Discover and track all of the SPACs at spactrack.io

If you haven’t subscribed to this Free nightly newsletter, you can do so below.

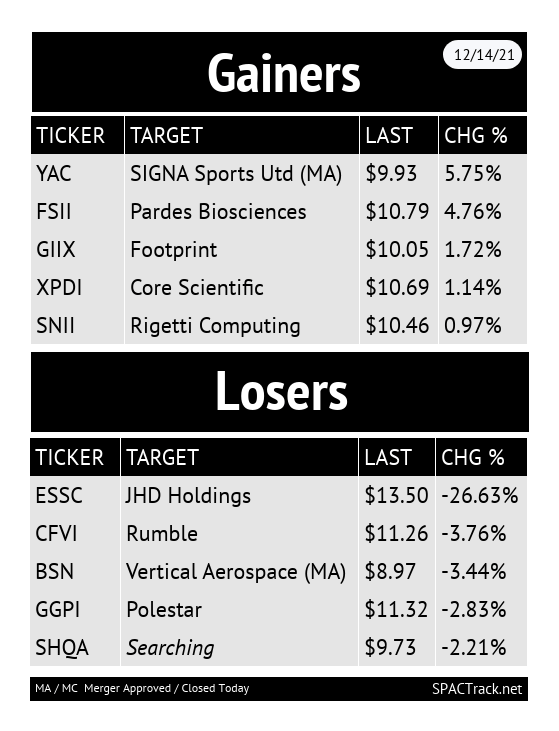

The Stats:

The Deals:

1) Spring Valley Acquisition Corp. (SV: warrants +92.29%) & NuScale Power

Merger Partner Description:

NuScale Power is poised to meet the diverse energy needs of customers across the world. It has developed a new modular light water reactor nuclear power plant to supply energy for electrical generation, district heating, desalination, hydrogen production and other process heat applications. The groundbreaking NuScale Power Module™ (NPM), a small, safe pressurized water reactor, can generate 77 MWe of electricity and can be scaled to meet customer needs. The VOYGR™-12 power plant is capable of generating 924 MWe, and NuScale also offers the four-module VOYGR-4 (308 MWe) and six-module VOYGR-6 (462 MWe) and other configurations based on customer needs. The majority investor in NuScale is Fluor Corporation, a global engineering, procurement, and construction company with a 70-year history in commercial nuclear power.

Valuation: $1.87B EV

PIPE: $181M including investments from Samsung C&T Corporation, DS Private Equity, Segra Capital Management, Pearl Energy (Spring Valley’s sponsor)

2) Gores Holdings VIII, Inc. (GIIX: warrants +19.23%) & Footprint

Merger Partner Description:

Footprint has a clear vision to create a healthier planet and healthier people. Phase one of our mission is to provide solutions that eliminate single-use and short-term use plastics in our food chain. Footprint’s team of engineers use plant-based fiber technology to design, develop and manufacture biodegradable, compostable, and recyclable products that compete with plastic’s cost, and exceed its performance. Footprint is rapidly expanding into new categories with customized and patented solutions for customers. Footprint’s products have already led to a global redirection of 61 million pounds of plastic waste from entering the air, earth, and water working with leading global consumer brands.

Footprint was founded in by former Intel engineers, Troy Swope and Yoke Chung. The company employs more than 2,500 employees, with operations in the U.S., Mexicali, Europe, and Asia. Footprint was named to the 2020 Fortune “Change the World” list in 2020, is a member of the World Economic Forum’s Global Innovators Community and was named a CNBC Disruptor 50 company in 2021.

Valuation: $1.6B EV

PIPE: $461M including investments from Koch Strategic Platforms and sponsor affiliate

News:

Bets placed on £3bn Playtech bidding war as Univision-backed SPAC deal nears (Sky News)

Sky News has learnt that Caliente Interactive, an online gambling business predominantly operating in Mexico, is in advanced talks about a roughly-$2.5bn merger with Tekkorp Digital (TEKK), a New York-listed special purpose acquisition company (SPAC).

The SPAC deal is significant because Playtech owns roughly half of Caliente Interactive through a joint venture.

Under the plans to finance the merger with Tekkorp Digital, $250m would be invested in a PIPE - private investment in public equity - by Univision and its shareholders, with an additional $190m from other institutional investors.

City sources said that Caliente was expected to exercise its option over Playtech's 49% stake, triggering a payment to shareholders in the UK-based company.

That payment would, however, be accelerated as part of a takeover bid for Playtech being formulated by Eddie Jordan, founder of the eponymous former F1 team, through the creation of a contingent value right (CVR).

Insiders said on Tuesday that Mr Jordan and his partners at JKO Play were putting the finishing touches to an offer of about 750p-a-share that they hope would secure a recommendation from Playtech's board.

Their offer would be structured in cash or with a partial share alternative to allow existing Playtech investors to remain as part-owners of the company.

A formal bid could be tabled by JKO and its own financing partners - including Centerbridge Partners - within days, the insiders said.

Shares in Playtech, which has a market capitalisation of more than £2.2bn, are trading well above a 680p-a-share bid accepted from Aristocrat, an Australian company.

