Good evening!

If you were forwarded this report or chanced upon it online, welcome! Hit the subscribe button at the top to get this report directly in your inbox.

There’s a lot of activity to cover each week, so for the best reading experience, you can read the report on your browser here.

Here's what we're covering this week:

IPOs & Other Initial Public Listings

New IPO/ Listing Action

Hit the Market Last Week (12)

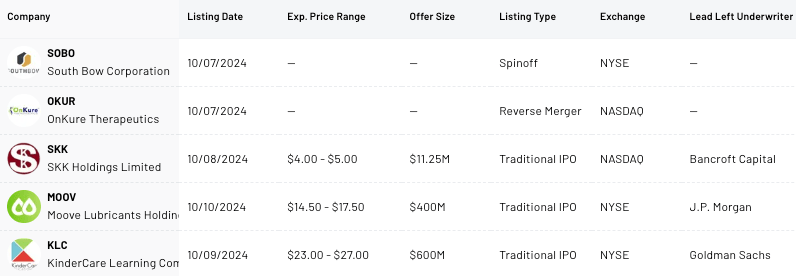

Expected this week (5)

IPOs:

KinderCare Learning (KLC), the largest provider of early childhood education in the US, is expected to raise $600M. Lead left UW: Goldman Sachs.

Moove Lubricants (MOOV), a Brazilian lubricants producer owned by the Cosan Group, is expected to raise $400M. Lead left: JP Morgan.

SKK Holdings (SKK), a Singapore-based civil engineering firm. Exp. raise: $11.25M. Lead left: Bancroft.

Other listings:

Head to ListingTrack.io to see all of the Latest IPOs and Latest Listings // See the Top Performers from Listings 2019-

New IPO Filings (12)

Infinity Natural Resources (INR), an oil and gas E&P company operating within the Appalachian Basin. IPO led by Citigroup. — S-1

4 SPACs: Oaktree III Life Sciences, Willow Lane Acq Corp, Ocean Capital Acq Corp, A SPAC III Acq Corp

4 China/ Hong Kong-based : Majestic Ideal (Refile), Smart Logistics Global, Decent Holding, Leishen Energy

See all of the latest IPO Filings

Listing Plans and Rumors

Plans

MDU Resources announced the spinoff of its construction services business, Everus Construction Group, is expected to close on Nov 1. When-issued trading for the Spinco is expected to begin Oct 28 on NYSE under the symbol MDU WI, followed by regular-way trading on or around Nov 1 under the symbol MDU. — PR

SPAC Iron Horse ($IROH) announced it will merge with Hong Kong-based food biotech company China Food Investment (Zhong Guo Liang Tou Group) at a $479M pre-money equity valuation. — PR

Rumors

Brazilian digital bank PicPay is targeting a Nasdaq IPO in 2025 and is said to bring on Citigroup, among others, but hasn't officially hired any firms yet. Bloomberg previously reported that the company was working with Citigroup on the IPO. — Reuters

French energy giant Total Energies is working on a US listing. The company, which has its primary listing in Paris, was previously considering switching its primary listing to New York but has now stated Paris will remain the primary. — BB

See the list of Planned IPOs and Rumored IPOs // See the SPAC Hub for all our SPAC coverage

Planned/ Rumored IPOs — Major Corporate News

Klarna's CEO cites Europe’s unfavorable share-based comp rules as the company’s top risk as it prepares for an IPO. — CNBC

IPO Market Commentary

JPMorgan Says IPO Market for PE-Backed Companies Is ‘Very’ Open — BB

IPO Candidates

IPO Candidate/ Prominent Startup News

Chat app Discord is preparing to roll out its second ad format, a move to diversify from its primary revenue-generating product — ‘Nitro’ subscriptions, ahead of a future IPO. — Business Insider

Menlo Security has exceeded $100M in ARR and expects to be cash flow positive in 2025. The CEO isn’t planning for an IPO in the near term — but potentially could be in the cards In 2-3 years. — Reuters

