February 11th, 2021

Good evening,

Thanks for reading “The Nightcap”, a nightly recap of all the day’s highlights in the SPAC world. In this newsletter, you will find a breakdown of the day’s deals, IPO’s, “in talks” reports, and noteworthy new SPAC S-1 filings.

Of course, you can always discover and track all of the SPACs at spactrack.net.

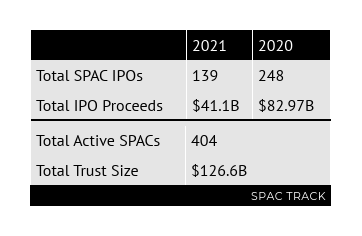

The SPAC Market Stats:

Volume Leaders:

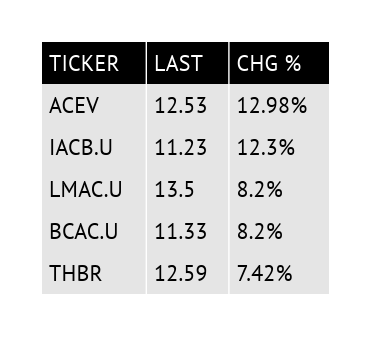

Top Gainers:

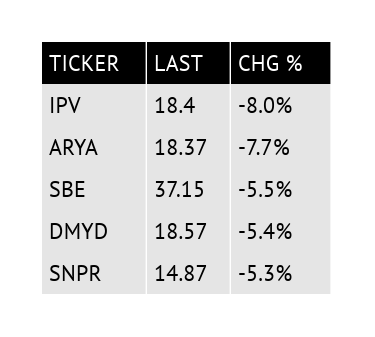

Top Losers:

The Deals:

Nebula Caravel Acquisition Corp (NEBC) & Rover, a pet sitting and dog walking marketplace.

$1.35B EV

$50M PIPE

NEBC closed the day at $11.15 (+1.36%).

The cover slide of the Rover investor presentation below was included in order to help you start your Friday morning off on the right paw.

Find the Rover investor presentation here: https://www.sec.gov/Archives/edgar/data/1826018/000119312521037558/d63727dex992.htm

Deal News Reports:

1) Reinvent Technology Partners (RTP), which is led by Reid Hoffman (LinkedIn Co-founder) and Mark Pincus (Zynga Founder), is said to be close to a merger deal with Joby Aviation, an electric air taxi company, at a valuation of around $5.7B, according to the Financial Times.

RTP was previously reported as in talks with Hippo, an InsurTech company, by Bloomberg last Friday.

2) Northern Star Investment Corp. II (NSTB) is in talks to merge with Apex Clearing, a digital securities clearing & custody company owned by Peak6, at as much as $5B valuation, according to Bloomberg.

Notable IPOs:

1) Tishman Speyer Innovation Corp. II (TSIB.U) — will trade tomorrow

$300M, 1/5 warrant

Focus: PropTech

The sponsor is an affiliate of Tishman Speyer

Chairman & CEO:

Rob Speyer (CEO of Tishman Speyer)

Directors:

Ned Segal (CFO of Twitter and Director of Beyond Meat)

Jennifer Rubio (Co-founder, President and Chief Brand Officer of Away)

The sponsor’s first SPAC, TS Innovation Acquisitions Corp. (TSIA), announced its merger with Latch, an enterprise SaaS platform for buildings and residents. TSIA closed the day at $16.04.

2) Social Leverage Acquisition Corp I (SLAC.U) — will trade tomorrow

$300M, 1/4 warrant

Focus: Fintech, Enterprise Software, Consumer Tech

CEO and Director:

Howard Lindzon (Founder and Managing Partner of Social Leverage, Co-founder and Former CEO of StockTwits)

Directors

Michael Lazerow (Former Chief Strategy Officer of Salesforce)

3) Broadscale Acquisition Corp. (SCLE.U) — will trade tomorrow

$300M, 1/4 warrant

Focus: Decarbonization (particularly in the energy, transportation, buildings, manufacturing, and food and agriculture sectors)

Chairman and CEO:

Andrew Shapiro (Founder and Managing Partner of Broadscale, Founder of GreenOrder and Former Director of Blink Charging)

Advisors:

Betsy Cohen (Founder & Former CEO of The Bancorp and Serial SPAC Sponsor)

Raymond Lane (Fomer COO and Director of Oracle, Managing Partner of GreatPoint Ventures and Director of Beyond Meat and Hewlett Packard Enterprise)

4) Tuatara Capital Acquisition Corporation (TCAC.U) — will trade tomorrow

$175M, 1/2 warrant

Focus: Cannabis

CEO and Director:

Albert Foreman (Founder of Tuatara Capital)

Director:

Jeff Bornstein (Former Vice Chairman and CFO of GE)

Notable New SPAC S-1 filings:

1) Atlantic Coastal Acquisition Corp. (ACAH)

$300M, 1/2 warrant

Focus: Next-Generation Mobility

Chairman and CEO:

Shahraab Ahmad (Founder and CIO of Decca Capital)

Director:

Bryan Dove (Former CEO of Skyscanner)

SPACs Leaving the Nest:

(Not Quite Yet):

Today’s Switchback Energy Acquisition Corp’s (SBE) shareholder meeting to approve its business combination with ChargePoint was delayed until February 25th to give shareholders more time to vote.

99.9% of votes were in favor of the business combination, but only 45% of the shares were voted.

Upcoming Dates:

Tomorrow’s Shareholder Meetings:

Longview Acquisition Corp (LGVW) Shareholder Meeting to Approve Business Combination with Butterfly Network

Tomorrow’s Unit Splits (common shares and warrants to commence trading separately from underlying units):

7GC & Co. Holdings Inc. (VII)

Thank you for reading.

Thanks,