Good morning!

If you are receiving this newsletter for the first time, welcome! You will find the Weekly SPAC Review in the first section below followed by an update on Friday’s SPAC activity.

While Friday's update is included in this Weekly newsletter, the other daily updates (covering Mon-Thurs) are sent in our SPAC Morning Update newsletter to ListingTrack Pro users on the morning of each trading day.

Weekly SPAC Review (Feb 24th - 28th)

Headlines of the Week

De-SPAC M&A

CoStar Group (CSGP) closed its appx. $1.8 billion acquisition of Matterport (Delisted: MTTR). —PR

Other De-SPAC News

Lucid Motors' (LCID) CEO Peter Rawlinson stepped down from his roles as CEO and CTO of the company. — TechCrunch

Nikola (NKLA --> NKLAQ) was delisted by Nasdaq and is set to begin trading OTC under the new symbol NKLAQ following its bankruptcy announcement.

Short seller Bleecker Street Research published a report targeting RocketLab (RKLB) titled 'We Think It’s Gonna Be a Long, Long Time' — Bleeker Street

SPAC Coverage*

dMY Squared Technology Group (DMYY) has entered into a non-binding letter of intent (LOI) to merge with Horizon Quantum Computing, which develops software tools for quantum computers, in a transaction valuing Horizon at approximately $500 million. The definitive agreement is anticipated in Q2, with the merger expected to close by year-end. Additionally, DMYY's CEO, Niccolo de Masi, has resigned to become the CEO of IonQ (IONQ). —SF

*Covering the notable activity not included in the section below

Key Weekly SPAC Activity

Deal Announcements/ Terminations/ Closings

See more: SPAC Deal Pipeline

Mergers announced:

