Good afternoon!

As a reminder, this fully detailed, in-depth version of our weekly market recap is another benefit of ListingTrack Pro, along with full access to our premium platform and datasets at ListingTrack.io. This includes a comprehensive review of IPOs, public M&A, activist campaigns, and pre-IPO developments—with full event details, premium data, deeper analysis, and direct source links. Unlike the free version, no key events are omitted, all source links are included, and every bullet is covered in full.

Thanks for subscribing, and enjoy this week’s complete breakdown!

New Feature for Pro users: Dark Mode is now live! To enable it, go to the manage account drop-down at the top right of the page and toggle dark mode on!

Theme News Coverage

Tariffs/ Trade War

After the Nasdaq’s worst week since 2020, markets rebounded hard. Trump paused tariffs (excluding China), and stocks responded with historic gains.

Key numbers from the week:

S&P 500: +5.70% (previous week: -9.08%)

Nasdaq: +7.29% (previous week: -10.02%)

VIX: -17.11% (after +109% the week before)

10Y Treasury yield: +12.81% — the sharpest rise since 2001

We put together a comprehensive recap of one of the most volatile trading weeks in years—complete with daily performance, market records, policy shifts, and emerging risks. Read the full Weekly Trade War Recap.

See more: Tariff tracker: our page covering Trade War & Tariff news and the US companies most at risk

AI

Alphabet (GOOG) reaffirmed its commitment to spend $75 billion in 2025 on data center infrastructure and AI development, despite market concerns tied to rising U.S. tariffs. CEO Sundar Pichai emphasized the strategic importance of the investment to support core businesses like Search and AI initiatives, including the Gemini model. The capex figure, disclosed earlier this year, exceeds analyst expectations by 29%. Google Cloud’s VP of infrastructure noted that tariffs could raise hardware import costs, but strong customer demand continues to justify the spending. — Reuters

Alphabet (GOOG) has partnered with PJM Interconnection, North America's largest electric grid operator, to deploy artificial intelligence solutions that streamline the process of connecting new power sources to the grid. This marks the first full-scale use of AI to manage an interconnection queue, addressing growing delays as demand for electricity surges from AI-related data center expansion. The initiative aims to improve efficiency and reduce bottlenecks in grid infrastructure development, aligning with broader industry shifts toward digital energy solutions. — Reuters

OpenAI has reportedly discussed acquiring io Products, the AI hardware startup founded by Jony Ive and backed by OpenAI CEO Sam Altman, for approximately $500 million. The startup is developing AI-focused hardware and has received funding from Emerson Collective and others. The potential acquisition would deepen OpenAI’s vertical integration by combining its software capabilities with bespoke hardware design. — TechCrunch

OpenAI has countersued Elon Musk, alleging a campaign of harassment including legal claims, public attacks, and a rejected $97.4 billion takeover bid aimed at disrupting the company’s operations and governance. The countersuit, filed in U.S. District Court for the Northern District of California, seeks to block Musk from further interference and hold him accountable for alleged damages. The dispute stems from Musk’s earlier lawsuit over OpenAI’s transition to a capped-profit model and control structure. A jury trial is scheduled for spring 2026. — Reuters

Space & Defense

Amazon (AMZN) has postponed the launch of 27 Kuiper internet satellites due to adverse weather conditions, including heavy winds and persistent cumulus clouds, delaying a scheduled liftoff from Cape Canaveral via a United Launch Alliance (ULA) rocket. No revised launch date has been set. The delay adds time pressure as Amazon faces a Federal Communications Commission deadline requiring deployment of at least 1,618 satellites—half of its planned constellation—by July 2026. Despite the setback, Amazon is continuing satellite preparations for upcoming launches, which will also utilize ULA’s Atlas V rockets. — CNBC

President Trump announced plans for a forthcoming defense budget “in the vicinity” of $1 trillion, marking what would be the first-ever trillion-dollar allocation for the Pentagon. The fiscal 2026 budget proposal is expected later this spring, while the government remains under a continuing resolution for FY25. Defense Secretary Pete Hegseth emphasized the expansion as part of a military rebuild, while concurrently supporting internal cost-cutting measures led by the Department of Government Efficiency (DOGE). Earlier this year, Hegseth ordered an 8% reduction in unspecified spending areas to reallocate funds toward higher-priority programs like missile defense. — Bloomberg

