Discover and track all of the SPACs at spactrack.net.

If you haven’t subscribed to this Free nightly newsletter, you can do so below.

The Stats:

The Deals:

None today

News:

E-scooter startup Lime raises $523 million, eyes going public in 2022 (Reuters)

Urban mobility company Lime said on Friday it had raised $523 million from investors to scale up production of its latest e-scooters and e-bikes and its top executive said the startup is aiming for a stock market listing in 2022.

The San Francisco-based company said the money it had raised from convertible debt and term loan financing included fresh capital from ride-hailing company Uber, which became an investor in 2020. The funding round was “significantly oversubscribed,” Lime Chief Executive Officer Wayne Ting told Reuters.

“I think it’s a recognition that Lime is now the undisputed leader in this space,” Ting said. “It’s a real milestone that shows investor confidence that Lime will be going public and we’ll use this as a launching pad to go public next year.”

Ting told Reuters that depending on market conditions, he was hoping for a listing in the summer of 2022. He said he was “agnostic” as to whether the company will pursue a more traditional initial public share offering (IPO), or opt for a listing via a merger with a special purpose acquisition company (SPAC).

Santa Monica-based electric scooter rental company Bird is merging with Switchback II Corp, a SPAC, and will start trading on the New York Stock Exchange on Friday under the ticker symbol “BRDS” in a deal valuing the scooter startup at $2.3 billion.

Crypto Billionaire-Backed SPAC Listing Plan Sends Monex Limit Up (Bloomberg—paywalled)

Monex Group Inc. surged by its daily limit after the Japanese financial firm announced plans to list its U.S. online trading subsidiary through a deal with Michael Novogratz’s Galaxy Digital Holdings Ltd.

In a statement after the market close Thursday, Monex said its wholly-owned unit TradeStation Group Inc. plans to list on the New York Stock Exchange in the first half of 2022 following a merger with Quantum FinTech Acquisition Corp (QFTA). The deal puts TradeStation at an implied pro forma enterprise value of $1.43 billion at closing.

The special purpose acquisition company will receive $50 million from each of the co-anchor investors, Monex and Galaxy Digital LP, a unit of Galaxy Digital Holdings. Monex will own about 80% of TradeStation at closing. The Japanese firm’s stock jumped 20% Friday, the most since April 2018.

Monex acquired TradeStation -- a platform for trading stocks, ETFs, derivatives and cryptocurrencies -- in 2011 for about $400 million. Canada-listed Galaxy, which was founded by billionaire and former Goldman partner Novogratz, had $2.3 billion in assets under management as of Sept. 30.

Merger Votes/ Completions:

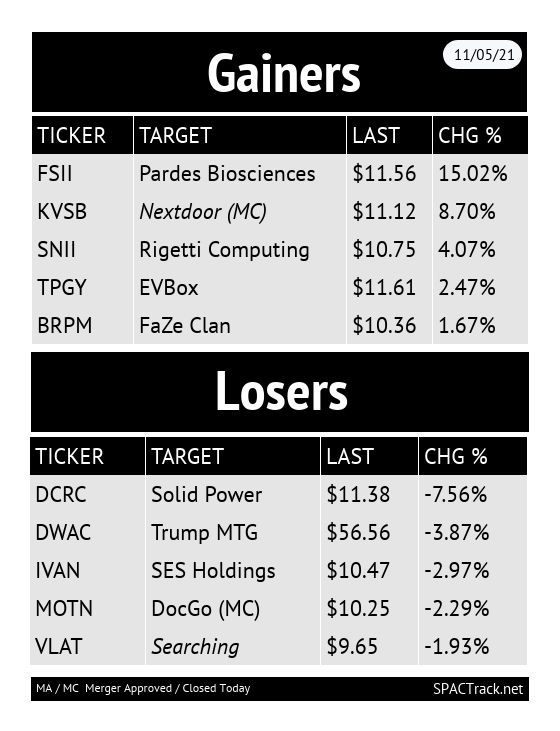

Motion Acquisition Corp. (MOTN: $10.25 -2.29%) completes its merger with DocGo. Will trade as DCGO on Monday

DocGo received appx $158M from the transaction after expenses

Khosla Ventures Acquisition Co. II (KVSB: $11.12 +8.70%) completes its merger with Nextdoor. Will trade as KIND on Monday

Nextdoor received $675M in gross proceeds from the transaction

If you find this newsletter useful, feel free to share it with a friend and suggest they subscribe:

Tracking De-SPAC S-1s (including PIPE resale registrations):

S-1s that went effective today:

Mirion Technologies (MIR: $11.26 +1.81%)

S-1 filings:

Aurora Innovation (AUR: $9.99 +4.06%)

Science 37 Holdings (SNCE: $10.74 -2.27%)

Vivid Seats (SEAT: $13.39 +0.68%)

S-1/A filings:

424B3 filings (S-1 likely to go effective Monday):

Algoma Steel (ASTL: $11.36 +0.44%)

Quick News:

Leo Holdings III Corp (LIII) adds an additional $25M to the PIPE for its merger with Local Bounti, bringing the total PIPE proceeds to $150M. The min. cash condition is $150M

New S-1s (3):

1) Ault Disruptive Technologies Corporation (ADRT)

$100M, 1/2 Warrant

Focus: Tech

2) Europa Growth Acquisition Company (EGAC)

$235M, 1/2 Warrant

Focus: Financial services, Fintech, and environmental services, GreenTech in Europe

Management:Richard Laxer (Former Chairman & CEO of GE Capital)

3) Legato Merger Corp. II (LGTO)

$200M, 1/2 Warrant

Focus: Infrastructure, E&C, industrial and renewables industries

Upcoming Dates:

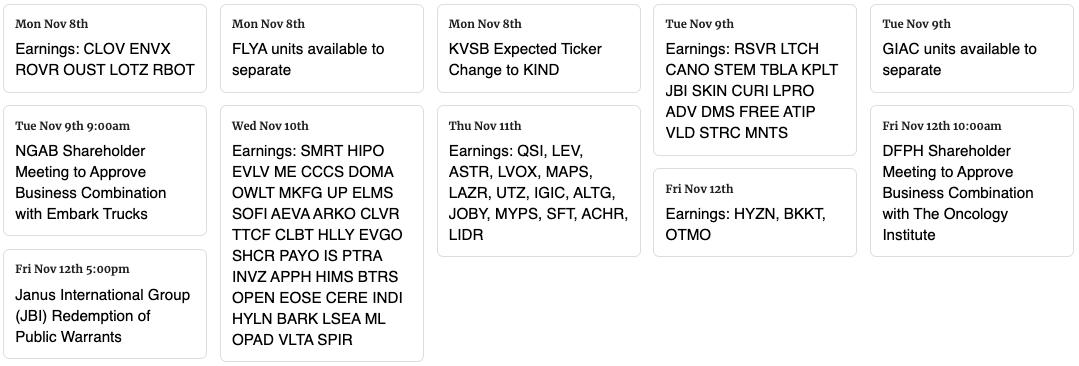

Next Week’s Announced Shareholder Meetings, Unit Splits, Warrant Redemptions, Earnings, and Expected Ticker Changes

See the full calendar here.

Thanks for reading,