May 10th, 2021

Good evening,

Thanks for reading “The Nightcap”, a nightly recap of all the day’s highlights in the SPAC world. In this newsletter, you will find a breakdown of the day’s deals, IPO’s, “in talks” reports, and noteworthy new SPAC S-1 filings.

Of course, you can always discover and track all of the SPACs at spactrack.net.

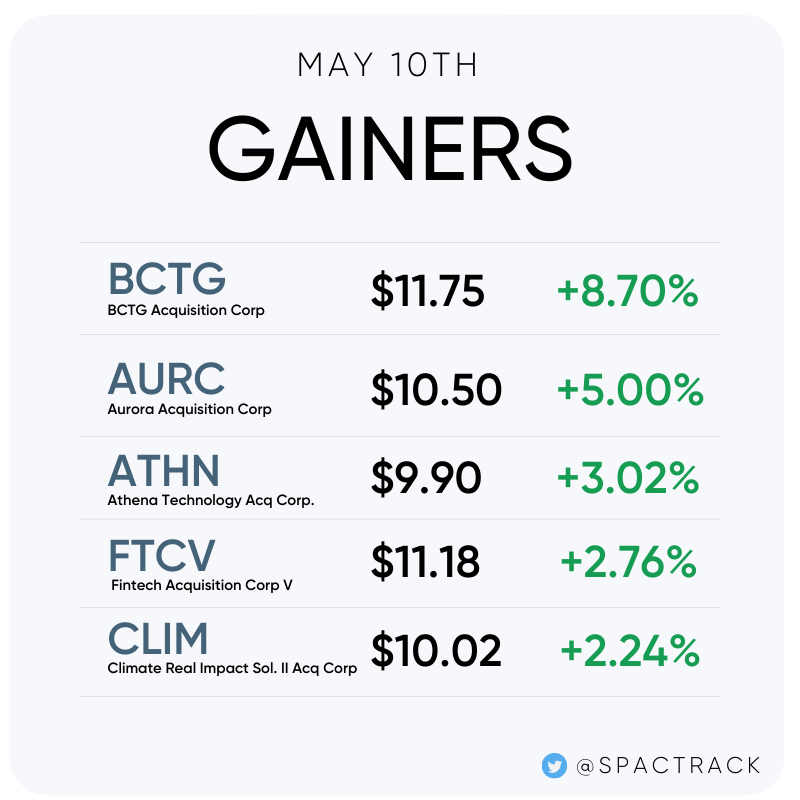

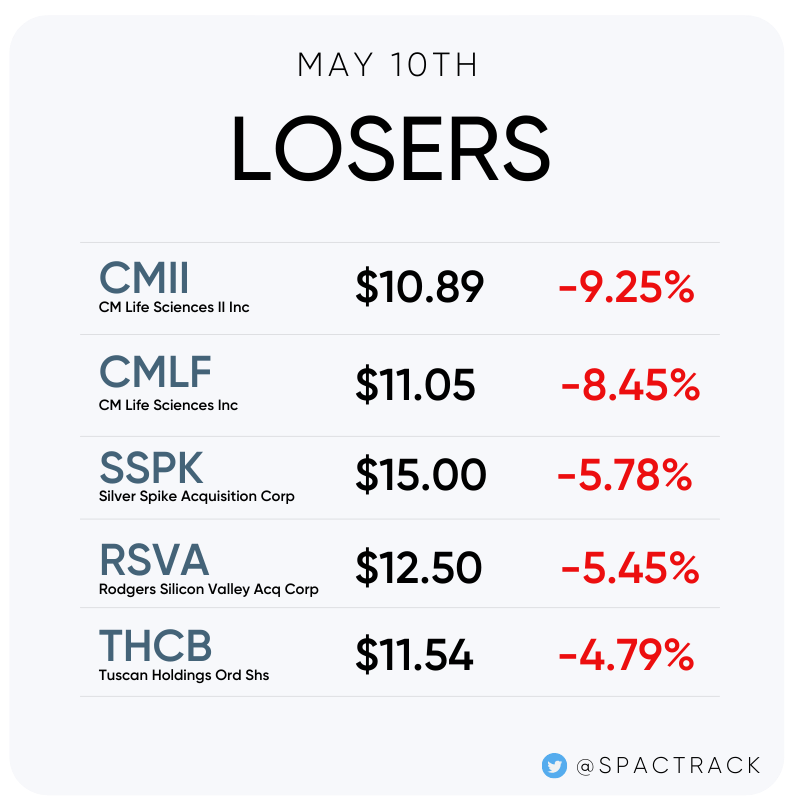

The Stats:

The Deals:

1) LIV Capital Acquisition Corp. (LIVK) & AgileThought

$482.3M EV

$42.5M PIPE

2) Hennessy Capital Investment Corp. V (HCIC) & Plus

$2.47B EV

$150M PIPE

3) Star Peak Corp II (STPC) & Benson Hill

$1.35B EV

$225M PIPE

Afternoon deal:

4) Austerlitz Acquisition Corporation I (AUS) & Wynn Interactive, a subsidiary of Wynn Resorts.

$3.16B EV

No PIPE

The combined company is expected to have an enterprise value of approximately $3.2 billion at closing, representing 4.5x Wynn Interactive’s projected 2023 revenue.

Cannae Holdings, Inc. has agreed to fully backstop share redemptions, assuring availability of cash proceeds at closing. As a result, irrespective of share redemptions by the public stockholders of Austerlitz I, approximately $640 million in cash will be available to fund the combined Company’s operations and support new and existing growth initiatives of Wynn Interactive.