President Trump has signed an executive order initiating a comprehensive review of the Pentagon’s weapons acquisition programs, targeting those exceeding cost or schedule benchmarks by more than 15% for potential cancellation. The directive emphasizes speed, flexibility, and execution, and specifically highlights Boeing’s (BA) Air Force One program—now five years behind schedule and delayed to 2029 or later—as well as multiple Navy ship programs and the Air Force’s Sentinel ICBM project, which is 37% over budget. The $485B F-35 program, the Pentagon’s most expensive to date, may also face renewed scrutiny. This order introduces significant downside risk for defense contractors with exposure to lagging or over-budget military projects. — Bloomberg

See more: New Space theme page; NextGen Defense theme page

IPOs & Other Initial Public Listings

IPO/ Listing Action

Past week

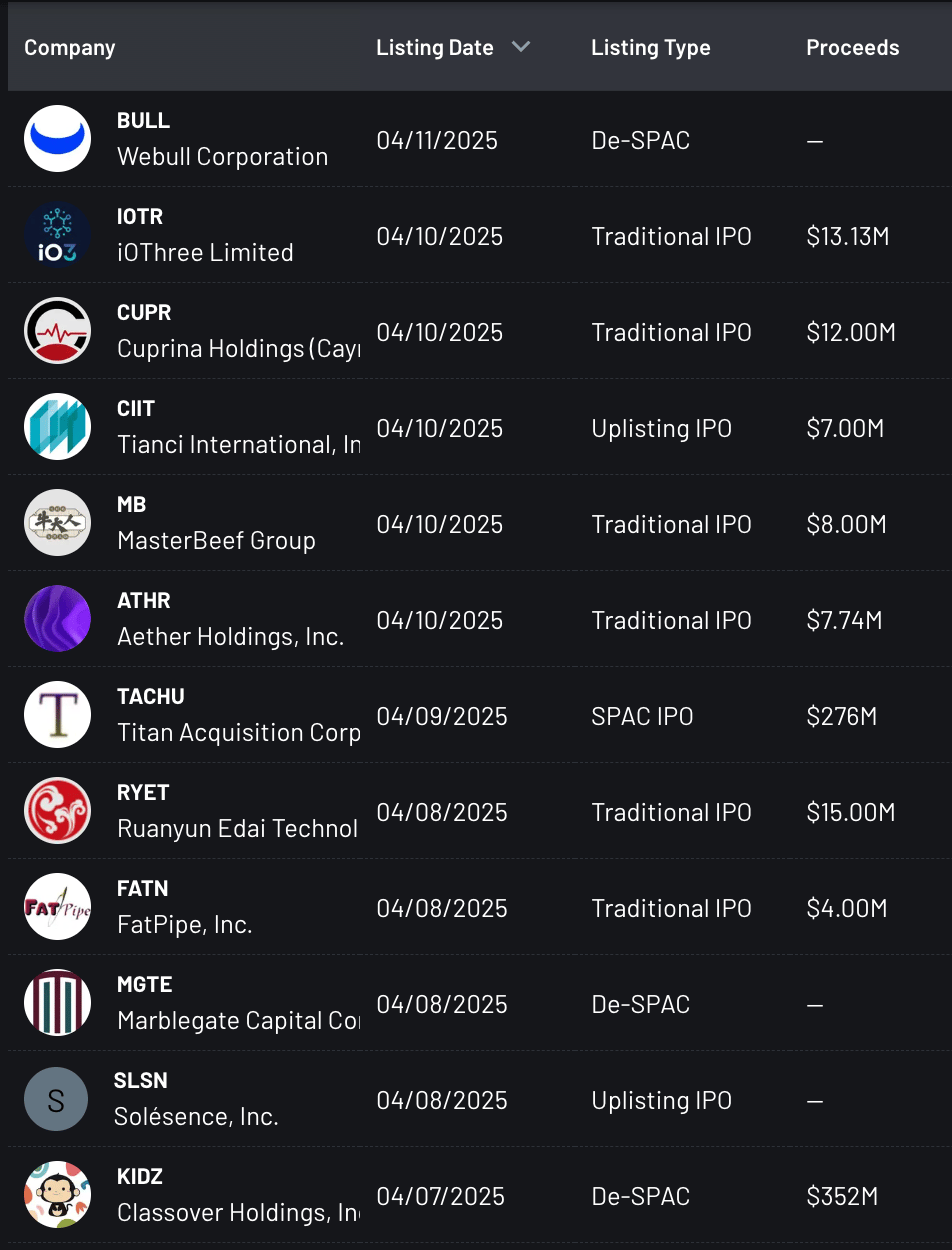

See more: Latest Listings

Prominent Listings

Expected Listings

Airo Group (Pre-listing: AIRO), a U.S.-based aerospace and defense technology company focused on urban air mobility and drones, is seeking to raise up to $80 million in its IPO by offering 5 million shares priced between $14 and $16. The IPO would value the company at approximately $398 million. — Bloomberg

Chinese tea chain Chagee Holdings (Pre-listing: CHA) is proceeding with a U.S. IPO to raise up to $411 million by offering 14.68 million ADS at $26–$28 each, targeting a valuation of approximately $3.3 billion. The offering comes amid heightened market volatility triggered by President Trump’s tariff policies. The company plans to price shares on April 16, with trading expected to commence on the Nasdaq under the symbol CHA. — Bloomberg

Galaxy Digital (GLXY), the crypto financial services firm led by Michael Novogratz, has received SEC approval for a direct listing on the Nasdaq following its re-domiciliation from the Cayman Islands to Delaware. A special shareholder meeting is scheduled for May 9 to approve the reorganization. Pending shareholder and TSX approval, Galaxy will list on Nasdaq under the ticker GLXY. The company, which is currently traded on the Toronto Stock Exchange, will maintain its Canadian listing. — Bloomberg

See more: Upcoming Listings

Listing Plans Rumors

See more: Listing Plans & Rumors

IPO Market Commentary & Post-IPO Coverage

