Good morning!

If you are receiving this newsletter for the first time, welcome! You will find the Weekly SPAC Review in the first section below followed by an update on Friday’s SPAC activity.

While Friday's update is included in this Weekly newsletter, the other daily updates (covering Mon-Thurs) are sent in our SPAC Morning Update newsletter to ListingTrack Pro users on the morning of each trading day.

Weekly SPAC Review (Mar 3-7)

Headlines of the Week*

De-SPAC News

FREYR Battery (FREY) changed its name and symbol to T1 Energy (TE).

NKGen Biotech (NKGN) was delisted by Nasdaq and began trading OTC.

SPAC Coverage

Newbury Street (NBST) reported that its former merger partner, Infinite Reality, failed to pay the termination fee due on March 1 and has contacted the company.

*Covering the notable activity not included in the section below

Key Weekly SPAC Activity

Deal Announcements/ Terminations/ Closings

See more: SPAC Deal Pipeline

Mergers announced:

Relativity Acquisition Corp. (RACY: Delisted) & biotech focusing on stem cell technology and regenerative medicine, Instinct Brothers Co. — PR

No Terminations

No Completions

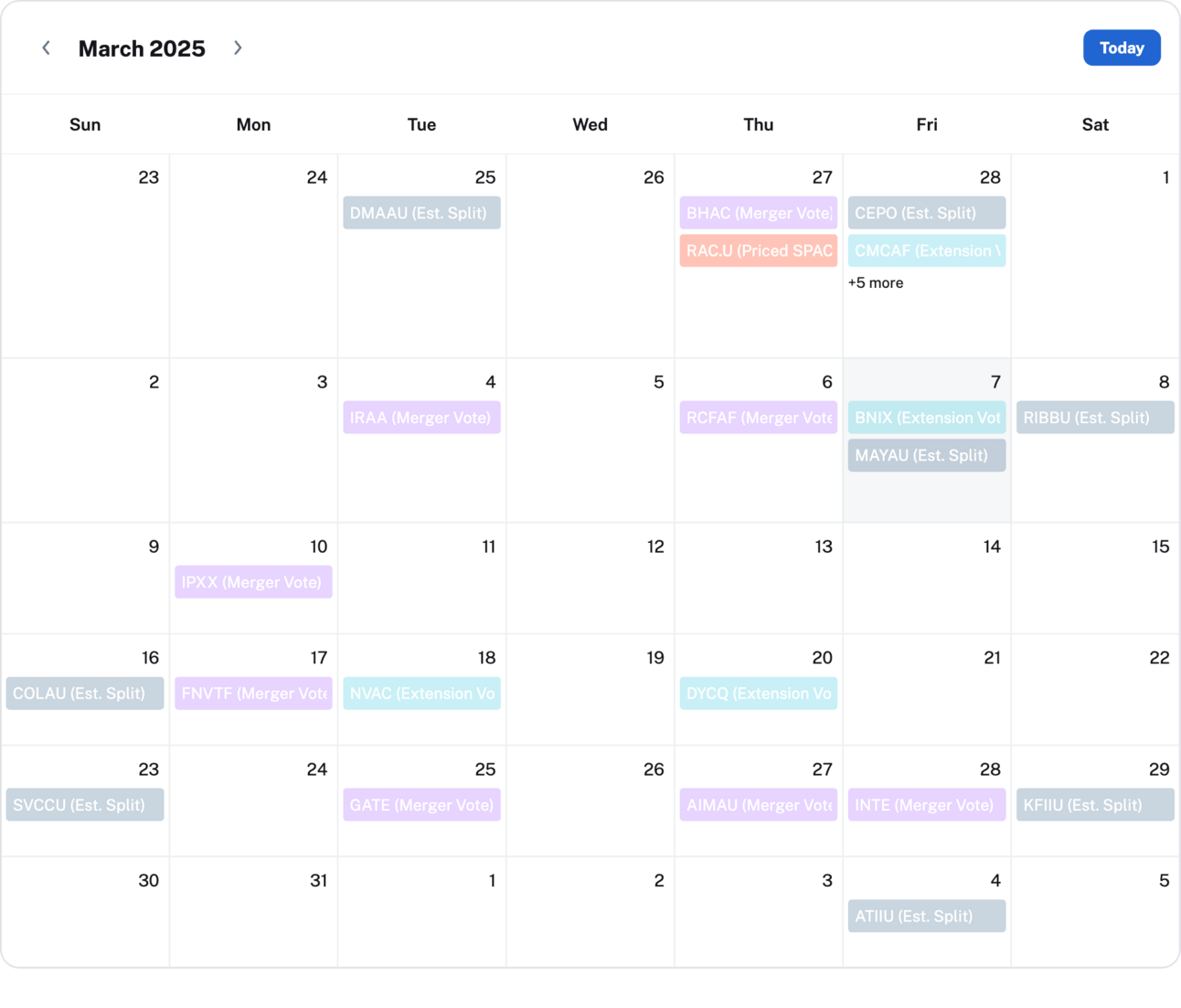

Merger Votes

See more: Merger Votes Calendar

Merger votes set:

Deals in limbo (merger approved & pending closing):

