Welcome!

Please find a sample Morning Update newsletter below. This premium newsletter, covering all of the key SPAC action, is sent to subscribers each trading day before the market opens.

You can subscribe here on Beehiiv for the newsletter ONLY.

Alternatively, you can sign up for SPAC Track Pro at spactrack.io/pro to access the premium version of our website featuring our database with over a hundred data points covering 1300+ SPACs + De-SPACs since 2019. As a benefit of your SPAC Track Pro subscription, you will also receive this premium daily newsletter!

To take a test drive of the premium newsletter only, sign up here for our 2-day free trial:

Morning Update (sent Monday, October 31st)

SPAC Market Snapshot (weekly update)

Activity last Week:

3 Mergers Announced

6 Mergers Completed

0 IPOs

0 Terminations

1 Liquidation Announced

12 Filed Prelim. Proxies seeking accelerated liquidation

Current Stats:

Total SPACs Searching: 505

Announced Deals: 135

Total Active SPACs: 652

Liquidation Stats:

28 total liquidating or seeking accelerated liquidation:

3 with set liquidation dates

16 filed prelim. proxies to vote on accelerated liquidation

9 filed definitive proxies to vote on accelerated liquidation

Liquidated Year-to-Date: 38

That makes for a total of 68 SPACs that have liquidated year-to-date or are currently seeking liquidation. Thus out of the 692 Active SPACs at the start of 2022, 9.8% have been or will be liquidated.

