Good evening,

Thanks for reading “The Nightcap”, a nightly recap of the highlights of the SPAC world. You can always discover and track all of the SPACs at spactrack.net.

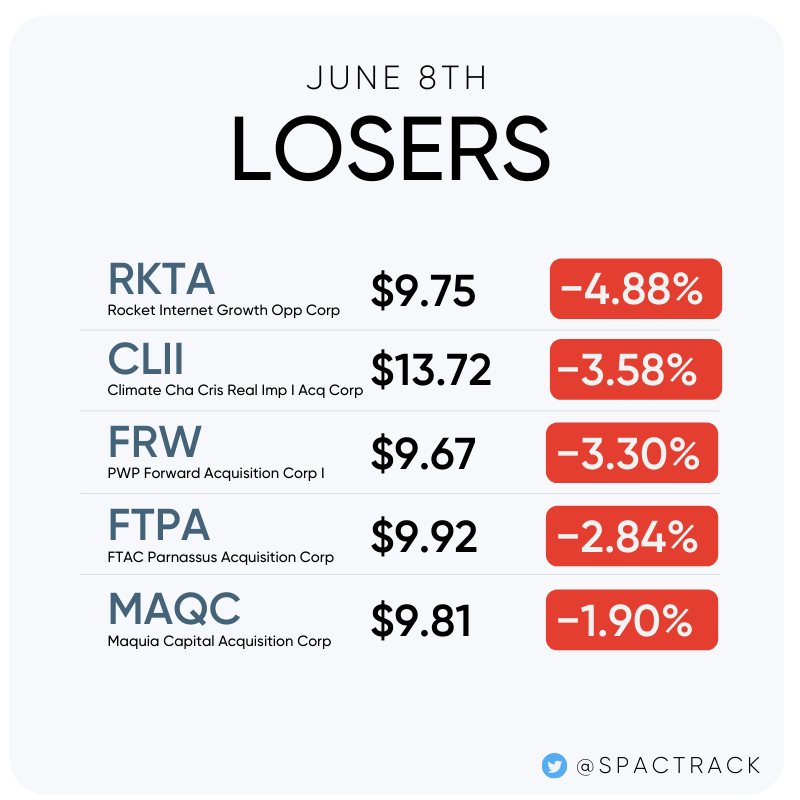

The Stats:

The Deals:

None today.

Deal News Reports:

1) Bridgetown 2 Holdings Ltd. (BTNB: $10.29) is in advanced talks to merge with PropertyGuru, according to Bloomberg.

Bridgetown 2 Holdings Ltd., the blank-check company backed by billionaires Richard Li and Peter Thiel, is in advanced talks to merge with Singapore’s online real estate firm PropertyGuru Pte, according to people with knowledge of the matter.

The special purpose acquisition company has been in discussions with PropertyGuru on the potential deal, which could be announced as soon as next month, said the people, who asked not to be identified as the information is private. A transaction could value the combined firm at as much as $2 billion, the people said.

Shares in Bridgetown 2 Holdings rose 5.7% in pre-market trading in New York.

PropertyGuru, backed by private-equity firms KKR & Co. and TPG Capital, is considering a U.S. listing through a merger with a SPAC and has held preliminary talks, Bloomberg News reported in March.

Deliberations are ongoing and could still be delayed or fall apart, the people said. PropertyGuru Chief Executive Officer Hari V. Krishnan said the company is always looking to any beneficial scenario to fund its growth but declined to comment further. A representative for Bridgetown 2 Holdings declined to comment.

Founded by entrepreneurs Steve Melhuish and Jani Rautiainen in 2007, PropertyGuru has become a household name in the property-crazed Singapore. The real estate marketplace also has operations in countries including Vietnam, Indonesia, Malaysia and Thailand.

The company scrapped plans for an initial public offering on the Australian stock exchange back in 2019 over valuation concerns. In September, it announced $300 million in new funding from investors including existing backers KKR and TPG. Last week, the startup inked a deal for REA Group Ltd.’s operating entities in Malaysia and Thailand, marking the biggest acquisition in its 14-year history.

2) Decarbonization Plus Acquisition Corp. III (DCRC: $10.65) is in talks to merge with Solid Power, according to Bloomberg.

Solid Power, a maker of solid-state batteries that counts Ford Motor Co. and BMW AG among its investors, is in talks to go public through a merger with Decarbonization Plus Acquisition Corp. III, according to people with knowledge of the matter.

The blank-check firm is seeking to raise more than $100 million in new equity to support a transaction that’s set to value the combined entity at about $1.2 billion, including debt, one of the people said. Terms could change and as with all deals that aren’t finalized, it’s possible talks could collapse.

