Good afternoon and Happy Labor Day Weekend!

As the markets are closed on Monday, I hope everyone enjoys the extra time off. To our Pro subscribers— we will see you on Wednesday morning.

If you are receiving this newsletter for the first time, welcome! The Weekly SPAC Review is in the first section below, followed by an update on Friday’s SPAC activity.

While Friday's update is included in this Weekly newsletter, the other daily updates (covering Mon-Thurs) are sent in our SPAC Morning Update newsletter to ListingTrack Pro users on the morning of each trading day.

Weekly SPAC Review (Aug 26-30)

Headlines of the Week

De-SPAC M&A

The take-private acquisition of MariaDB (MRDB) for $0.55 per share by K1 Investment Management closed.

Other De-SPAC News

AvePoint announced a tender offer to purchase each outstanding warrant for $2.50 per share in cash. The offer will expire on Sep 24. — PR

AST SpaceMobile ($ASTS) announced it will redeem all of the public warrants that aren’t exercised by Sep 27. Any warrants not exercised by the Sep 27 deadline will be redeemed for $0.01 per warrant. — PR

Westrock Coffee ($WEST) announced it commenced a warrant exchange offer. WEST will offer warrant holders 0.29 common shares per warrant up to the deadline of Sep 26. — PR

Cellebrite ($CLBT), which previously announced its warrant redemption plan, announced the fair market value of 0.342 ordinary shares per warrant. The deadline to exercise is Sep 16. — PR

Hindenburg Research published a short report on iLearningEngines ($AILE), which closed its SPAC merger in April, titled ‘iLearningEngines: An Artificial Intelligence SPAC With Artificial Partners And Artificial Revenue.’ The stock dropped over 53% during market hours after the release. AILE responded in a press release.

HNR Acquisition Corp ($HNRA) will undergo a name and symbol change to EON Resources Inc. (EONR) on Sep 18. — PR

SPAC Coverage*

SLAM Corp. ($SLAM) was delisted by Nasdaq and began trading OTC.

Atlantic Coastal II ($ACAB) & Abpro Corporation entered into PIPE subscription agreements with Abpro Bio and Celltrion. — SF

*Covering the notable activity not included in the section below

Key Weekly SPAC Activity

Deal Announcements/ Terminations/ Closings

See more: SPAC Deal Pipeline

Mergers announced:

Cactus Acquisition Corp. 1 ($CCTS) & electric utility vehicle maker, Tembo E-LV, a subsidiary of VivoPower International PLC ($VVPR) — PR / Pending IP

Mountain Crest V ($MCAG) & South Korean cancer diagnostics company CUBEBIO — PR / Pending IP

PowerUp ($PWUP) & Puerto Rican early-stage biopharma company Aspire Biopharma — SF / Pending IP

Terminations:

99 Acquisition Group ($NNAG) & Nava Health MD

Completions:

InFinT (IFIN) & CURRENC Group, -37% from IPO

Merger Votes

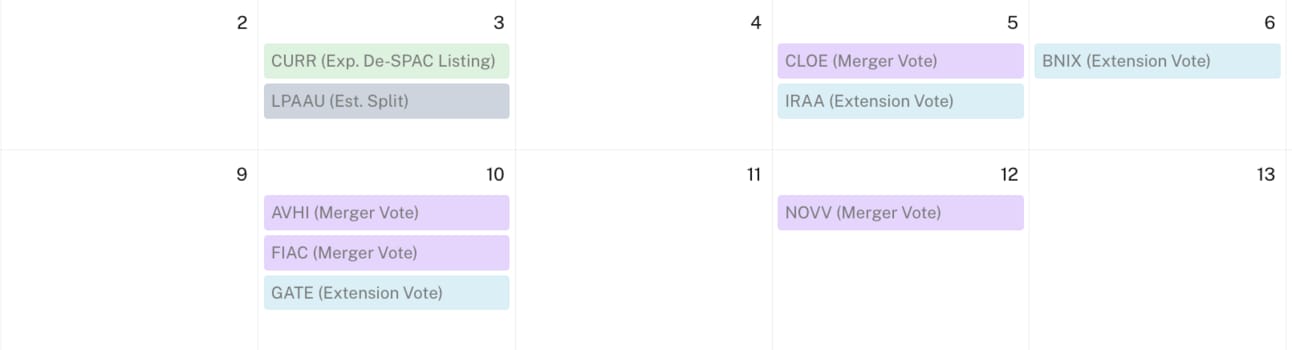

See more: Merger Votes Calendar

Deals in limbo (merger approved & pending closing):

Acri Capital ($ACAC) & Foxx Development (approved this week)

Pono Capital Two ($PTWO) & SBC Medical Group (approved this week)

$PLMI & Veea

Extensions

See more: Extension Votes Calendar

Approvals:

$YOTA: Oct 2025

$MNTN: Nov 2024

Votes set:

$BAYA, $IRAA, $GATE

IPOs and New S-1s

See more: IPO Calendar & Pre-IPO Dataset

New IPOs:

GigCapital7 ($GIGG-U): $200M

Black Spade II ($BSII-U): $150M

New registrations:

Ribbon Acquisition (RIBB)

Liquidations

See more: Liquidations Dataset

No new liquidations were announced last week, while FEXD was scheduled to cancel its shares on August 29.

