Good evening,

Thanks for reading the “Nightcap”, a nightly recap of the highlights in the SPAC world. You can always discover and track all of the SPACs at spactrack.net.

The Stats:

If you find that this newsletter keeps you informed of SPAC news, please consider sharing it with a friend or colleague and suggest they subscribe!

The Deals (1):

1) Velocity Acquisition Corp. (VELO: $9.81) & BBQGuys

BBQGuys, A Leading Online Grilling And Outdoor Living E-Commerce Platform, To Become A Publicly Traded Company Via Merger With Velocity Acquisition Corp. (Press Release)

Merger Partner Description:

BBQGuys is a leading e-commerce retailer of higher-end grills, grilling accessories and outdoor living products for both homeowners and professional builders. What began as a humble brick-and-mortar store in 1998 has since evolved into one of America’s fastest-growing businesses–one that has served over a million happy customers nationwide.

Valuation: $839M Pro-forma EV

PIPE: None

BBQGuys Investor Presentation

Deal News:

Cvent Nears $5-Billion-Plus SPAC Deal (WSJ article behind paywall)

Cvent Inc. has agreed to merge with a special-purpose acquisition company in a deal that would take the event-management software company public, according to people familiar with the matter.

Cvent is slated to merge with Dragoneer Growth Opportunities Corp. (DGNS: $9.92) in a transaction that values the private-equity-owned company at more than $5 billion including debt, the people said.

Cvent is owned by private-equity firm Vista Equity Partners, which took the company private in 2016 in a $1.65 billion deal.

Before the coronavirus pandemic, the maker of cloud-based event-management software focused only on live events, but it has pivoted over the past year to become a major player in the fast-growing arena of virtual events.

The company’s virtual-events arm now has more than $100 million in revenue, a significant chunk of its more than $500 million in annual sales, according to one of the people familiar with the matter.

Vice Media’s SPAC Talks Stall (The Information article behind paywall)

Vice Media’s plan to go public by merging with a special purpose acquisition company has stalled as the company struggles to raise additional financing for the deal amid questions about Vice’s valuation, according to people familiar with the situation.

In early discussions with SPACs such as one backed by 7GC & Co, [7GC & Co. Holdings Inc. (VII: $9.68)] Vice was expected to be valued at around $2.5 billion, a huge reduction from its peak valuation of $5.7 billion in 2017. But even that number now looks ambitious. Judging by the valuation put on BuzzFeed in its proposed SPAC merger announced this month, Vice may struggle to persuade investors it is worth even $2 billion.

IPOs to Begin Trading Tomorrow*:

1) Portage Fintech Acquisition Corporation (PFTA-U)

$240M, 1/3 warrant

Focus: Fintech

Joint Book-running Managers: Goldman Sachs, BTIG, Scotiabank, and SoFi

Directors:

Paul Desmarais III (Chairman of Wealthsimple Financial Corp.)

Steve Freiberg (Vice Chairman of SoFi, Director of MasterCard, Former Co-Chairman & CEO of Citigroup’s Global Consumer Group, and Former CEO of E*Trade)

Stuart Charles Harvey, Jr. (Former Chairman of Paysafe Group)

Tom Hutton (Chairman & Former Interim CEO of SoFi)

*Priced at the time of this writing

Quick News Corner:

Andina Acquisition Corp III (ANDA: $9.20) completed its merger with Stryve Foods. Will begin trading as SNAX tomorrow.

FG New America Acquisition Corp. (FGNA: $9.97) completed its merger with OppFi (Opportunity Financial). Will begin trading as OPFI tomorrow.

Property Solutions Acquisition (PSAC: $13.83) shareholders approved the merger with Faraday Future

Ascendant Digital Acquisition (ACND: $8.77) shareholders approved the merger with MarketWise

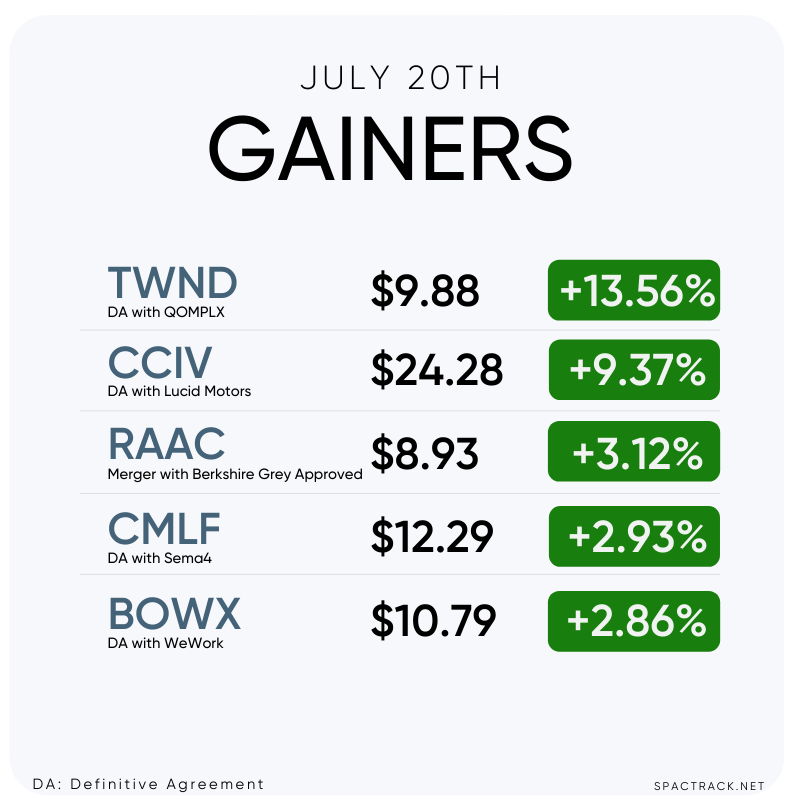

Tailwind Acquisition Corp. (TWND: $9.88) adjourned its meeting to July 30th

Motion Acquisition Corp. (MOTN: $9.95) announced DocGo’s Record Preliminary Second Quarter 2021 Revenue

Gores Holdings VI, Inc. (GHVI: $13.41) shareholders approved the merger with Matterport

Revolution Acceleration Acquisition Corp (RAAC: $8.93) shareholders approved the merger with Berkshire Grey

New S-1s (5)

$200M, 1/3 warrant

Focus: Tech-enabled consumer goods and services

Directors:Kay Koplovitz (Founder, Former Chairman & CEO of USA Networks, the SyFy Channel & USA Networks International, Director of ION Media Networks, and Former Director of Time Inc. and Liz Clairborne)

$40M, 1 right (1/10 sh), 1/2 warrant

Focus: Internet and tech, including blockchain infrastructure and software

$220M, 1/3 warrant

Focus: Life Sciences

$100M, 1/3 warrant

Focus: Healthcare Tech in Israel

$50M, 1 right (1/10 sh)

Focus: New energy, biotech, and education in Asia

Upcoming Dates:

This Week’s Announced Shareholder Meetings, Unit Splits, Warrant Redemptions

Wednesday, July 21st

Merger Meetings:Tuscan Holdings Corp (THCB: $11.39) & MicrovastCM Life Sciences, Inc. (CMLF: $12.29) & Sema410X Capital Venture Acquisition Corp (VCVC: $9.91) & REE Automotive

Thursday, July 22nd

Merger Meeting: Churchill Capital Corp IV (CCIV: $24.28) & Lucid Motors

Unit Split: Lakeshore Acquisition I Corp. (LAAA-U: $10.22)

If you haven’t subscribed to this free nightly newsletter, you can do so below.

Thanks for reading,