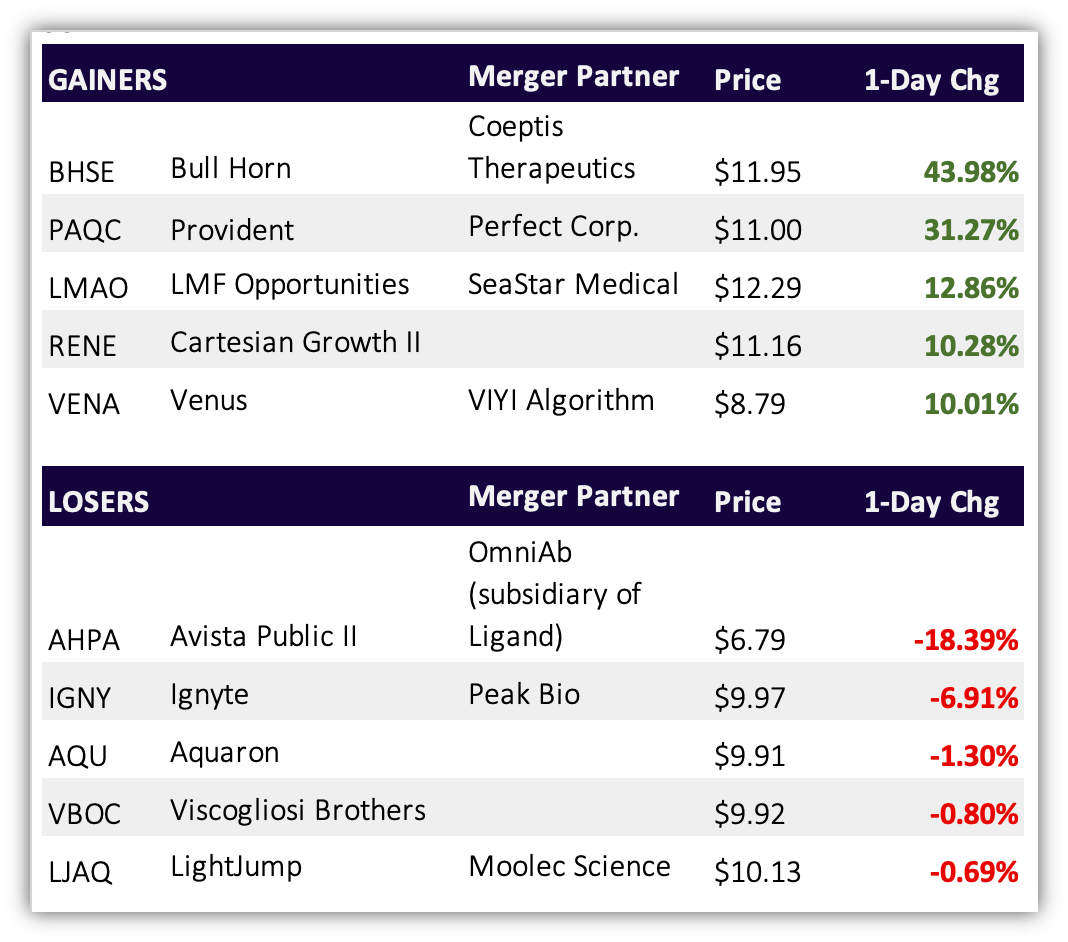

SPAC Gainers & Losers (prev. session)

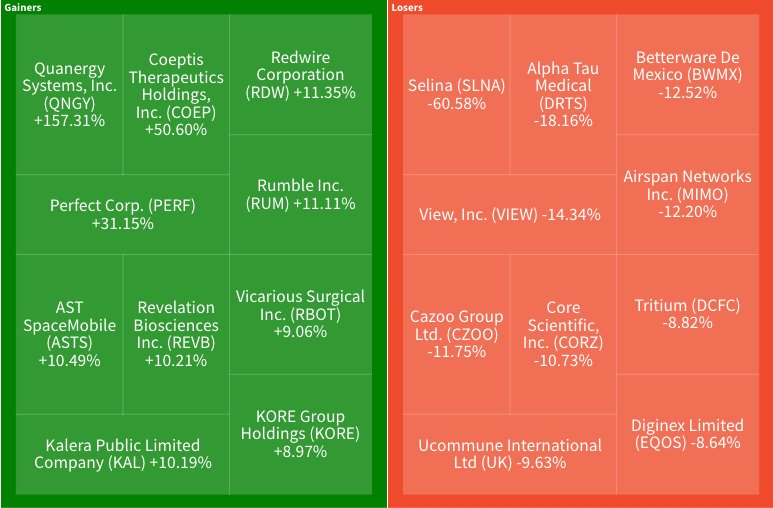

De-SPAC Gainers & Losers (prev. session)

News & De-SPAC Updates

Michael Klein to merge advisory firm with Credit Suisse investment bank (FT)

Activist Starboard takes a stake in Vertiv [$VRT: 2020 De-SPAC], and an opportunity to boost margins is in sight (CNBC Opinion)

Ensysce Biosciences [$ENSC: 2021 De-SPAC] completed a 1-for-20 reverse stock split. The stock closed Friday's session at $3.88 or down 98% split-adjusted from the SPAC IPO

ICE takes $1.1 billion write-down for stake in crypto platform Bakkt [$BKKT: 2021 De-SPAC] (YF)

After Pulling Its SPAC Deal [with SCVX, now liquidated], Startup Bright Machines Raises $100 Million On Factory-Reshoring Trend (Forbes)

The Deals

1) Spree 1 Ltd [$SHAP] & zTrip

WHC Worldwide, LLC dba zTrip is a technology-based, North American-wide transportation company, whose mission is to use mobility to enhance the lives of its customers, driver partners and employees. The company, founded in 2018, has a diverse portfolio of business, most prominently zTrip®, the largest taxi fleet operator in the U.S. (source: The Transportation Alliance), with operations in 26 cities, more than 2,700 vehicles and over 3,170 contracted drivers on its platform. zTrip® combines a taxi-service model with technology to create a new hybrid brand of on-demand transportation, with a platform capable of operating local mobility service providers more effectively and efficiently. Combining its experience of acquiring and operating traditional taxi fleets with its proprietary technology-based shared infrastructure, zTrip has been consolidating the local mobility service market and driving what it believes to be greater technology adoption and other operating efficiencies. zTrip is led by a veteran management team with decades of experience in the ground transportation industry and a proven track record of owning and operating successful transportation companies. zTrip also operates under the brand names SuperShuttle® and ExecuCar®, serving more than 63 North American airports.