A Solid Power representative didn’t immediately respond to a request for comment. A Decarbonization Plus spokesman declined to comment.

Colorado-based Solid Power raised $130 million last month in a round led by Ford, BMW and Volta Energy Technologies LLC, funding that the company said would help it start producing automotive-scale batteries on its production line early next year. “Solid-state battery technology is important to the future of electric vehicles, and that’s why we’re investing in it directly,” Hau Thai-Tang, Ford’s chief product platform and operations officer, said in a statement at the time.

IPOs to Begin Trading Tomorrow:

1) Global Consumer Acquisition Corporation (GACQ.U)

$170M, 1/2 warrant

Focus: Consumer

New S-1 Filings:

1) Foresight Acquisition Corp. II (FACQ)

$250M, 1/3 warrant

Focus: Tech-enabled consumer and consumer healthcare

Management: Greg Wasson (Former CEO of Walgreens)

2) Nabors Energy Transition Corp. (NETC)

$250M, 1/3 warrant

Focus: Alternative energy, energy storage, emissions reduction and carbon capture

Management: Anthony Petrello (Chairman & Former CEO of Nabors)

Notable News:

Sportradar and Horizon Acquisition Corp. II (HZON: $9.83), a SPAC led by Los Angeles Dodger co-owner Todd Boehly, are walking away from a potential deal to take the sports data provider public, according to people familiar with the matter.

Sportradar will instead try to go public through a more traditional IPO, said one of the people, who was granted anonymity because the matter is private. It’s unclear when that process would begin.

Sportradar and Horizon agreed in March on a deal that would take the company public at a $10 billion valuation. Since that letter of intent was signed, the market for SPACs—and for the large private investments that are often required—has dried up. The two sides extended their negotiating window last month to continue conversations with institutional investors, but a formal agreement was never reached.

Vista Global Holding Ltd., a private aviation provider that competes with Warren Buffett’s NetJets, is in talks to go public through a merger with a special purpose acquisition company, according to people familiar with the matter.

A transaction could value Vista at more than $10 billion including debt, said the people, who asked not to be identified because the information is private.

The company has projected 2021 earnings before interest, taxes, depreciation and amortization of about $450 million, a person briefed on the matter said. Terms of a potential deal haven’t been finalized, and the identity of the blank-check firm in talks with Vista couldn’t immediately be learned.

Vista’s chairman and majority owner is Swiss billionaire Thomas Flohr, who started in 2004 with just three planes. Its business is built around VistaJet, which has a fleet of more than 70 aircraft adorned with the firm’s hallmark silver and red livery, according to its website. Rhone Capital invested in the private jet firm in 2017 at a valuation of more than $2.5 billion.

SPACs Leaving the Nest:

1) ARYA Sciences Acquisition Corp III (ARYA: $10.68) shareholder approve business combination with Nautilus Biotechnology. ARYA will trade as NAUT upon merger completion.

2) Deerfield Healthcare Technology Acquisitions Corp. (DFHT: $14.92) Announces Closing of Business Combination With CareMax

Deerfield Healthcare Technology Acquisitions Corp. announced today that it has closed its business combination with CareMax Medical Group, L.L.C. and IMC Medical Group Holdings LLC , creating a technology-enabled care platform providing value-based care and chronic disease management to seniors. As previously announced, the transaction was approved at a special meeting of DFHT’s stockholders held on June 4, 2021.

The combined company, which has been renamed CareMax, Inc., expects that its Class A common stock and public warrants will commence trading on the Nasdaq Global Select Market under the new trading symbols “CMAX” and “CMAXW”, respectively, starting on Wednesday, June 9, 2021.

Quick News Corner:

Upcoming Dates:

This Week’s Shareholder Meetings and Unit Splits (common shares and warrants to commence trading separately from underlying units)

Wednesday, June 9th

HighCape Capital Acquisition Corp. (CAPA: $10.55) Shareholder Meeting to Approve Business Combination with Quantum-Si

Thunder Bridge Acquisition II (THBR: $10.35) Shareholder Meeting to Approve Business Combination with indie Semiconductor

Thursday, June 10th

Silver Spike Acquisition Corp (SSPK: $18.15) Shareholder Meeting to Approve Business Combination with WM Holding Company (Weedmaps)

VG Acquisition Corp (VGAC: $10.25) Shareholder Meeting to Approve Business Combination with 23andMe

Churchill Capital Corp II (CCX: $10.11) Shareholder Meeting to Approve Business Combination with Skillsoft and Global Knowledge

Friday, June 11th

ArcLight Clean Transition Corp (ACTC: $18.99) Shareholder Meeting to Approve Business Combination with Proterra

If you found this newsletter useful and you aren’t a subscriber yet, subscribe for free here:

Thanks for reading,