Cisco will invest in CoreWeave at a $23 billion valuation in a secondary sale allowing existing shareholders to sell $400M-$500M of their shares. Coreweave, an AI data center company, is rumored to IPO in 2025. — BB

Equity Raises

Prominent Startups, Series D+, and Private Equity Rounds:

OpenAI closed a $6.6 billion financing round, with participation from new investors— Nvidia, SoftBank, Coatue, Fidelity, Altimeter Capital, and existing investors— Microsoft, Thrive Capital, Tiger Global, and Khosla Ventures. The round featured a unique condition requiring a commitment from investors not to invest in 5 of its competitors— Elon’s xAI, Anthropic, Safe Superintelligence (Former OpenAI CTO’s company), Perplexity, and Glean. — Reuters

Film Director Peter Jackson invested $10M into Colossal Biosciences, the ‘de-extinction’ biotech startup aiming to bring extinct species like the Tasmanian Tiger and Woolly Mammoth back to life. — BB

poolside, an AI software development startup, raised $500M in its Series B led by Bain Capital Ventures and with participation from NVIDIA and the venture arms of Citi, Capital One, HSBC, LG, and eBay. — PR

See our list of IPO Candidates and the most recent prominent rounds here.

Public M&A

Public M&A Activity

Definitive Announcements

SilverCrest ($SILV), a Canadian precious metals miner, announced it will be acquired by Coeur Mining ($CDE), a US-based peer, in an all-stock deal that valued SILV’s equity at $1.7 billion at the time of the announcement. SILV holders will receive 1.6022 CDE shares per SILV share. CDE and SILV holders will own 63% and 37% of the combined company, respectively. — PR

Martin Midstream Partners L.P. ($MMLP), a Gulf Coast-focused diversified midstream energy company, will be acquired by Martin Resource Management Corporation. The transaction is in an all-cash deal at $4.02 per unit (6.07% premium to the prev. closing price), or a total equity value of appx. $157M. — PR

Merger Closings

Bain Capital’s acquisition of Powerschool Holdings (PWSC) for $22.80 per share in cash, or a total EV of appx. $5.6 billion, closed on Tues, Oct 1. — PR

Chesapeake Energy (CHK) and Southwestern Energy (SWN) closed their merger with the combined company rebranded as Expand Energy ($EXE), which began trading under the new symbol of EXE on Tuesday. — PR

Commure Inc. closed its acquisition of Augmedix (AUGX) for $2.35 in cash per share. — PR

Perficient’s ($PRFT) acquisition by EQT (EQT Asia) was closed. PRFT shareholders received $76 per share in cash, for a total EV of appx. $3 billion. — PR

IQ Ventures closed its acquisition of The Aaron’s Company (AAN) for $10.10 per share in cash. — PR

Upcoming Expected Closings

Chuy’s ($CHUY) acquisition by Darden Restaurants ($DRI), for $37.50 per share, is expected to close on Oct 11.

JT Group’s (Japan Tobacco) tender offer to acquire the shares of Vector Group ($VGR) that it did not already own was scheduled to close on Oct 4.

Live Deal Coverage and Updates

Senators Elizabeth Warren and Sherrod Brown sent a letter to the CEO of US Steel ($X), inquiring about the potential $72M golden parachute payout he could earn if the Nippon Steel deal goes through and he is terminated following the acquisition. The Senators said they are concerned that the financial incentives for executives could lead them to accept the Nippon Steel bid despite its risks. — BB

Darden Restaurants, the owner of LongHorn Steakhouse and Olive Garden, issued $750M in bonds to finance its acquisition of Chuy’s ($CHUY). — BB

Candian PE firm Brookfield reaffirmed its interest in acquiring Grifols ($GRFS) alongside the Grifols family but is asking for more time to complete due diligence. — Reuters

Vista Outdoor ($VSTO) agreed to sell its sporting goods business Revelyst to Strategic Value Partners for $1.1 billion. The company also revised the terms of its definitive deal with Czechoslovak Group (CSG) for the acquisition of VSTO’s ammunition business, Kinetic. The consideration for Kinetic was increased to $2.2 billion. Together, the two deals value VSTO at $45 per share. Previously, VSTO planned to sell only its Kinetic unit to CSG while spinning off Revelyst into a separate public company. — Reuters