Silicon Valley’s long-anticipated IPO pipeline has stalled amid global market turmoil triggered by President Donald Trump’s sweeping tariff announcements. Key IPO candidates like StubHub, Klarna, and eToro have paused their listing plans, with some unlikely to proceed in 2025. Venture capital firms now face increased liquidity risk, as continued delays threaten to extend the current multi-year exit drought. Some firms are adjusting expectations to 2026 or later, which could impact capital returns and future fundraising in the venture ecosystem. — Bloomberg

A Delaware judge has ruled that Newsmax (NMAX) broadcast false and defamatory statements about Dominion Voting Systems' role in the 2020 U.S. election, allowing Dominion’s $1.6B defamation lawsuit to proceed to trial. The decision follows a precedent set in Dominion's $787.5M settlement with Fox News. Newsmax, which recently went public and saw its stock surge over 1,000%, denies wrongdoing and claims it will vigorously defend itself, citing concerns over press freedom. Financial pressure mounts as the company also faces a June 30 deadline to pay the remaining half of a $40M settlement with Smartmatic, another voting technology firm pursuing similar defamation claims. Newsmax has also entered a standby equity purchase agreement with Yorkville Advisors for up to $1.2B post-IPO. — NPR

IPO Candidates

See more: IPO Candidates

Series C+ and Prominent Fundraising

AI

Mira Murati, former CTO of OpenAI, is reportedly raising over $2 billion in venture funding for her new AI startup, Thinking Machines Lab, doubling the $1 billion target reported two months prior. The valuation being sought is at least $10 billion. The company has attracted key OpenAI alumni, including ChatGPT co-creators John Schulman and Barret Zoph. Details of the round remain fluid, and no formal comments were provided. The raise follows similar high-profile AI startup fundings, including Ilya Sutskever’s $1 billion round for Safe Superintelligence. — Business Insider

Rescale, a digital engineering platform focused on advanced computing and AI for R&D, raised $115 million in Series D funding, bringing total funding to over $260 million. New investors include Applied Ventures, Hanwha, Foxconn, and NVIDIA, with continued backing from notable early investors such as Sam Altman, Jeff Bezos, and Peter Thiel. The capital will accelerate development of Rescale’s unified platform for intelligent data management and applied AI to support enterprise innovation. — PR

