Good morning!

If you are receiving this newsletter for the first time, welcome! You will find the Weekly SPAC Review in the first section below followed by an update on Friday’s SPAC activity.

While Friday's update is included in this Weekly newsletter, the other daily updates (covering Mon-Thurs) are sent in our SPAC Morning Update newsletter to ListingTrack Pro users on the morning of each trading day.

Weekly SPAC Review (Aug 19th -23rd)

Headlines of the Week

De-SPAC M&A

Allego’s (ALLG) was acquired by its majority shareowner, Meridiam, via a tender offer. — PR

Other De-SPAC News

Trump Is About to Get the All-Clear to Cash In on Media ($DJT) Shares — Bloomberg

AvePoint ($AVPT) is considering a secondary listing in Singapore that could take place in the next 12 months. — Bloomberg

BurgerFi International ($BFI) warns of possible bankruptcy, joins growing list of embattled restaurant brands in 2024 — FastCompany

Sonder ($SOND) jumped 130% upon announcing a licensing agreement with Marriott and a capital injection, including $43M of new convertible preferred equity and adjusted financing. — PR

SPAC Coverage*

*Covering the notable activity not included in the section below

Key Weekly SPAC Activity

Deal Announcements/ Terminations/ Closings

See more: SPAC Deal Pipeline

Mergers announced:

Terminations:

Global Technology I ($GTAC) & Tyfon Culture Holdings

TortoiseEcofin III ($TRTLF) & One Energy Enterprises

Vision Sensing ($VSAC) & Mediforum

No new Completions

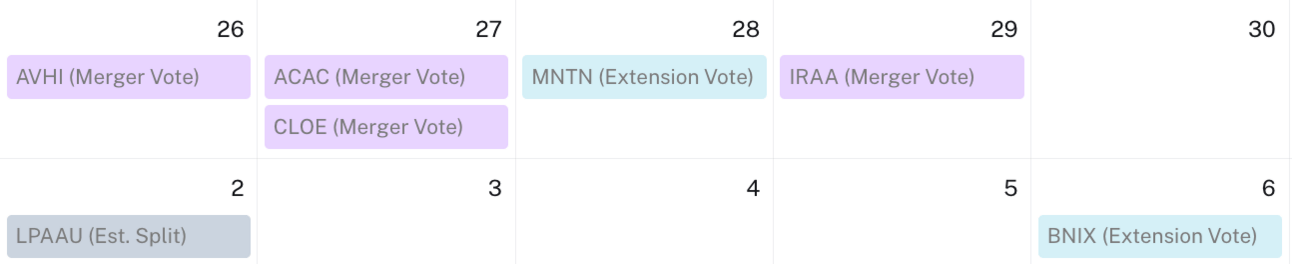

Merger Votes

See more: Merger Votes Calendar

Merger votes set:

$NOVV & Real Messenger: Sep 10

Deals in limbo (merger approved & pending closing):

$IFIN & Seamless Group (CURRENC Group)

$PLMI & Veea

Extensions

See more: Extension Votes Calendar

Approvals:

$CSLM: July 2025

Votes set:

$MNTN

IPOs and New S-1s

See more: IPO Calendar & Pre-IPO Dataset

No new IPOs

No new registrations

Liquidations

See more: Liquidations Dataset

Last week, 1 new liquidation was announced ($TRTLF)

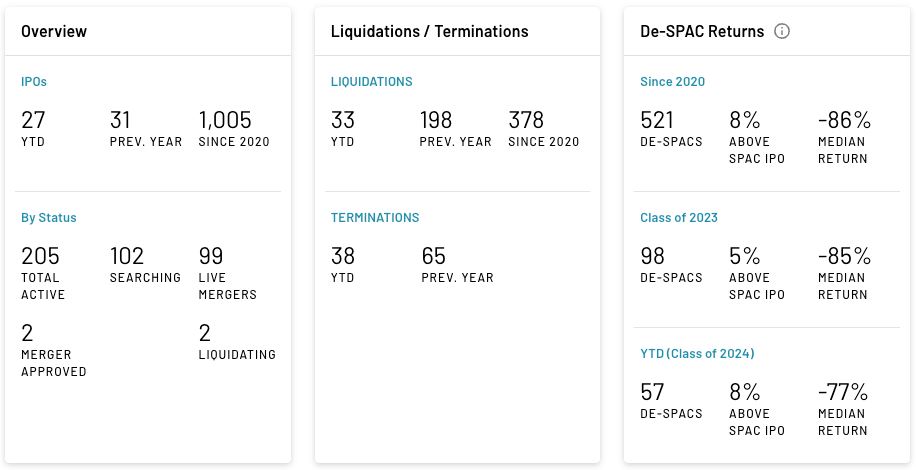

33 SPACs have liquidated YTD 2024, and 2 are in the process of liquidating.

Friday’s SPAC Update

The section below is the format for the SPAC Morning Update newsletter sent to ListingTrack Pro subscribers on the morning of each trading day. You can sign up for ListingTrack Pro here.

