Discover and track all of the SPACs at spactrack.net.

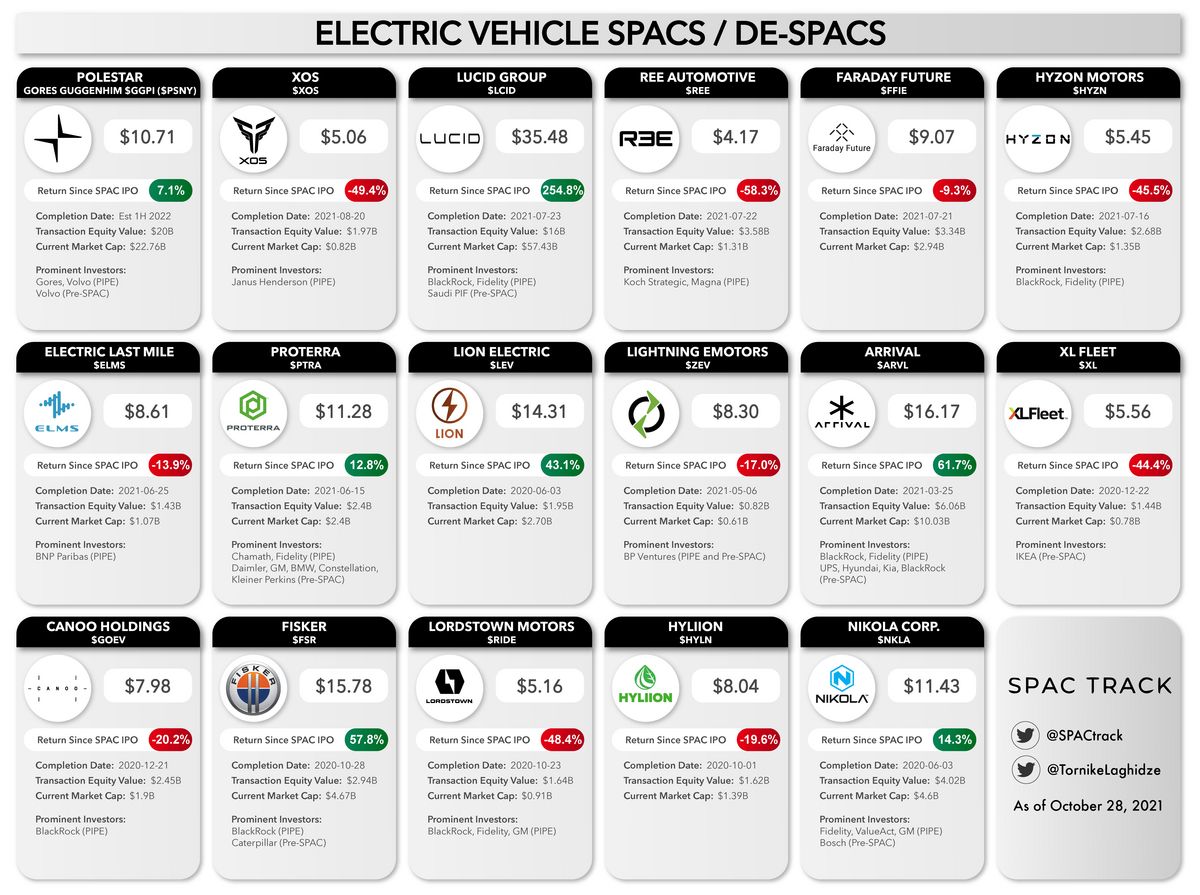

With the infrastructure bill looming, many E.V. De-SPAC / SPAC names posted strong performance today, with Lucid Motors (LCID: $35.48) closing the day up 31%.

Here’s a graphic from the great Tornike, with all of the electric vehicle companies that have taken the SPAC route.

If you haven’t subscribed to this Free nightly newsletter, you can do so below.

The Stats:

The Deals:

After-hours deal:

1) Tailwind Two Acquisition Corp (TWNT: $9.89 +1.96%) & Terran Orbital

Merger Partner Description:

Terran Orbital Corporation is a leading vertically integrated provider of end-to-end satellite solutions. Terran Orbital combines satellite design, production, launch planning, mission operations, and in-orbit support to meet the needs of the most demanding military, civil and commercial customers. In addition, Terran Orbital is developing the world's largest, most advanced NextGen Earth Observation constellation to provide persistent, real-time earth imagery.

Valuation: $1.58B EV

PIPE: $51M including investments from AE Industrial Partners, Beach Point Capital, Daniel Staton1, Lockheed Martin and Fuel Venture Capital

Additional Financing: $75M of commitments from Francisco Partners and Beach Point Capital, with up to an additional $125M in debt commitments from Francisco Partners and Lockheed Martin may be available subject to certain conditions

News:

Shares of EV start-up Lucid surge as much as 47% after confirming deliveries of its first car (CNBC)

Shares of electric vehicle start-up Lucid Group (LCID: $35.48 +31.31%) surged by as much as 47% during trading Thursday, a day after the company confirmed the first customer deliveries of its $169,000 Air Dream Edition sedan would begin Saturday.