Energy

Texas-based residential battery startup Base Power Inc. has raised $200M in Series B funding to support national expansion and the construction of its first manufacturing facility in Texas. The round was led by Addition LP (Lee Fixel) and included Andreessen Horowitz, Lightspeed Venture Partners, Thrive Capital, Valor Equity Partners, Altimeter, and others. The company offers low-cost residential backup power systems and is positioning itself as a cost-effective alternative to traditional generators. Base has been scaling its talent pool with high-profile hires from Tesla, SpaceX, and Anduril, including Andrew Ross, former director of battery manufacturing at Tesla. — Bloomberg

Industrial: Drones, Autonomous Driving

BRINC, a U.S.-based emergency response drone manufacturer, raised $75 million in a new funding round led by Index Ventures, with participation from Motorola Solutions (forming a strategic alliance), Mike Volpi, and Figma CEO Dylan Field. The capital will be used to expand production capacity, accelerate R&D of next-generation drone technology, and grow its workforce in response to increasing demand from public safety agencies. — PR

Autonomous driving company Nuro has raised $106M to date in its ongoing Series E round, valuing the firm at $6B. The funding includes investments from T. Rowe Price, Fidelity, Tiger Global, Greylock Partners, and XN LP, with strategic partner participation to be disclosed in a forthcoming announcement. The capital supports Nuro’s licensing-based model for its vehicle-agnostic autonomy platform, which has undergone eight years of development and four years of real-world driverless deployment in California and Texas. The company aims to scale across commercial fleets, robotaxis, and personal vehicles. — PR

Cybersecurity / Enterprise Software

AI-driven staffing platform Jobandtalent raised €92 million ($103 million) in a Series F round at a post-money valuation of €1.3 billion ($1.5 billion), down from $2.35 billion in its 2021 Series E. Investors include Atomico, BlackRock, DN Capital, Hercules, Infravia, Kibo, and Kinnevik. The Madrid-based firm, active in 10 countries, cited broader market conditions as the driver behind the valuation cut. The new funding will support continued growth and AI integration across its offerings. — TechCrunch

Toronto-based security startup Tailscale has raised $160M in a new funding round led by Accel, with participation from CRV, Insight Partners, Heavybit, Uncork Capital, and CrowdStrike CEO George Kurtz. The round values the company at approximately $1.5B. This marks a substantial increase from its prior valuation of C$1B (~$780M USD) three years ago. The company reports that annual recurring revenue has recently doubled, reinforcing investor confidence amid a cooling venture environment. Tailscale has now raised a total of $275M. — Bloomberg

Healthcare

Caris Life Sciences raised $168 million in a growth capital round led by existing investor Braidwell LP, with participation from new investors Perceptive Advisors, Woodline, and Ghisallo, as well as existing backers Millennium Management and First Light Asset Management. The round brings Caris’ total capital raised since 2018 to $1.86 billion. The company is focused on AI-driven precision medicine and diagnostics. — PR

Featured ListingTrack Tool

Tariff Tracker

After last Wednesday’s tariff announcement from the Trump administration, markets saw one of the steepest selloffs since the COVID crash—marking one of the most volatile weeks in recent memory. This week the market bounced back aggressively in one of the market’s most volatile weeks on record.

To help investors navigate these developments, we launched the Tariff Tracker on ListingTrack: 🔗 listingtrack.io/theme/tariffs

The Tracker offers a curated overview of the sectors and companies most affected by tariff shifts, with filters to drill down by industry and country of import exposure. It includes:

Summarized, curated tariff news

Deal activity and earnings updates for impacted companies

Sector and country-level filtering for focused discovery

We’re actively updating it as new developments unfold. Take a look and let us know what you think.