Valuation: $251M pre-money equity value

2) Phoenix Biotech [$PBAX] & Intrinsic Medicine

Intrinsic Medicine, Inc. is a preclinical-stage therapeutics company leveraging synthetic biology-manufactured human milk oligosaccharides (HMOs), as new medicines to treat large patient populations underserved by current treatment options. In the first half of 2023, Intrinsic plans to initiate a Phase 2 clinical trial under an approved protocol in Australia using FDA recommended primary end points to test its lead drug candidate in over 400 patients with the constipation dominant form of irritable bowel syndrome (IBS), which is estimated to affect approximately five million patients in the United States alone.

Valuation: $136M pre-money equity value

SPAC Updates

Liquidations / Terminations

Benessere [$BENE] set to liquidate today

Benessere Capital [$BENE] provides an update on its previously announced liquidation by setting today, Oct 31 as the effective date for redemption (PR)

Lux Health Tech [$LUXA] and Sarissa Capital Acquisition [$SRSA] liquidated

Pivotal Investment Corporation II [$PICC] warrants were delisted from NYSE (SF)

New Accelerated Liquidation Seekers:

Definitive Proxy Filed for Accelerated Liquidation:

PWP Forward [$FRW] files its definitive proxy, setting Nov 28 as the meeting date to vote on accelerated liquidation with an appx. liquidation price of $10.03 (SF)

Austerlitz I [$AUS] and II [$ASZ] file definitive proxies, setting Nov 22 as the meeting date to vote on accelerated liquidation with an appx. liquidation price of $10 (SF)

ION 3 [$IACC] files its definitive proxy, setting Nov 17 as the meeting date to vote on accelerated liquidation with an appx. liquidation price of $10.06 (SF)

Sandbridge X2 [$SBII] file sits definitive proxy, setting Nov 29 as the meeting date to vote on accelerated liquidation with an appx. liquidation price of $10.08 (SF)

Merger Votes / Completions

Completions:

Vote Set:

Deal Updates

Thunder Bridge Capital Partners IV [$THCP] & Coincheck, Inc. (subsidiary of Monex Group) file Monex Group's Q1 (Monex's fiscal Q2) financial results including Coincheck results (SF)

LightJump [$LJAQ] and Moolec Sciences file an investor presentation (SF)

Shareholders of Mount Rainier's [$RNER] merger partner HUB Cyber Security have approved the merger with RNER and the delisting from the Tel Aviv Stock Exchange (PR)

Extensions

CONX [$CONX] reported that shareholders have redeemed 67,451,616 shares or an estimated ~90% of the public SPAC shares in connection with its upcoming extension vote taking place on Oct 31. CONX advised the deadline to withdraw redemption requests is 3 pm EST on Oct 31. (SF)

Vision Sensing [$VSAC] announced it has extended its deadline from Nov 3 to Feb 3, 2022 by adding $0.10 per share to trust (PR)

International Media [$IMAQ] deposited $350,000 to extend its deadline from Nov 2 to Feb 2, 2023 (SF)

Perception Capital II [$PCCT] shareholders approved the extension of its deadline from Nov 1 to May 1, 2023. Shareholders redeemed 20,542,108 shares or an estimated ~90% of the public SPAC shares. Following the redemption, appx. $24M remains in trust (SF)

M3-Brigade Acquisition II Corp. [$MBAC] files a preliminary proxy to extend its deadline and includes proposals to amend the charter to allow for interest accrued on the trust post-amendment to be used to fund working capital and the 1% excise tax (SF)

Maquia Capital [$MAQC] postpones the extension meeting from Nov 1 to Nov 3. MAQC also noted that its sponsor intends to "intends to indemnify Maquia for any excise tax liabilities resulting from the implementation of the IR Act with respect to any future redemptions that occur after December 31, 2022." (PR)

More

Pershing Square SPARC Holdings, Ltd. files an amended S-1 (SF)

Listings

IPOs, New S-1s, Registration Withdrawals

—

Key Filings

Extensions:

S-4 Filings*:

Post-SPAC Merger S-1 Filings**:

*Latest S-4 filings are found in the “Deal Details” view under the column “S-4 Link”**including PIPE resale registrations where applicable — latest post-merger S-1 filings are found in the “De-SPAC" view under the column “Post-Close S-1”