Lucid’s stock hit $39.78 a share – its highest point since the company went public through a SPAC deal on July 26 – before retreating to close at $35.48 a share, up by 31.3%. The price remains far below its 52-week high of nearly $65 a share in February when it was reported that Lucid was nearing a deal with blank-check company Churchill Capital IV Corp. to go public.

The company invited select Air Dream Edition reservation holders to pick up their cars at its headquarters in California. Lucid did not disclose how many people were invited to the event.

The customer deliveries come about a month after Lucid started production of its first cars for customers at its new factory in Casa Grande, Ariz. At that time, Lucid said customer deliveries were expected to begin in late-October.

A company spokesman declined to say how many vehicles Lucid has built so far, but he said the automaker will continue to increase production of the car.

In total, Lucid has said it plans to deliver 520 customer-configured Lucid Air Dream Editions, followed by deliveries of lower-priced models. Lucid told investors in July that it expects to produce 20,000 Lucid Air sedans in 2022, generating more than $2.2 billion in revenue, according to an investor presentation.

The Dream Edition is a $169,000 special edition of its flagship sedan, with an industry-leading range of up to 520 miles, according to the EPA. Pricing for an entry-level version of the car, the Lucid Air sedan, starts at $77,400 before an up to $7,500 federal tax credit for plug-in vehicles.

Lucid on Thursday also scheduled its first earnings report and call for investors since going public. The event is scheduled for Nov. 15.

Merger Votes/ Completions:

Mountain Crest Acquisition Corp. II (MCAD) completed its merger with Better Therapeutics. Ticker change to BTTX set for tomorrow

Spartacus Acquisition Corporation (TMTS) completed its merger with NextNav. Ticker change to NN set for tomorrow

17.4M public shares were redeemed or an estimated 86%, leaving ~2.85M public shares

Min. cash requirement of $250M was not met due to redemptions, but was waived by NextNav

Trident Acquisitions Corp. (TDAC) shareholders approved its merger with Lottery.com.

~21k shares were redeemed (less than 1%)

Closing is expected on 10/29 with the ticker change to LTRY on 11/1

If you find this newsletter useful, feel free to share it with a friend and suggest they subscribe:

Tracking De-SPAC S-1s (including PIPE resale registrations):

S-1s that went effective today:

Shapeways (SHPW: $7.24 -1.23%)

Lilium (LILM: $8.95 +9.68%)

Valens Semiconductor (VLN: $9.09 +4.24%)

S-1 filings:

Enjoy Technology (ENJY: $10.45 -1.88%)

424B3 filings (S-1 likely to go effective tomorrow):

Velo3D (VLD: $10.37 -0.67%)

Quick News:

Gores Metropoulos II, Inc. (GMII) announces a reduction in valuation for Sonder (from an enterprise value of ~$2.2B to $1.925B).

GMII raised an additional PIPE investment of ~$109M (~11M shares at $8.89 and 709k shares at $10) from affiliates of the sponsor, and existing PIPE investors: Fidelity, BlackRock, Atreides, and Senator. The total PIPE is now ~$309M.

Additionally, Sonder entered into a non-binding term sheet for $220M delayed draw notes with certain PIPE investors

IPOs to begin trading tomorrow*:

1) Cactus Acquisition Corp. 1 Limited Announces Pricing of Upsized $110 Million Initial Public Offering (CCTS-U)

2) Project Energy Reimagined Acquisition Corp. Announces Pricing of $250 Million Initial Public Offering (PEGR-U)

*Priced as of this writing

New S-1s (1):

1) LF Capital Acquisition Corp. II (LFAC)

$225M, 1/2 Warrant

Focus: Fintech, tech, digital asset or consumer

Management:Baudouin Prot (Former Chairman & CEO of BNP Paribas)

Directors:Robert Black (Former Chief Strategy Officer of Kimberly-Clark)

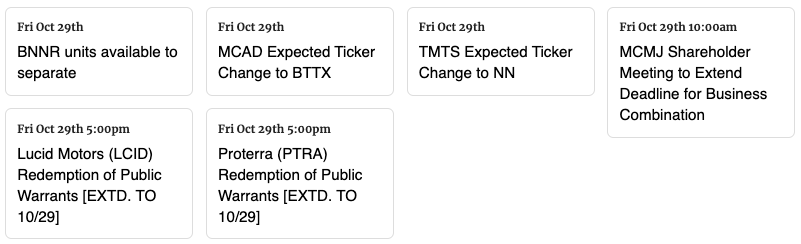

Upcoming Dates:

This Week’s Announced Shareholder Meetings, Unit Splits, Warrant Redemptions, and Expected Ticker Changes

See the full calendar here.

Thanks for reading,