Screenshot of our Tariff tracker theme page

Public M&A

Merger Announcements

Republic Airways and Mesa Air Group (MESA) announced a definitive agreement to merge in an all-stock reverse merger transaction, creating a publicly traded regional airline under the name Republic Airways Holdings Inc. The combined company will remain NASDAQ-listed under the ticker "RJET." Republic shareholders will own 88% of the combined entity, while Mesa shareholders will own between 6% and 12%, contingent on Mesa meeting certain pre-closing conditions. All existing Mesa debt will be extinguished as part of the transaction. The merger has received unanimous board approval from both companies and is expected to close in Q3 or Q4 2025. — PR / Deal Page

See more: Active M&A

Closings

Transcarent completed its $621 million acquisition of Accolade, with Accolade shareholders receiving $7.03 per share in cash. The deal was financed by General Catalyst, 62 Ventures, other investors, and debt led by J.P. Morgan, as well as existing cash reserves. — PR

Stonepeak closed its $3.1 billion acquisition of Air Transport Services Group (ATSG). — PR

Expected Closings

Altus Power (AMPS) shareholders approved the previously announced acquisition by TPG through its TPG Rise Climate Transition Infrastructure strategy. Under the terms of the merger agreement, Altus stockholders will receive $5.00 per share in cash. The transaction is expected to close on April 16, 2025. — PR / Deal Page

See more: Closed M&A

Live Deal Coverage and Updates

President Donald Trump ordered a new review of Nippon Steel’s proposed $14.1 billion acquisition of US Steel (X), reopening a deal previously blocked by the Biden administration on national security grounds. The Committee on Foreign Investment in the United States (CFIUS) has 45 days to report findings. The order raises the possibility of reversing Biden’s January 2025 decision, which halted the deal due to national security concerns. Following the announcement, US Steel shares surged 16% to $44.50, still trading below the $55 per share offer price. — Bloomberg / Deal Page

The $34 billion cash-and-stock acquisition of Ansys (ANSS) by Synopsys (SNPS), announced in January 2024, faces growing uncertainty due to delays in securing approval from Chinese regulators — the final major hurdle. Despite receiving clearance from the U.S., UK, EU, and other jurisdictions, the deal spread has widened from $25 to over $40 per share, reflecting investor concerns. China’s prolonged antitrust review process, especially amid rising tensions with the Trump administration, poses a risk that the deal could be indefinitely delayed or ultimately abandoned. Synopsys derives 16% of its revenue from China, raising the strategic profile of the transaction. — Bloomberg / Deal Page

Potential M&A News

Talks / Offers

Capgemini is in advanced talks to acquire outsourcing firm WNS Holdings (WNS), having emerged as the lead bidder after fending off competing suitors. WNS has been exploring a sale following reported takeover interest, and analysts have estimated a potential sale price between $75 and $84 per share. A deal may be finalized in the coming weeks. — Bloomberg / Deal Page

El Pollo Loco received an unsolicited, non-binding acquisition proposal from Biglari Capital Corp. to acquire the remaining shares it does not already own. The Board is reviewing the proposal with financial and legal advisors and entered into a confidentiality agreement with a standstill on April 6, 2025. — SF / Deal Page

Exploring Sale / Strategic Alternatives

Keros Therapeutics (KROS) adopted a limited-duration stockholder rights plan (poison pill) to prevent hostile takeovers amid a strategic review that may include a potential sale. The plan will trigger dilution if any investor acquires more than 10% of the company’s shares (15% for passive investors), protecting the board’s ability to oversee the review process without coercion or disruption. — Reuters

See more: Potential M&A

Post-M&A Coverage

Elon Musk failed to appear for a scheduled deposition on April 3, 2025, related to an investor lawsuit alleging his 2022 bid to acquire Twitter (X Corp. (fka Twitter) - acquired by XAi) was intended to manipulate the stock price. Despite a court order setting the deposition, plaintiffs' counsel said Musk’s attorney informed them just 20 minutes after the scheduled time that he would not attend. Plaintiffs also noted ongoing challenges in rescheduling the deposition. — Bloomberg

Prominent Private Deals (private targets, including public subsidiaries)

TikTok US Updates

President Donald Trump confirmed that a potential deal to spin off

TikTok’s U.S. operations remains under consideration, following a brief pause. The proposed structure would create a new U.S.-based company majority-owned by American investors, reducing ByteDance’s stake below controlling levels. Trump extended the divestiture deadline to June 19, when a ban would otherwise take effect. While some U.S. senators have criticized the deal, Trump defended it, emphasizing that its future may depend on developments with China. This marks the second enforcement reprieve granted since the original January deadline. — Reuters

