Good morning!

If you are receiving this newsletter for the first time, welcome! You will find the Weekly SPAC Review in the first section below followed by an update on Friday’s SPAC activity.

While Friday's update is included in this Weekly newsletter, the other daily updates (covering Mon-Thurs) are sent in our SPAC Morning Update newsletter to ListingTrack Pro users on the morning of each trading day.

Weekly SPAC Review (Aug 12-16)

Headlines of the Week

De-SPAC M&A

Lockheed Martin announced it will acquire Terran Orbital ($LLAP) for $0.25 per share in cash, or a total enterprise value of appx. $450M.

PropertyGuru ($PGRU) agreed to be acquired by EQT for $6.70 per share in cash, or a total equity value of $1.1B.

Other De-SPAC News

KORE Group ($KORE) announced it will implement a restructuring plan that includes laying off 25% of its workforce.

Collective Audience ($CAUD) was delisted from Nasdaq and began trading OTC Pink under the same symbol.

Cellebrite ($CLBT) set Sep 16 as the deadline to exercise its outstanding warrants. Any warrants not exercised by then will be redeemed for $0.10 per warrant.

Zura Bio ($ZURA) completed its warrant exchange offer and set Aug 27 as the post-offer warrant exchange deadline.

*Covering the notable activity not included in the section below

Key Weekly SPAC Activity

Deal Announcements/ Terminations/ Closings

See more: SPAC Deal Pipeline

Mergers announced:

$HAIA & Leading Group Limited

$IRRX & Tar Sands Holdings II

Terminations:

$ADRT & Gresham Worldwide

$FEXD & Mobitech International

CVII & CorpAcq (CVII liquidated)

Completions:

Armada I (AACI) & Rezolve ($RZLV), +1.9% from IPO

Moringa (MACA) & Silexion ($SLXN), -81%

Golden Arrow ($GAMC) & Bolt Threads ($BSLK), -56%

TenX Keane (TENK) & Citius Oncology ($CTOR), -80%

Genesis Growth Tech (GGAAF) & MindMaze IP —> NeuroMind AI Corp ($GGAAF), +17%

Merger Votes

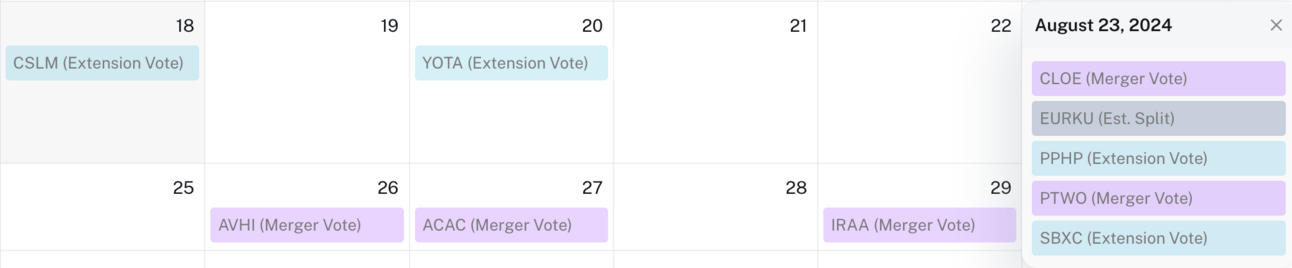

See more: Merger Votes Calendar

Merger vote set:

$PTWO & SBC Medical: Aug 23.

Deals in limbo (merger approved & pending closing):

$IFIN & Seamless Group (CURRENC Group)

$PLMI & Veea

Extensions

See more: Extension Votes Calendar

Approvals:

$EMCG: Aug 2025

$IVCA: May 2025

$RRAC: May 2025

$CPTK: May 2025

$NOVV: Feb 2025

Votes set:

$GATE, $BAYA, $PPHP

IPOs and New S-1s

See more: IPO Calendar & Pre-IPO Dataset

Priced IPOs:

HCM II ($HOND-U)

SilverBox Corp IV ($SBXD-U)

Cantor Equity Partners ($CEP)

New registrations:

FACT II (FACT)