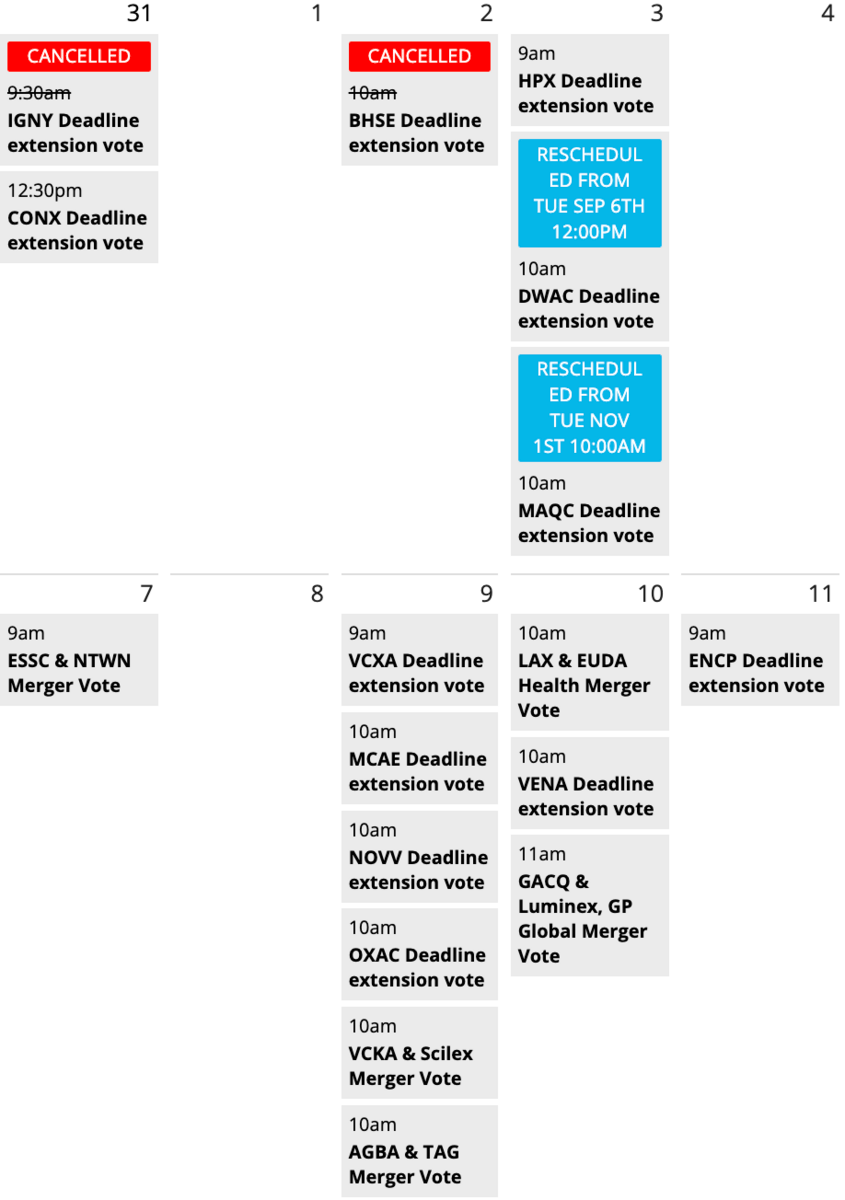

Key Events Calendar:

See the full calendar with proxy links here.

SPAC Track Pro:

Please note that a list of all the data points available on the Pro Screener with download eligibility can be found here: spactrack.io/data-catalog

Thanks for reading,

The team at SPAC Track (spactrack.io)

Abbreviations: DA: Definitive Agreement, MA: Merger Approved, PR: Press Release, SF: Company filing with the SEC, IP: Investor Presentation, Bloomberg: BB, Reuters: RTS, TechCrunch: TC, Business Insider: BI

DISCLAIMER: The information provided in this newsletter is for your convenience only and is not intended to be treated as financial, investment, tax, or other advice. SPAC Track and its parent, CommonFi, do not make any guarantees, representations, or warranties as to, and shall have no liability for, the timeliness, truthfulness, sequence, quality, completeness, or accuracy of any of the information or data provided in this newsletter or on the SPAC Track website.