Announcements/ Closings

Capri Holdings (CPRI) has agreed to sell Versace to Prada for $1.375B in cash, a significant markdown from the $2.1B Capri paid in 2018. The transaction, expected to close in H2 2025 pending regulatory approvals, marks a strategic exit from a prior effort to build a multi-brand luxury group under the Capri umbrella. Market reaction was mixed: Capri shares fell 11%, likely reflecting investor disappointment in the sale price, while Prada shares rose. The sale potentially allows Capri to refocus on its core Michael Kors brand, while enhancing Prada’s portfolio with another heritage Italian fashion house. — PR

Ripple has agreed to acquire digital assets and FX prime brokerage Hidden Road for $1.25 billion, marking its largest acquisition to date and one of the largest in the crypto industry. As part of the transaction, Hidden Road will adopt Ripple’s RLUSD stablecoin as collateral for its services and transition post-trade operations to the XRP Ledger. Ripple expects the acquisition to enhance its Ripple Payments platform by improving cost efficiency and liquidity, and by offering custody services to Hidden Road’s clients. Hidden Road, founded in 2018 by former SAC Capital and Point72 executive Marc Asch, previously raised $50 million in a 2022 Series A round from investors including Citadel Securities. — Bloomberg

A group led by Ari Emanuel and backed by Apollo Global Management and RedBird Capital Partners has won the auction to acquire Endeavor’s tennis assets, including the Miami Open and Madrid Open, for more than $1 billion. The group outbid CVC Capital Partners. While terms have not been finalized, the deal represents a strategic asset shift for Endeavor following its recent privatization by Silver Lake. — Bloomberg

Live Deal Coverage

Constellation Energy (CEG) defended its proposed $16.4 billion acquisition of privately held Calpine before the Federal Energy Regulatory Commission, addressing concerns from consumer groups about potential market power. The combined entity would become the largest independent power producer in the U.S. Constellation argued that safeguards exist to prevent market manipulation and that the company lacks financial incentive to withhold power supply. The company requested FERC to reject the protests and approve the transaction. — Reuters / Deal Page

DSV has received EU antitrust clearance for its €14.3 billion ($15.8 billion) acquisition of Schenker, the logistics arm of Deutsche Bahn. The European Commission concluded the deal does not raise competition concerns, noting the combined entity will hold only 6%–7% of the fragmented global logistics market. The transaction, announced in September 2024, will position DSV as the world’s largest logistics company, competing with DHL Logistics and Kuehne und Nagel. — Reuters

SC Capital Partners, backed by CapitaLand Investment, has emerged as the sole potential bidder for British data center operator Global Switch, according to Reuters sources. SC Capital is working with advisers on a possible acquisition, with the transaction potentially valuing Global Switch at $4 billion to $5 billion. Global Switch is currently controlled by Chinese steelmaker Jiangsu Shagang Group. — Reuters

Activism, Shorts, & Other Special Situations

Activism, Investor Disputes & Shorts

Activism

Elliott Investment Management has intensified its proxy campaign against Phillips 66 (PSX), gaining the backing of Gregory Goff, a former ConocoPhillips executive and current $10M shareholder in the company. Goff supports Elliott’s director slate, criticizing Phillips 66’s strategy of combining midstream and refining assets, which he argues has underperformed relative to peers. Elliott, which holds a $2.5B stake in Phillips 66, is advocating for the divestiture or spin-off of midstream assets to unlock shareholder value. A shareholder vote is scheduled for May 21. Phillips 66 has defended its track record of returning $43B in value but raised concerns over Goff’s ties to Elliott through Amber Energy, fully owned by Elliott-affiliated funds. — Bloomberg

Ancora Holdings has withdrawn its proxy campaign to replace U.S. Steel’s (X) CEO after President Trump directed a renewed CFIUS review of Nippon Steel’s proposed $14.1 billion acquisition. Ancora, which owns approximately 1% of U.S. Steel, initially launched the board challenge following the Biden administration's opposition to the Nippon deal. However, Trump's intervention revived optimism for the deal, leading Ancora to reconsider its strategy. Conversations with major shareholders confirmed limited support for the proxy effort, prompting Ancora to exit the campaign to avoid interfering with a potential transaction and to protect its standing among investors. — Reuters