SPAC & De-SPAC Daily Trading (prev. session)

SPAC Gainers & Losers

Ticker | DA Target | Price | Daily % Chg. |

|---|---|---|---|

SBC Medical Group | $13.00 | 17.65% | |

Kustom Entertainment | $13.60 | 14.29% | |

Seamless Group | $11.41 | 10.24% | |

$12.85 | 5.24% | ||

Real Messenger | $12.70 | 4.10% | |

$11.40 | -0.78% | ||

Cardea Corporate Holdings | $11.04 | -0.90% | |

$11.38 | -2.65% | ||

Liminatus Pharma | $10.50 | -3.76% | |

RBio Energy | $10.78 | -8.26% |

SPAC Volume Leaders

De-SPAC Gainers & Losers

Ticker | IPO Return | Price | Daily % Chg. |

|---|---|---|---|

-99% | $1.05 | 82.39% | |

-93% | $0.67 | 31.94% | |

-93% | $0.75 | 22.23% | |

-86% | $1.41 | -18.97% | |

-99% | $1.13 | -21.88% | |

-86% | $1.45 | -23.68% |

De-SPACs listed from 2019- in descending order with the 3 Gainers followed by the 3 Losers

News & De-SPAC Updates

Cantor, Lutnick Pay $12 Million to Settle View Inc. (VIEW: Bankruptcy Delisting) SPAC Case — Bloomberg Law

ESS Tech ($GWH) implemented a 1-for-15 reverse stock split that will be effective on Aug 26. — PR

The Deals

Plum Acquisition III ($PLMJ) & Tactical Resources (OTC: USREF) — PR

Target Details:

HQ: Vancouver, Canada

Description: Tactical Resources is a mineral exploration and development company focused on U.S.-made rare earth elements used in semiconductors, electric vehicles, advanced robotics, and most importantly, national defense. The Company is also actively involved in the development of innovative metallurgical processing techniques to further unlock REEs development potential.

Valuation: $500M Pre-money equity value / $589M Pro-forma enterprise value

SPAC Updates

Merger Votes / Completions

Iris ($IRAA) & Liminatus Pharma canceled the Aug 29 merger vote. IRAA intends to call a new meeting. — SF

Pono Capital Two ($PTWO) & SBC Medical Group reported that, pursuant to the non-redemption agreement, an investor purchased 1,512,575 public shares. At present, 135,471 public shares, representing 8% of the total, have been redeemed, leaving 1,513,945 public SPAC shares ($17.6M), including the NRA shares, prior to any potential reversals. — SF

Deal Updates

AlphaTime ($ATMC) & HCYC Group Company amended the BCA to increase the minimum PIPE commitment to $9M. — SF

Coliseum ($MITA) & Rain Enhancement Technologies amended the BCA to, among other things, permit the sponsor to exclude a portion of its shares from lock-up restrictions and to reflect changes in RET's capital structure. — SF

ExcelFin ($XFIN) & Baird Medical extended the outside date to Sep 30. — SF

Extensions

Listing Warnings / Transfers:

Key Filings

Extensions:

S-4 Filings*:

Global Star ($GLST) & K Enter — F-4/A

*The latest S-4 filings can be found in the Announced Mergers dataset.

Thanks for reading,

The team at ListingTrack (listingtrack.io)

Abbreviations: BC: Business Combination, BCA: Business Combination Agreement, DA: Definitive Agreement, PR: Press Release, SF: Company SEC filing

DISCLAIMER: The information provided in this newsletter is for your convenience only and is not intended to be treated as financial, investment, tax, or other advice. ListingTrack, SPAC Track, and the parent, CommonFi, do not make any guarantees, representations, or warranties as to, and shall have no liability for, the timeliness, truthfulness, sequence, quality, completeness, or accuracy of any of the information or data provided in this newsletter or on the ListingTrack or SPAC Track websites.