the offer. This potential merger of two major Hollywood studios reflects accelerating media consolidation due to rising streaming costs and competitive pressures. (Deal Page)

More on the potential deal: Paramount Skydance, led by CEO David Ellison, is in preliminary talks with Apollo Global Management to acquire Warner Bros. Discovery. Discussions also involve Apollo-owned Legendary Entertainment, which produces major Warner Bros. franchises. Paramount, which merged with Skydance in August, is considering an approach before Warner Bros. spins off its cable-TV networks next year.

Other Industry Activity:

Verizon (VZ -8.35% Wkly, $168.02B MC): Verizon will acquire Starry, a fixed wireless broadband provider, to expand its broadband reach in MDUs and dense urban areas. The deal, expected to close in Q1 2026, will integrate Starry's mmWave tech with Verizon's assets for faster, lower-cost broadband deployment and enhanced fixed wireless access.

Thanks for reading. We welcome feedback on this newsletter and sponsorship opportunities at [email protected].

The team at ListingTrack

Market Data and Coverage: All market data presented is based on the stock prices at the close of the previous trading day. We cover the US market only at this time.

DISCLAIMER: The information provided in this newsletter is for informational purposes and for your convenience only and is not intended to be treated as financial, investment, tax, or other advice. The author or guest authors may have positions in any of the stocks discussed. ListingTrack and its parent, CommonFi, do not make any guarantees, representations, or warranties as to, and shall have no liability for, the timeliness, truthfulness, sequence, quality, completeness, or accuracy of any of the information or data provided in this newsletter or on the ListingTrack website.