Focus Impact BH3 (BHAC) & XCF Global — approved last week

ShoulderUp Technology (SUAC) & SEE ID

Bowen (BOWN) & Shenzhen Qianzhi BioTech (Emerald)

Global Star (GLST) & K Enter

Battery Future's (BFACF) & Classover

Rigel Resources (RRACF) & Aurous

Extensions

See more: Extension Votes Calendar

Approvals:

Concord II (CNDA) was approved to extend up to Dec 2025

Votes set:

IPOs and New S-1s

See more: IPO Calendar & Pre-IPO Dataset

No New IPOs

New registrations

Cal Redwood Acquisition Corp. ($CRA) filed for IPO. — S-1

$200M, (1/10 sh)

Focus: Technology, media and telecommunications ('TMT')

UW: Cohen & Company

Siddhi Acquisition Corp (SDHI) filed for IPO. – S-1

$200M, 1 R (1/10 sh)

Focus: N/A

UW: Santander

Dune Acquisition Corp II ($IPOD) filed for IPO. – S-1

$150M, 3/4 Warrant

Focus: Software as a service, artificial intelligence, medtech or asset management and consultancy

UW: Clear Street

Liquidations

See more: Liquidations Dataset

No new Liquidation Announcements/ Delistings

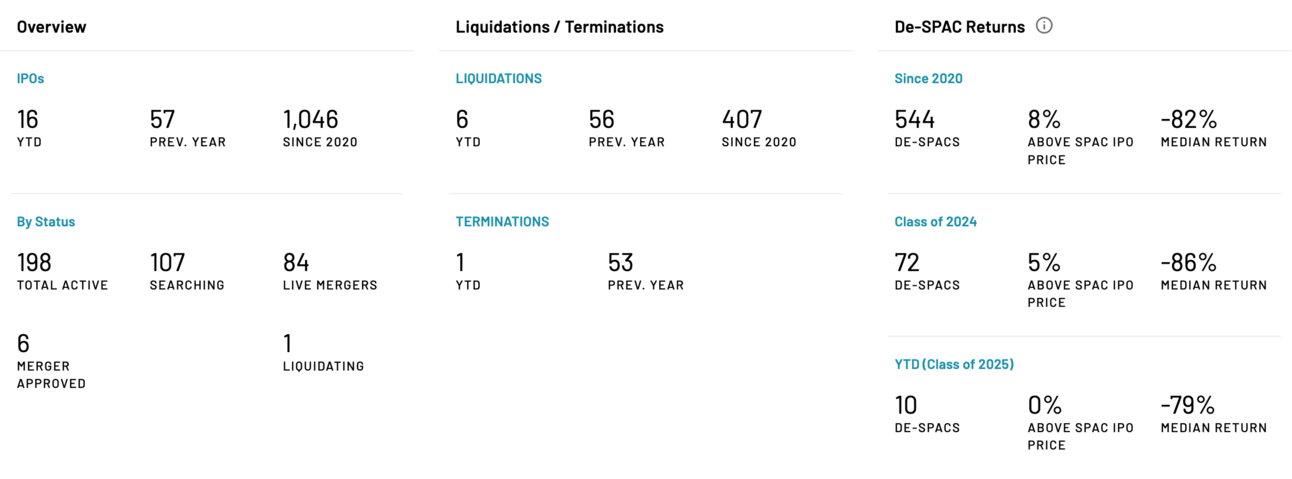

6 SPACs have liquidated YTD 2025 and 1 is in the process of liquidating.

SPAC Update

The section below is the format for the SPAC Morning Update newsletter sent to ListingTrack Pro subscribers on the morning of each trading day. You can sign up for ListingTrack Pro here.