Liquidations

See more: Liquidations Dataset

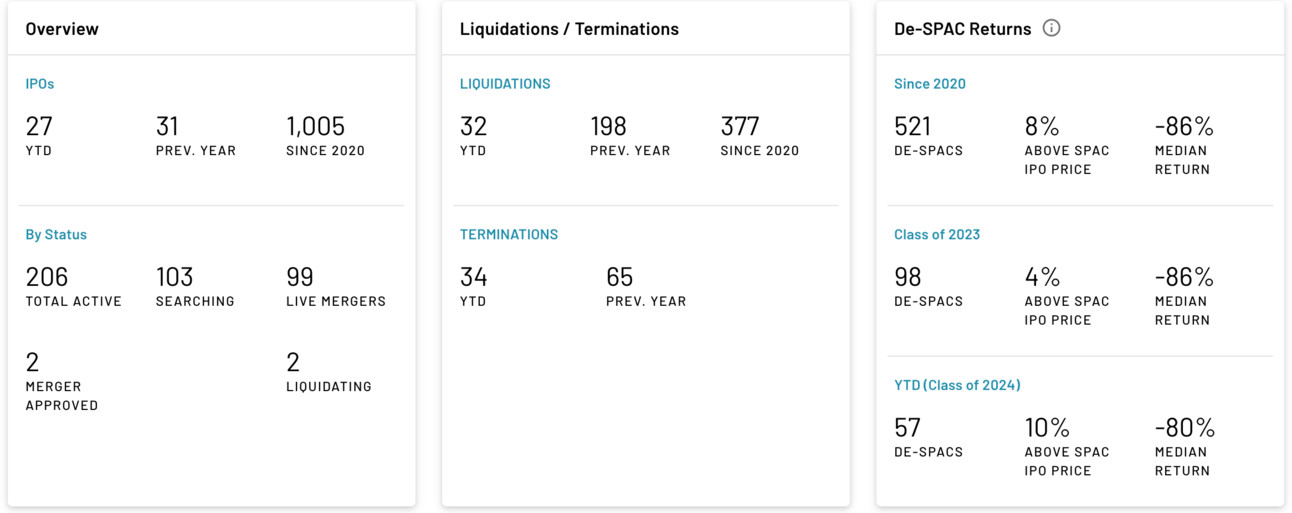

Last week, 2 new liquidations were announced ($FEXD, CVII), and 2 liquidations/share cancelations were implemented (TGVC, CVII)

32 SPACs have liquidated YTD 2024, and 2 are in the process of liquidating.

Friday’s SPAC Update

The section below is the format for the SPAC Morning Update newsletter sent to ListingTrack Pro subscribers on the morning of each trading day. You can sign up for ListingTrack Pro here.

SPAC & De-SPAC Daily Trading (prev. session)

SPAC Gainers & Losers

Ticker | DA Target | Price | Daily % Chg. |

|---|---|---|---|

$12.22 | 9.01% | ||

$11.80 | 1.58% | ||

SBC Medical Group | $14.25 | 1.35% | |

Xtribe | $11.50 | 1.14% | |

Real Messenger | $13.34 | 1.06% | |

$11.69 | -1.52% | ||

Kustom Entertainment | $12.18 | -1.77% | |

Mobitech International | $10.97 | -4.02% | |

Seamless Group | $10.03 | -10.53% | |

$12.63 | -15.80% |

SPAC Volume Leaders

De-SPAC Gainers & Losers

Ticker | IPO Return | Price | Daily % Chg. |

|---|---|---|---|

-98% | $0.18 | 63.21% | |

-55% | $4.46 | 40.69% | |

-78% | $2.25 | 38.89% | |

-56% | $4.39 | -23.52% | |

-99% | $0.05 | -27.75% | |

-98% | $0.25 | -32.87% |

De-SPACs listed from 2019- in descending order with the 3 Gainers followed by the 3 Losers

News & De-SPAC Updates

PropertyGuru ($PGRU) agreed to be acquired by EQT for $6.70 per share in cash, or a total equity value of $1.1B. — PR

Jefferies sued Rubicon ($RBT) for failure to pay its $7M underwriting fee. The firm claimed it only received $40,000 worth of stock. — Bloomberg

Gingko Bioworks ($DNA) will implement a 1-for-40 reverse split on Aug 20.

SPAC Updates

Liquidations / Terminations

Churchill VII (CVII) announced on Sunday that it and CorpAcq mutually terminated the merger due to unfavorable IPO market conditions. CVII will liquidate with the shares canceled as of this past Friday, Aug 16. — PR

Fintech Ecosystem ($FEXD) reported it will liquidate effective Aug 29. Appx. redemption price: $10.69. FEXD announced its BC with Mobitech International in Sep of 2022. — SF

TG Venture (TGVC), which was delisted by Nasdaq in April and hasn’t traded on any exchange since, liquidated with a redemption price of ~$11.159.

Merger Votes / Completions

Clover Leaf Capital ($CLOE) & Kustom Entertainment postponed the merger vote meeting from Aug 20 to Aug 23. — PR

Deal Updates

Extensions

Listings

New Issues: IPOs, New S-1sFilings

FACT II Acquisition Corp. (FACT) — S-1

$175M, 1/2 Warrant

Focus: N/A

UW: Cohen & Company

Listing Warnings / Transfers:

Arogo Capital ($AOGO): non-compliance warning. — PR

Thanks for reading,

The team at ListingTrack (listingtrack.io)

Abbreviations: BC: Business Combination, BCA: Business Combination Agreement, DA: Definitive Agreement, PR: Press Release, SF: Company SEC filing

DISCLAIMER: The information provided in this newsletter is for your convenience only and is not intended to be treated as financial, investment, tax, or other advice. ListingTrack, SPAC Track, and the parent, CommonFi, do not make any guarantees, representations, or warranties as to, and shall have no liability for, the timeliness, truthfulness, sequence, quality, completeness, or accuracy of any of the information or data provided in this newsletter or on the ListingTrack or SPAC Track websites.