Potential M&A News

Talks / Rumors and Other Potential Deals

Rio Tinto has been in talks to buy lithium miner Arcadium Lithium ($ALTM) in a potential deal that could value the company at $4 billion to $6 billion or higher. If the deal goes through Rio Tinto is expected to be the 3rd largest producer of EV battery metals. — Reuters. Following the reported talks, an ALTM investor, Blackwattle, wrote to the ALTM Board, imploring the company that a deal should be valued at least around $8 billion.

Helix Energy Solutions ($HLX) is exploring strategic options, including a potential sale, and is working with advisers to gauge interest from potential buyers. — BB

23andMe ($ME) is no longer open to considering third-party takeover proposals as the CEO, Anne Wojcicki, stated the best path forward is for her to take the company private. — Reuters

Apollo is in talks to acquire aerospace components maker Barnes Group ($B) in a deal that could value the company at more than $45 per share. An agreement could be reached in the coming weeks. — Reuters

Elis, a French workplace supplies company, ended its talks with US competitor Vestis ($VSTS) after it approached the firm about a potential acquisition last month. Vestis has now attracted interest from other parties, including PE firms, and is working with advisers on its options. — BB

Additional Elis talks: UniFirst, another US competitor, initiated talks with Elis for a potential acquisition after the Elis-Vestis talks were made public. Elis made a non-binding proposal to acquire UniFirst, which was rejected by its Board. The Elis-UniFirst talks have ended as well. — BB

Offers

Mobix Labs ($MOBX) submitted a non-binding proposal to acquire EMCORE ($EMKR) for $3.80 per share in cash or an appx. total market value of $34.5M. Mobix reported only $205,000 in cash and issued a going concern warning on its latest quarterly report. — PR

TTEC Holdings’ CEO Tuchman reported that he submitted a non-binding proposal to take the company private by acquiring all the shares he doesn’t already own for $6.85 per share in cash. While the proposal is under review by the company’s Special Committee, Tuchman will pursue potential financing sources. — SF

Territorial Bancorp ($TBNK) rejected Blue Hill Advisors' increased offer of $12.50 per share, citing the highly speculative nature of the proposal and uncertainties regarding financing and other conditions for the potential merger. In contrast, the definitive agreement for acquisition by Hope Bancorp ($HOPE) is progressing with only a few remaining conditions to close. — PR

Hall of Fame Resort & Entertainment ($HOFV) received a non-binding proposal from an investor, IIRG Canton Village Member (12.5% owner of HOFV), to acquire all of the outstanding shares it does not own already for $1.98 per share in cash. HOFV closed Tuesday, the session prior to Wednesday’s filing, for $1.86 per share. — SF

Quick break to introduce ListingTrack.io!

ListingTrack.io is a follow-up to our former site, SPAC Track. ListingTrack features a radically improved user experience and access to a significantly broader dataset covering public listing events, including IPOs, SPACs, Spinoffs, and pre-IPO companies. There is also much more coverage in the pipeline, including Public M&A.

Here's a quick rundown of the site's coverage: Our Listing Hub covers all initial public listings (IPOs, Spinoffs, de-SPACs, and more) and delistings. The IPO Hub drills into IPOs and is the hub for our pre-IPO coverage. The SPAC Hub is the new and improved home for SPAC Track’s SPAC and De-SPAC data.