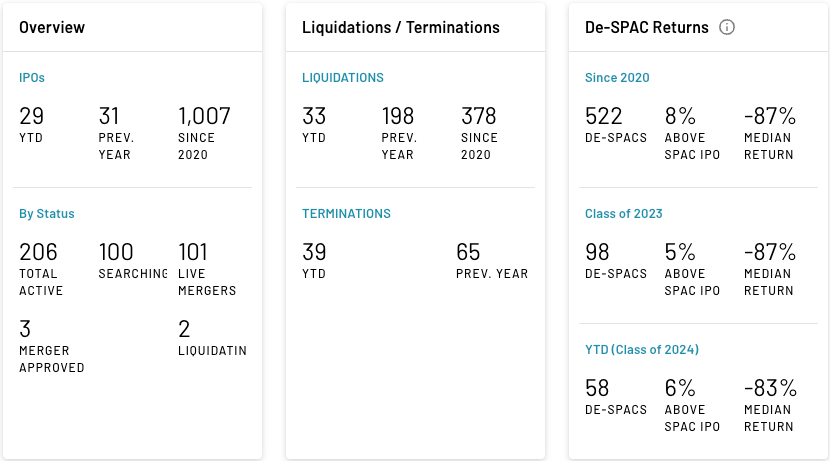

33 SPACs have liquidated in 2024, and 2 are in the process of liquidating (including FEXD).

Friday’s SPAC Update

The section below is the format for the SPAC Morning Update newsletter sent to ListingTrack Pro subscribers on the morning of each trading day. You can sign up for ListingTrack Pro here.

SPAC & De-SPAC Daily Trading (prev. session)

SPAC Gainers & Losers

Ticker | DA Target | Price | Daily % Chg. |

|---|---|---|---|

$12.38 | 2.70% | ||

$12.25 | 2.00% | ||

Nava Health MD | $10.58 | 0.76% | |

Phytanix Bio | $11.25 | 0.63% | |

$10.88 | 0.55% | ||

Kustom Entertainment | $12.08 | -4.13% | |

Car Tech | $11.11 | -7.34% | |

Foxx Development | $10.78 | -13.06% | |

SBC Medical Group | $10.32 | -20.12% | |

MKD Technology | $9.00 | -16.12% |

SPAC Volume Leaders

De-SPAC Gainers & Losers

Ticker | IPO Return | Price | Daily % Chg. |

|---|---|---|---|

-87% | $1.30 | 30.00% | |

-99% | $0.04 | 29.03% | |

-12% | $8.78 | 20.44% | |

-79% | $2.12 | -20.30% | |

-98% | $0.17 | -23.56% | |

-95% | $0.54 | -29.87% |

De-SPACs listed from 2019- in descending order with the 3 Gainers followed by the 3 Losers

The Deals

Target Details:

HQ: Puerto Rico

Description: Aspire Biopharma is a privately held, early-stage biopharmaceutical technology company founded in 2021. The Company is engaged in the business of developing and marketing a disruptive technology for novel delivery mechanisms for “do no harm” FDA approved drugs, nutraceuticals and supplements. Aspire has developed and acquired technologies that are a Novel Soluble Formulation which address emergencies and drug efficacy, dosage management, patient compliance and safety and rapid response and absorption time when required and desired. The Company’s lead candidate Instaprin addresses cardiology emergencies and pain management, is a granular or powder formulation of a soluble, Ph neutral, fast acting aspirin.

Valuation: $316.8M Pre-money equity value

SPAC Updates

Liquidations / Terminations

99 Acquisition Group ($NNAG) & Nava Health MD reported the BC with Nava Health MD was terminated after the company delivered a termination notice. NNAG is required to pay Nava $300,000 in reimbursement for transaction costs. — SF

TortoiseEcofin III ($TRTL) & reached an agreement for mutual release with One Energy in which the former target agreed to pay certain vendor expenses. — SF

Merger Votes / Completions

InFinT (IFIN) & Seamless Group: merger closed. IFIN was delisted from NYSE with the combined company, renamed CURRENC Group, to trade on Nasdaq under the new ticker $CURR starting Tuesday, Sep 3. — PR

Deal Updates

Extensions

SilverBox III ($SBXC) was approved to extend up to Mar 2025. ~73% of the public SPAC shares were redeemed. Remaining in trust: ~$40.5M / 3,780,300 shares. — SF

Listing Warnings / Transfers:

Key Filings

Extensions:

Newbury Street ($NBST) — PRE

S-4 Filings*:

Insight ($INAQ) & Alpha Modus — S-4/A

Post-Merger S-1 Filings**:

Oklo ($OKLO) — S-1/A

*The latest S-4 filings can be found in the Announced Mergers dataset.

**Includes PIPE resale registrations where applicable — the latest post-merger S-1 filings can be found in the De-SPAC Screener in the column group “De-SPAC Profile”.

Thanks for reading,

The team at ListingTrack (listingtrack.io)

Abbreviations: BC: Business Combination, BCA: Business Combination Agreement, DA: Definitive Agreement, PR: Press Release, SF: Company SEC filing

DISCLAIMER: The information provided in this newsletter is for your convenience only and is not intended to be treated as financial, investment, tax, or other advice. ListingTrack, SPAC Track, and the parent, CommonFi, do not make any guarantees, representations, or warranties as to, and shall have no liability for, the timeliness, truthfulness, sequence, quality, completeness, or accuracy of any of the information or data provided in this newsletter or on the ListingTrack or SPAC Track websites.