See more: Activism

Separations

The U.S. Federal Trade Commission's antitrust lawsuit against Meta (META) over its acquisitions of Instagram (2012) and WhatsApp (2014) is set to go to trial, aiming to unwind both deals on grounds they were illegal “killer acquisitions” that stifled competition. The FTC argues these acquisitions degraded app quality, increased ads, and eroded privacy protections. The case represents a significant test of regulatory power in a changed tech landscape, where Meta faces competition from TikTok and Elon Musk’s X. Meta CEO Mark Zuckerberg has reportedly lobbied the Trump administration for settlement, and experts say Trump could still intervene during any appeal. The FTC is currently controlled by two Republicans following Trump’s dismissal of its Democratic commissioners in March. — Bloomberg

Bankruptcies/ Delistings

Bankruptcies/ Liquidations

WW International (Weight Watchers) (WW) is preparing for a potential Chapter 11 bankruptcy filing to transfer control of the company to creditors amid mounting financial strain and competitive disruption from GLP-1 weight-loss drugs like Ozempic. The company is in ongoing negotiations with lenders and bondholders, but restructuring outside of court appears unlikely due to its public listing. WW recently drew down the remaining $121M of its $175M revolving credit facility, citing a need for financial flexibility. The company faces over $1.4B in outstanding debt due in 2028–2029, in addition to the 2025 revolver maturity. — WSJ

Marin Software’s (MRIN) board has approved a Plan of Dissolution, subject to shareholder approval, following a strategic review. If approved, the company will cease operations, delist from Nasdaq, liquidate its remaining assets, settle its outstanding liabilities, and distribute net proceeds to shareholders. — PR

First Financial Northwest (FFNW) closed the sale of substantially all assets and liabilities of its banking subsidiary to Global Federal Credit Union for $228.7 million in cash. Following the transaction, the company will delist its shares from Nasdaq on April 21, 2025, and close its stock transfer books. Shareholders will receive distributions of remaining assets in two or more tranches, with an initial payment expected around April 30, 2025, net of taxes and wind-down expenses. — PR

Gritstone bio (OTC: GRTSQ) shares were canceled worthless as its bankruptcy became effective.

Mondee Holdings (MONDQ) exited Chapter 11 following its acquisition by Tabhi, which acquired substantially all of its assets and injected additional equity to reduce debt and obligations. Ownership of Tabhi includes affiliates of TCW Asset Management, Morgan Stanley Investment Management, and Co-Founder Prasad Gundumogula, who made a substantial personal investment, assumed majority ownership, and was appointed CEO. — PR

Other Delistings

Nxu (NXU --> NXUR) was delisted by Nasdaq and is set to begin trading OTC under the new symbol NXUR.

SPAC ClimateRock (CLRC --> CLRCF) was delisted by Nasdaq and is set to begin trading OTC under the new symbol CLRCF. The symbols for its units, warrants, and rights also changed to CLRUF, CLRWF, and CLRRF, respectively.

SPAC Global Lights (GLAC --> GLACF) was delisted from Nasdaq and began trading OTC under the new symbol GLACF. —

SPAC Metal Sky Star (MSSA --> MSSAF) changed symbol to MSSAF following its delisting from Nasdaq to OTC. The symbols for its units and warrants also changed to MSSUF and MSSWF, respectively.

Thanks for reading,

The team at ListingTrack

If you found this summary helpful, consider sharing the newsletter with a friend or colleague!

Market Data and Coverage: All market data presented is based on the stock prices at the close of the previous trading day. We cover the US market only at this time.

Abbreviations: PR: Press Release, SF: Company SEC filing, IP: Investor Presentation, BB: Bloomberg.

DISCLAIMER: The information provided in this newsletter is for your convenience only and is not intended to be treated as financial, investment, tax, or other advice. ListingTrack and its parent, CommonFi, do not make any guarantees, representations, or warranties as to, and shall have no liability for, the timeliness, truthfulness, sequence, quality, completeness, or accuracy of any of the information or data provided in this newsletter or on the ListingTrack website.