Helix II (HLXB) & BridgeBio Oncology Therapeutics

No Terminations

No Completions

Merger Votes

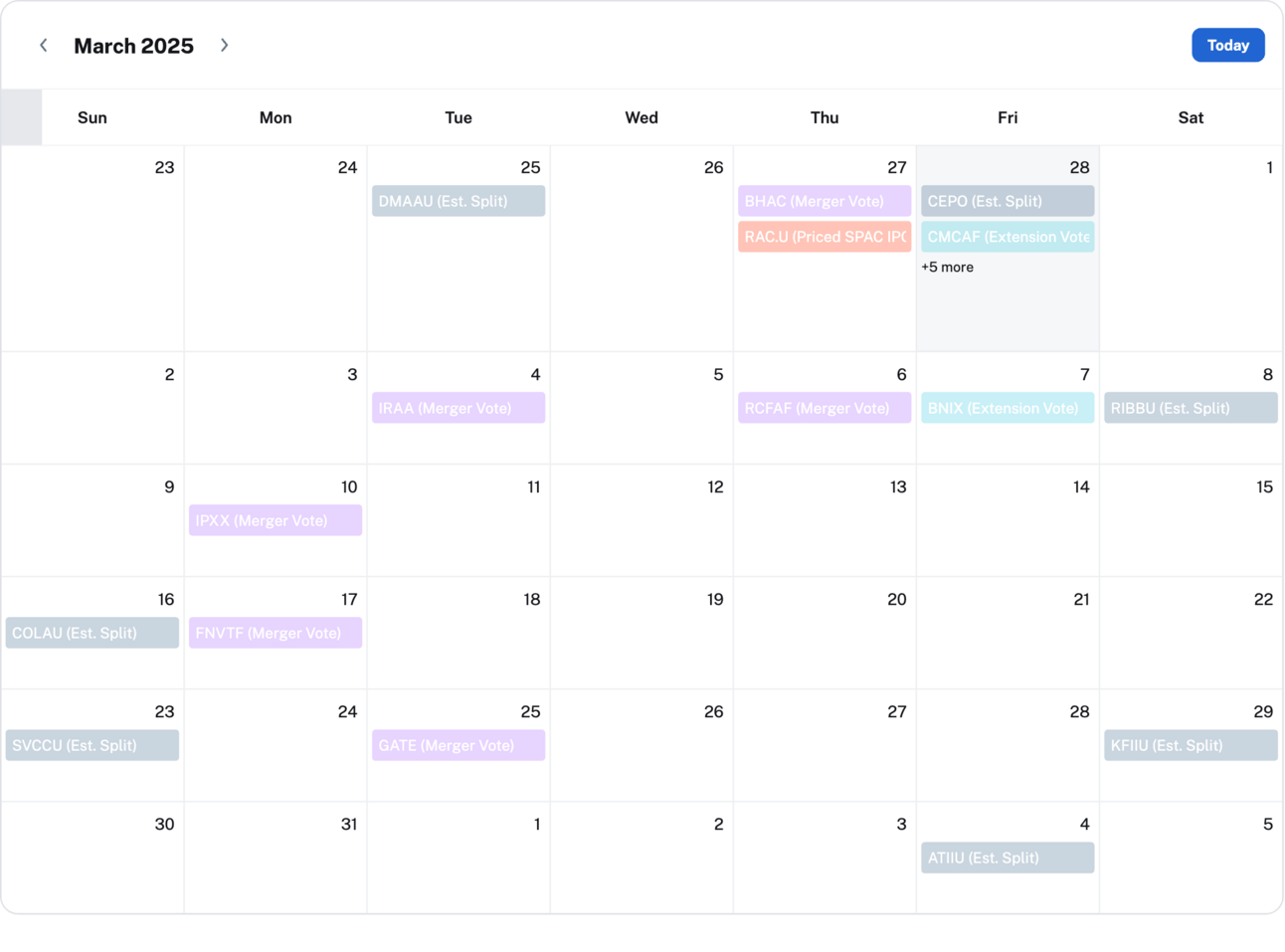

See more: Merger Votes Calendar

No new Merger votes set

Deals in limbo (merger approved & pending closing):

ShoulderUp Technology (OTC: SUAC) & SEE ID

Bowen (BOWN) & Shenzhen Qianzhi BioTech (Emerald)

Global Star (GLST) & K Enter

Battery Future's (OTC: BFACF) & Classover

Rigel Resource (OTC: RRACF) & Aurous — approved last week

IPOs and New S-1s

See more: IPO Calendar & Pre-IPO Dataset

New IPOs:

Live Oak Acquisition Corp. V ($LOKVU) priced its IPO — PR

$200M, 1/2 Warrant

Focus: N/A

UW: Santander

NewHold Investment Corp III ($NHICU) priced its IPO. — PR

$175M, 1/2 Warrant

Focus: Industrial technology

UW: BTIG

Fifth Era Acquisition Corp I ($FERAU) priced its IPO. — PR

$200M, 1 R (1/10th sh)

Focus: Focus: Internet, enterprise technology, software, AI, fintech and blockchain.

UW: Cantor

Rithm Acquisition Corp. (RAC) priced its $200 million IPO. Units include 1 common share and 1/3 of a warrant. Focus: Financial services, real estate, and digital infrastructure. UWs: Citi, BTIG, and UBS. —PR

New registrations

Quartzsea Acquisition Corporation ($QSEA) filed for IPO. — S-1

$60M, 1 R (1/10 sh)

Focus: N/A

UW: SPAC Advisory Partners

Sichuan Hongyi Enterprise Management Co., Ltd. (SJHK) filed for IPO. — S-1

$100M, No Units, No Warrants

Focus: China and Asia-Pacific

UW: N/A

Republic Digital Acquisition Company ($RDAG) filed for IPO. — S-1

$220M, 1/2 Warrant

Focus: Fintech, software, and cryptocurrency;

UW: Cantor

Liquidations

See more: Liquidations Dataset

No new Announcements/ Delistings

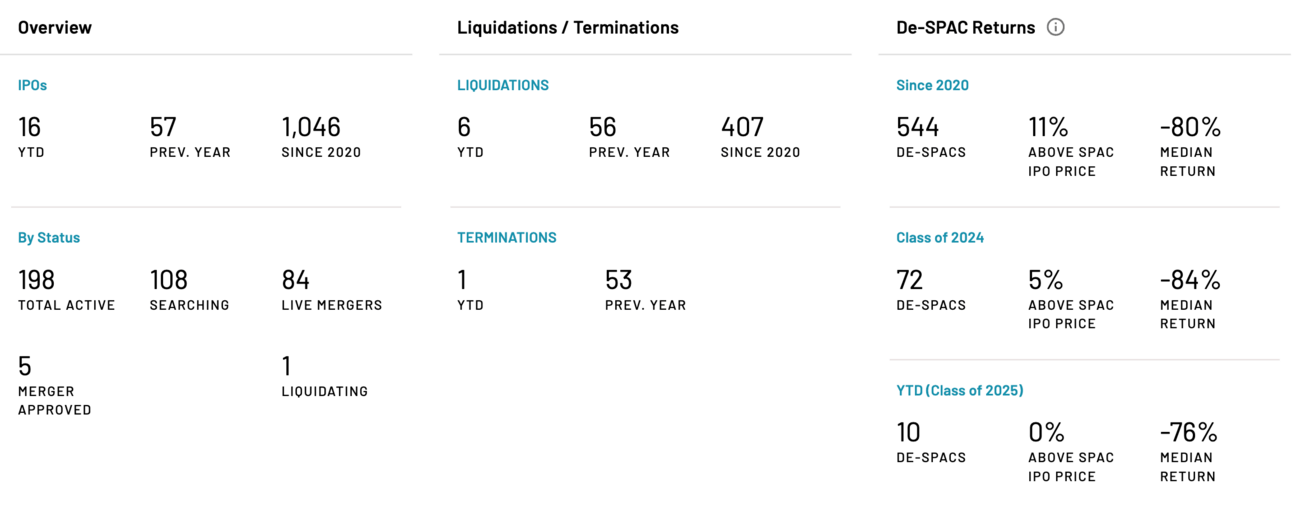

6 SPACs have liquidated in 2025 YTD and 1 is in the process of liquidating.

SPAC Update

The section below is the format for the SPAC Morning Update newsletter sent to ListingTrack Pro subscribers on the morning of each trading day. You can sign up for ListingTrack Pro here.