Data Intelligence Firm Near in Talks With KludeIn SPAC (Bloomberg—paywalled)

Near, a data intelligence platform, is in talks to go public through a merger with KludeIn I Acquisition Corp. (INKA), a blank-check firm, according to people with knowledge of the matter.

The companies are discussing a a transaction that could be announced in coming weeks, and that may give the combined entity an enterprise value of about $1 billion to $1.2 billion, one of the people said. As with all deals that aren’t finalized, it’s possible that terms change or that talks fall apart.

A KludeIn representative didn’t immediately respond to requests for comment. Karen Steele, a Near spokeswoman, declined to comment.

Founded in 2012, Near recently moved its headquarters to Pasadena, California, and has offices in cities including Singapore, Bangalore, New York, Sydney, Tokyo, London and Paris, its website shows. The company is led by Chief Executive Officer and founder Anil Mathews. Investors include Sequoia Capital, JPMorgan Asset Management, Telstra Ventures and Cisco Investments.

Africa’s Top Fiber Operator Is in Talks With Betsy Cohen SPAC (Bloomberg—paywalled)

Fintech Acquisition Corp. VI (FTVI), a blank-check company backed by serial dealmaker Betsy Cohen, is in talks to merge with a unit of African telecommunications conglomerate Econet Global, according to people with knowledge of the matter.

The deal would seek to value the unit, Cassava Technologies, at $4 billion or more, one of the people said, asking not to be identified discussing private information. Deliberations are ongoing and may not result in a transaction, the people said.

A representative for Fintech Acquisition declined to comment. Representatives for Econet didn’t immediately respond to requests for comment.

“We continuously review our capital structure and consider all opportunities,” a representative for Cassava said in a statement. “Our primary focus is to continue to strengthen our position as a pan-African technology leader with a clear vision to accelerate Africa’s digital transformation.”

Econet, founded by Zimbabwean billionaire Strive Masiyiwa, announced in November that it had folded its fiber-broadband networks, data centers and other assets into Cassava. Its holdings include telecommunications and data center provider Liquid Intelligent Technologies and Sasai Fintech, a so-called super app, according to that announcement. Super apps are online companies that offer a broad range of services.

Merger Votes/ Completions:

Broadstone Acquisition Corp. (BSN) shareholders approved its merger with Vertical Aerospace

Closing is expected to be 12/16 with ticker change to EVTL upon closing

Isos Acquisition Corp (ISOS) shareholders approved its merger with Bowlero

If you find this newsletter useful, feel free to share it with a friend and suggest they subscribe:

Tracking De-SPAC S-1s (including PIPE resale registrations*):

S-1s effective today:

Embark Technology (EMBK: $8.05 -12.78%)

S-1/A filings:

Microvast (MVST: $7.51 +1.90%)

*When applicable

Quick News:

CITIC Capital Acquisition Corp. (CCAC) Secures $125 Million Capital Commitment from Global Emerging Markets in Advance of Planned Business Combination with Quanergy

Sports Entertainment Acquisition Corp.’s (SEAH) CFO advises that the registration process is still underway and the anticipated closing of SEAH’s merger with Super Group has been moved to January

IPOs to begin trading tomorrow*:

1) Swiftmerge Acquisition Corp. Announces Pricing of $200 Million Initial Public Offering (IVCP-U)

2) Ahren Acquisition Corp. Announces Pricing of $275 million Upsized IPO (AHRN-U)

*Priced as of this writing

New S-1s:

None today.

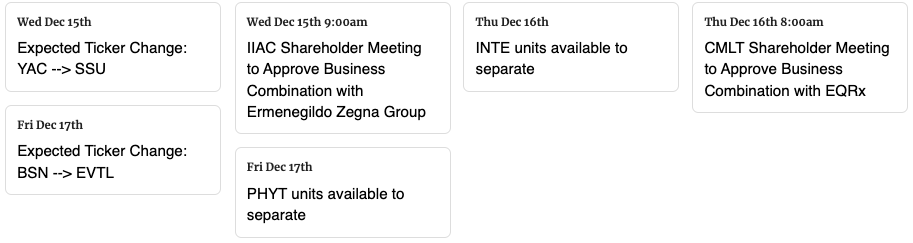

Upcoming Dates:

Upcoming Announced Shareholder Meetings, Unit Splits, Warrant Redemptions, Earnings, and Expected Ticker Changes

See the full calendar here.

SPAC TRACK PRO

SPAC Track Pro is a premium monthly subscription service to discover, track, and analyze SPACs & De-SPACs. The Pro version comes with 4x more data points than the standard version and includes several other useful features such as premium filters and table views, a unified view of SPACs and De-SPACs, as well as unlimited downloads of the Active & De-SPAC list.

We are offering introductory rates — the annual subscription is currently 30% off of the monthly rate (no coupon needed as the 30% off is already in the listed price) and you can get an additional 10% off the monthly or the annual subscription with the coupon: ‘NIGHTCAP10’. Check out spactrack.io/pro to learn more about Pro and to subscribe!

Feel free to reach out with any questions, and for inquiries on enterprise accounts (5 or more users), please send an email to [email protected].

Thanks for reading,