June 3rd, 2021

Good evening,

Thanks for reading “The Nightcap”, a nightly recap of the highlights of the SPAC world. You can always discover and track all of the SPACs at spactrack.net.

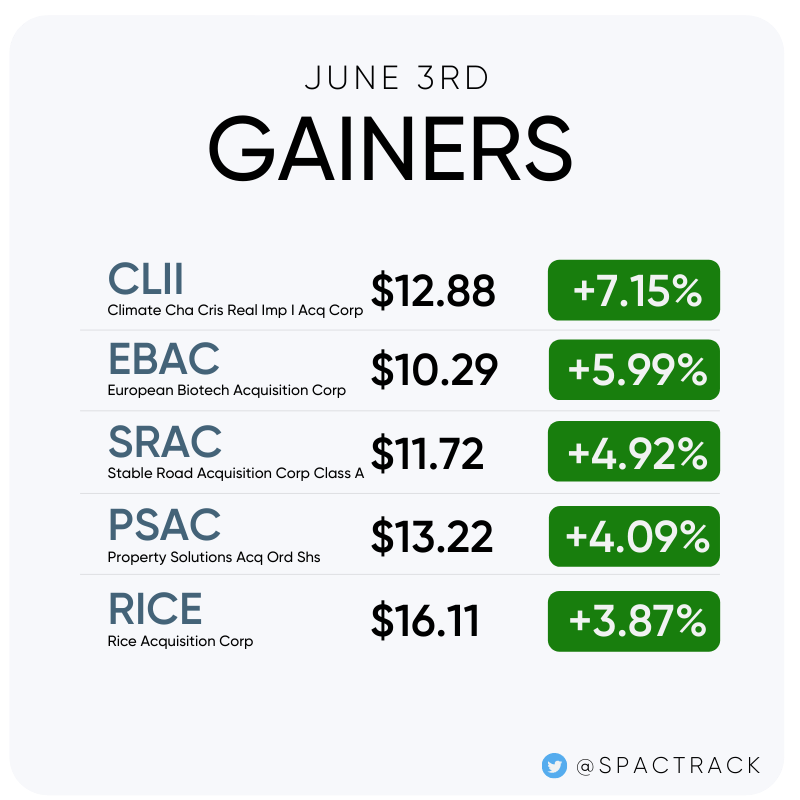

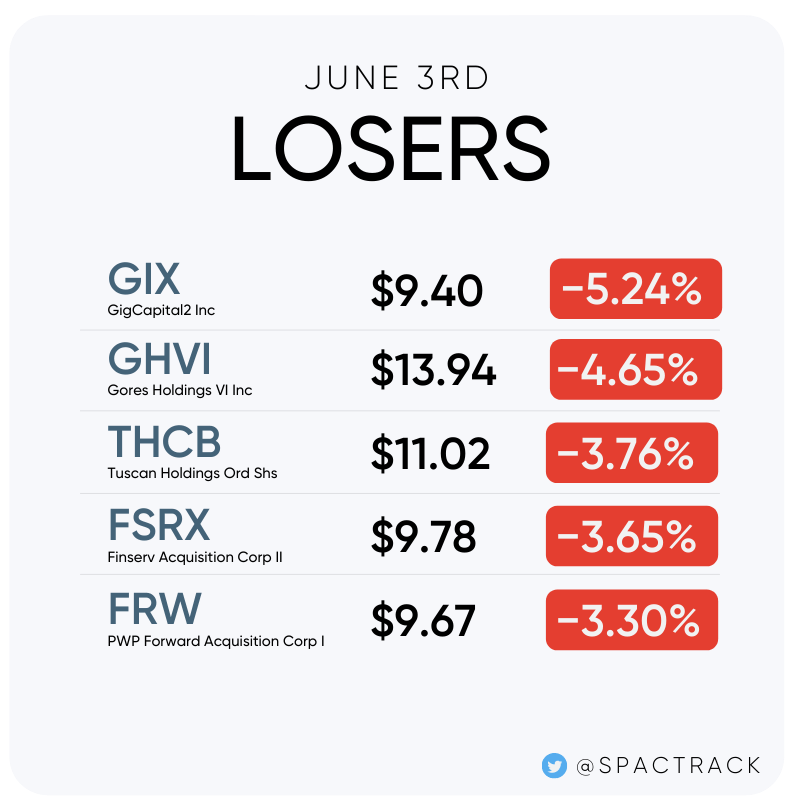

The Stats:

The Deals:

1) Alkuri Global Acquisition Corp. (KURI: $9.86) & Babylon.

- Babylon is a world leading, digital-first, value-based care company, covering 24 million people across four continents

- The company has scaled at c.5x annual revenue growth in 2020, and is expected to grow by c.4x in 2021

- Transaction implies a $4.2 billion equity value for Babylon including an estimated $575 million in gross proceeds

- Over 85% of raised cash from new, institutional external investors, including strategic investor Palantir (NYSE:PLTR)

- Babylon Founder and CEO Dr. Ali Parsa will become Chairman and CEO of the combined entity; an Alkuri Global representative will join the Board of Directors

Deal News Reports:

1) Pershing Square Tontine Holdings Ltd. (PSTH: $25.05) is close to a deal to merge with Universal Music Group.

Hedge-fund billionaire William Ackman’s special-purpose acquisition company is nearing a transaction with Universal Music Group that would value the world’s largest music business at about $40 billion, people familiar with the matter said.

The deal would be the largest SPAC transaction on record, exceeding the roughly $35 billion that Singaporean ride-hailing company Grab Holdings Inc. was valued at in a similar deal recently, according to Dealogic. It would have a so-called enterprise value, taking into consideration Universal’s debt, of about $42 billion.

It’s not guaranteed Universal and the SPAC, Pershing Square Tontine Holdings Ltd. will reach a deal. If they do, it could be finalized in the next few weeks and isn’t subject to any additional due diligence, the people said.

New S-1 Filings:

None today.

SPACs Leaving the Nest:

The merger is expected to close on 6/4 and TSIA ($10.84) is expected to trade as LTCH starting on 6/7.

2) Juniper Industrial Holdings, Inc. (JIH: $13.40) shareholders approve the business combination with Janus International.

JWS ($14.75) will trade as CANO starting tomorrow, 6/4.

Upcoming Dates:

This Week’s Shareholder Meetings and Unit Splits (common shares and warrants to commence trading separately from underlying units)

Friday, June 4th

Deerfield Healthcare Technology Acquisitions (DFHT: $15.12) Shareholder Meeting to Approve Business Combination with CareMax

GigCapital2, Inc (GIX: $9.40) Shareholder Meeting to Approve Business Combination with UpHealth and Cloudbreak

If you found this newsletter useful and you aren’t a subscriber yet, subscribe for free here:

Thanks for reading,