SPAC & De-SPAC Daily Trading (prev. session)

SPAC Gainers & Losers

Ticker | DA Target | Price | Daily % Chg. |

|---|---|---|---|

USA Rare Earth | $12.99 | 21.40% | |

Shenzhen Qianzhi BioTech | $3.80 | 2.15% | |

$11.09 | 0.54% | ||

$10.67 | 0.47% | ||

BridgeBio Oncology | $10.84 | 0.46% | |

Gadfin | $11.50 | -0.43% | |

$11.36 | -0.53% | ||

K Enter | $6.56 | -0.61% | |

$10.48 | -0.76% | ||

Cyabra | $11.25 | -0.79% |

SPAC Volume Leaders

Ticker | DA Target | Volume |

|---|---|---|

e2Companies | 1.61M | |

0.25M | ||

0.22M | ||

0.22M | ||

0.17M | ||

Polibeli Group | 0.11M |

De-SPAC Gainers & Losers

Ticker | IPO Return | Price | Daily % Chg. |

|---|---|---|---|

-83% | $1.74 | 138.55% | |

-99% | $1.04 | 28.08% | |

-99% | $1.23 | 20.59% | |

-92% | $0.75 | 18.24% | |

-18% | $8.24 | 16.55% | |

-99% | $0.67 | -14.92% | |

184% | $28.41 | -16.22% | |

-99% | $1.24 | -16.78% | |

-67% | $3.34 | -20.48% | |

-12% | $8.77 | -22.11% |

De-SPACs listed from 2019-

De-SPAC Volume Leaders

News & De-SPAC Updates

Faraday Future Intelligent Electric (FFIE --> FFAI) changed its symbol from FFIE to FFAI, effective March 10. Faraday's public warrants will trade as FFAIW. — PR

Pinstripes (OTC: PNST) announced it entered into a binding LOI with Oaktree for $7.5 million in financing. PNST was delisted by NYSE and is now trading OTC. — PR

Digital Media Solutions' (OTC: DMSIQ) shares were canceled worthless as its bankruptcy plan became effective.

Aquaron Acquisition Corp (AQU --> OTC: AQUC) was delisted from Nasdsaq and will begin trading OTC.

SPAC Updates

Merger Votes / Completions

Deal Updates

Globalink Investment ($GLLI) & Alps Global Holding Berhad amended the merger agreement to remove the earn-out provision and remove the $5M net tangible asset requirement. —SF

Extensions

Capitalworks Emerging Markets, now Piermont Valley Acquisition Corp., (CMCAF) was approved to extend up to March 2026. ~83% of the public SPAC shares were redeemed. Remaining in trust: ~$2.4M / 204,986 shares. CMCAF was also approved to change its name to Piermont Valley Acquisition Corp. —SF

Listings

New Issues: IPOs, New S-1s

Filings

Listing Warnings / Transfers:

Valuence Merger I ($VMCA) will be delisted by Nasdaq on March 11, with VMCA expecting to trade OTC under the same symbols VMCA, VMCAW, and VMCAU. — SF

Key Filings

Extensions:

NorthView ($NVAC) —DEF

Post-Merger S-1 Filings**:

MKDWELL ($MKDW) – F-1/A

*The latest S-4 filings can be found in the Announced Mergers dataset.

**Includes PIPE resale registrations where applicable — the latest post-merger S-1 filings can be found in the De-SPAC Screener in the column group “De-SPAC Profile”.

Thanks for reading,

The team at ListingTrack (listingtrack.io)

Abbreviations: BC: Business Combination, BCA: Business Combination Agreement, DA: Definitive Agreement, PR: Press Release, SF: Company SEC filing

DISCLAIMER: The information provided in this newsletter is for your convenience only and is not intended to be treated as financial, investment, tax, or other advice. ListingTrack, SPAC Track, and the parent, CommonFi, do not make any guarantees, representations, or warranties as to, and shall have no liability for, the timeliness, truthfulness, sequence, quality, completeness, or accuracy of any of the information or data provided in this newsletter or on the ListingTrack or SPAC Track websites.