Upon closing of the transaction, assuming no share redemptions by the public stockholders of Austerlitz I, Wynn Interactive’s current shareholders will retain an equity interest in the Company of approximately 79%, inclusive of 58% equity interest (and 72% voting interest) by Wynn Resorts, Ltd., Austerlitz I’s stockholders will hold approximately 18% and Austerlitz I’s sponsor will hold approximately 3%.

Deal News Reports:

1) Switchback II Corporation (SWBK) is in talks with Bird Rides.

Bird is preparing to merge with Switchback II Corporation, a Dallas-based blank check company focusing on companies reducing carbon emissions, according to documents reviewed by dot.LA. Switchback has been marketing a $200 million PIPE offering in recent weeks that allows investors to buy shares of Bird at the IPO price.

Bird will receive hundreds of million in cash through the deal, which it can use to fund its operations as it struggles to achieve profitability and to expand to more markets. Last month, the company announced plans to double the size of its European operation, spending $150 million to enter 50 new cities.

The transaction values Bird at $2.3 billion, below the $2.85 billion valuation it reached in the beginning of 2020. But that was before the pandemic, which drove 2020 revenue down to $95 million, a 37% decline from 2019, according to a deck pitching the deal seen by dot.LA.

2) 7GC & Co Holdings (VII) is still in talks to merge with Vice Media (initially reported in March by The Information.

Vice Media Targets Valuation of Nearly $3 Billion in Proposed SPAC Deal (WSJ— behind paywall)

The proposed transaction, valued at nearly $3 billion including debt, would leave existing shareholders—including TPG, Walt Disney Co. , A&E Networks Group, merchant bank Raine Group and founder Shane Smith—with a combined 75% ownership of the company, the people said. The rest of the company would be owned by Vice’s new investors.

The nearly $3 billion valuation under consideration would be a discount compared with the $5.7 billion valuation set in Vice Media’s last major equity-investment round, a $450 million infusion from TPG in 2017.

3) Aurora Acquisition Corp. (AURC) is nearing a merger deal with Better.

Mortgage Startup Better to Go Public in SPAC Merger (WSJ— behind paywall)

Better Holdco Inc. plans to merge with Aurora Acquisition Corp. , a SPAC sponsored by investment firm Novator Capital, at valuation of roughly $7 billion pre-money, the people said. The transaction could be completed this week.

SoftBank Group Corp. , which recently invested $500 million in Better, could put in another $1.3 billion through a PIPE, or private investment in public equity, a common feature of SPAC mergers. (Better might place $400 million of that with other investors.) The remaining $200 million of the $1.5 billion PIPE is to come from Aurora, whose sponsor is the investment vehicle of Icelandic billionaire Thor Bjorgolfsson.

New S-1 Filings:

None today.

Notable SPAC News:

1) Some Startups Went From Rescue PPP Loans to SPAC Windfalls (WSJ — behind paywall)

Of the 15 highest-valued startups that received a PPP loan and went on to announce a SPAC deal or IPO, one-third have repaid the loans or pledged to repay them, according to a Wall Street Journal analysis of PitchBook data and company securities filings, and interviews with company chief executives.

It is unclear if all of those loans would have qualified for forgiveness, but in several cases, startup CEOs said they would have. Lenders process loan forgiveness according to rules outlined by the Small Business Administration, which oversees the PPP.

Scott Mercer, CEO and founder of electric-vehicle-charging company Volta Industries Inc., said his company’s approximately $3 million PPP loan would have qualified for forgiveness, but he is paying it back now that he has a SPAC deal to raise $600 million.

“It was an invaluable tool, it helped, and we are happy to pay it back because it got us to a place of unexpected success,” said Mr. Mercer. “Back in April 2020, I had no idea what a SPAC was.”

2) Plus’s SPAC Merger Marks Autonomous Trucking Shift to Public Markets (WSJ — behind paywall)

Plus plans to deploy about 160 trucks this year in the U.S., scaling up to around 1,300 in 2022, according to an investor presentation.

“Our backlog already basically extends ourselves into 2023,” Mr. Liu said. “We’re just trying to make sure that we can actually increase our production and make sure our technology and products are robust and reliable enough to meet the demand.”

Other autonomous-vehicle startups that also focus on passenger vehicles are stepping up efforts to develop autonomous technology for freight transportation.

“The market is validating the view that self-driving trucks will arrive well before robotaxis,” said Asad Hussain, senior mobility analyst at PitchBook. He said widespread deployments of autonomous trucks will likely occur in the early-to-mid 2020s compared with the mid-to-late 2020s for self-driving cars.

Plus said it plans to reach full autonomy with its trucks by the end of 2024. The company expects to generate an estimated $16 million in revenue this year, and $250 million in 2022.

Upcoming Dates:

This Week’s Shareholder Meetings and Unit Splits (common shares and warrants to commence trading separately from underlying units)

Wednesday, May 12th

GreenVision Acquisition Corp (GRNV) Shareholder Meeting to Extend Deadline for Business Combination

Thursday, May 13th

Unit Splits: Supernova Partners Acquisition Co III, Ltd. (STRE), Forum Merger IV Corporation (FMIV), ArcLight Clean Transition Corp. II (ACTD)

Friday, May 14th

GX Acquisition Corp (GXGX) Shareholder Meeting to Extend Deadline for Business Combination

If you found this newsletter useful and you aren’t a subscriber yet, subscribe for free here:

Thanks for reading,