Activism, Shorts, & Other Special Situations

Activism, Investor Disputes & Shorts

Activist Investors/ Disputes

Starboard Value has taken a $1 billion stake in Pfizer ($PFE) and has approached two former Pfizer execs to assist in helping the activist fund make changes to improve performance. — WSJ

Irenic Capital Management has built an 8.1% stake in Reservoir Media ($RSVR) and urged the company to launch a strategic review of alternatives to maximize shareholder value and for its Board to form a special committee to oversee the review. — SF

Activist investor Mantle Ridge has built more than a $1 billion stake in Air Products and Chemicals ($APD), an industrial gas manufacturer, and plans to push for improvements at the company. — WSJ

Mexican billionaire Carlos Slim has built a 24.2% stake in Talos Energy ($TALO) through his investment vehicle, Control Empresarial de Capitales. Although Slim stated in an earlier filing that the share purchases are solely for investment purposes, TALO has adopted a poison pill plan to protect against Slim or any other investor attempting to gain control through open market accumulation. — BB

Agco’s ($AGCO) largest shareholder (with a 16.3% stake), India-based TAFE (Tractors and Farm Equipment Ltd.), issued a public letter to fellow shareholders outlining its plans to improve the business and stating that AGCO has ignored its ideas, took steps to disenfranchise TAFE, and isolated its representative on AGCO’s Board. AGCO responded by characterizing TAFE’s letter as self-serving, noting that it was issued after AGCO won a case against TAFE at the Indian Supreme Court and after AGCO terminated TAFE’s right to distribute AGCO’s Massey Ferguson products and use its trademark. — PR

Shorts and Non-Investor Activism

Toyota ($TM) told employees in a memo that it will no longer sponsor cultural events and will end participation in corporate culture surveys like the Human Rights Campaign. The memo comes after anti-DEI activist Robby Starbuck targeted the automaker last week. — BB

J Capital Research published a short report targeting Nano Nuclear Energy ($NNE) titled ‘The Rampant Stock Promotion and Undisclosed Related Parties Behind the Empty Shell that is NNE.’ — J Capital

Bloomberg profiled the troubles of majority family-owned Grifols ($GRFS) and the uphill battle for the family to retain control of the 80-year-old company following a short report by Gotham City Research— ‘How a Short Seller’s Attack Threatens This Spanish Family Company.’ — BB

Separations, Restructurings, and Other Special Sits

EchoStar Group ($SATS), controlled by Charlie Ergen, agreed to sell DISH DBS, which includes DISH and Sling TV, to DIRECTV for the assumption of $9.75 billion of debt. TPG will also buy out AT&T’s 70% stake in DIRECTV (which is co-owned by AT&T and TPG) for $7.6 billion in cash payments. — PR

CVS Health ($CVS) will lay off 2,900 as it explores options that could include a break-up of the company to separate its retail and insurance units. — BB

Sanofi asked for revised proposals from bidders, including CD&R and PAI, seeking to acquire Opella, Sanofi’s consumer health unit. — BB

Bankruptcies/ Delistings

Spirit Airlines ($SAVE) is exploring filing for Chapter 11 bankruptcy after its failed merger with JetBlue ($JBLU). SAVE has been in discussions with bondholders over the potential terms. — WSJ

Biolase (BIOL —> $BIOLQ) filed for Chapter 11 bankruptcy. — PR

The existing shares of Audacy (AUDAQ), Eiger Biopharmaceuticals (EIGRQ), and Phasebio Pharmaceuticals (PHASQ) were canceled worthless as the companies’ bankruptcy plans became effective.

Others downlisted to OTC:

Enviva (EVA —> $EVVAQ), Eagle Pharmaceuticals ($EGRX), Dixie Group ($DXYN)

Click here to view the Delisted & Downlisted companies that launched their initial public listings in 2020.

Thanks for reading,

The team at ListingTrack

If you found this summary helpful, consider sharing the newsletter with a friend or colleague!

Market Data and Coverage: All market data presented is based on the stock prices at the close of the previous trading day. We cover the US market only at this time.

Abbreviations: PR: Press Release, SF: Company SEC filing, IP: Investor Presentation, BB: Bloomberg, MC: Market Capitalization

DISCLAIMER: The information provided in this newsletter is for your convenience only and is not intended to be treated as financial, investment, tax, or other advice. ListingTrack and its parent, CommonFi, do not make any guarantees, representations, or warranties as to, and shall have no liability for, the timeliness, truthfulness, sequence, quality, completeness, or accuracy of any of the information or data provided in this newsletter or on the ListingTrack website.