SPAC & De-SPAC Daily Trading (prev. session)

SPAC Gainers & Losers

Ticker | DA Target | Price | Daily % Chg. |

|---|---|---|---|

BridgeBio Oncology | $11.05 | 2.31% | |

$10.20 | 0.89% | ||

USA Rare Earth | $11.13 | 0.63% | |

$10.17 | 0.39% | ||

$10.95 | 0.37% | ||

$10.03 | -0.89% | ||

$12.00 | -1.23% | ||

$11.25 | -1.32% | ||

Shenzhen Qianzhi BioTech | $3.94 | -3.90% | |

K Enter | $6.02 | -22.37% |

SPAC Volume Leaders

Ticker | DA Target | Volume |

|---|---|---|

BridgeBio Oncology | 0.94M | |

GrabAGun | 0.28M | |

Webull | 0.27M | |

0.22M | ||

0.1M | ||

0.08M |

De-SPAC Gainers & Losers

Ticker | IPO Return | Price | Daily % Chg. |

|---|---|---|---|

-99% | $0.84 | 140.94% | |

-93% | $0.72 | 32.57% | |

-88% | $1.23 | 26.76% | |

203% | $30.28 | 22.10% | |

-84% | $1.59 | 21.37% | |

-69% | $3.09 | -21.17% | |

-82% | $1.77 | -28.92% | |

-99% | $0.78 | -34.35% | |

-92% | $0.83 | -45.94% | |

-90% | $1.01 | -49.50% |

De-SPACs listed from 2019-

De-SPAC Volume Leaders

News & De-SPAC Updates

CoStar Group (CSGP) closed its appx. $1.8 billion acquisition of Matterport (Delisted: MTTR). —PR

Vincerx Pharma (VINC) announced the termination of its binding reverse merger term sheet with Oqory and Vivasor. Consequently, the board will reexamine its strategic alternatives, which include exploring out-licensing, various M&A opportunities, asset and technology sales, and potentially winding down operations. —PR

The Deals

Target Details:

HQ: San Francisco

Description (from PR): BridgeBio Oncology Therapeutics (BBOT) is a clinical-stage biopharmaceutical company advancing a next-generation pipeline of novel small molecule therapeutics targeting RAS and PI3Kα malignancies. Initially formed as a subsidiary of BridgeBio Pharma, Inc. (Nasdaq: BBIO), BBOT has the goal of improving outcomes for patients with cancers driven by the two most prevalent oncogenes in human tumors.

Valuation: $949M Pro-forma equity value

Additional Financing / Deal Notes: $260M PIPE

SPAC Updates

Merger Votes / Completions

Rigel Resource (RRACF) shareholders approved the merger with Aurous. 89% of the public SPAC shares were redeemed, leaving 760,036 public shares ($8.8M) prior to any potential reversals. The parties intend to close the merger "as soon as possible" and may accept redemption reversals. —SF

Listings

New Issues: IPOs, New S-1s

Filings

Republic Digital Acquisition Company ($RDAG) filed for IPO. — S-1

$220M, 1/2 Warrant

Focus: Fintech, software, and cryptocurrency;

UW: Cantor

Key Filings

Extensions:

S-4 Filings*:

DT Cloud (DYCQ) & Maius Pharmaceutical — F-4

Post-Merger S-1 Filings**:

FST Corp. ($KBSX) — F-1

*The latest S-4 filings can be found in the Announced Mergers dataset.

**Includes PIPE resale registrations where applicable — the latest post-merger S-1 filings can be found in the De-SPAC Screener in the column group “De-SPAC Profile”.

Thanks for reading,

The team at ListingTrack (listingtrack.io)

Abbreviations: BC: Business Combination, BCA: Business Combination Agreement, DA: Definitive Agreement, PR: Press Release, SF: Company SEC filing

DISCLAIMER: The information provided in this newsletter is for your convenience only and is not intended to be treated as financial, investment, tax, or other advice. ListingTrack, SPAC Track, and the parent, CommonFi, do not make any guarantees, representations, or warranties as to, and shall have no liability for, the timeliness, truthfulness, sequence, quality, completeness, or accuracy of any of the information or data provided in this newsletter or on the ListingTrack or SPAC Track websites.