Good evening!

Thanks for reading the Nightcap by SPAC Track. You can always discover and track all of the SPACs at spactrack.net.

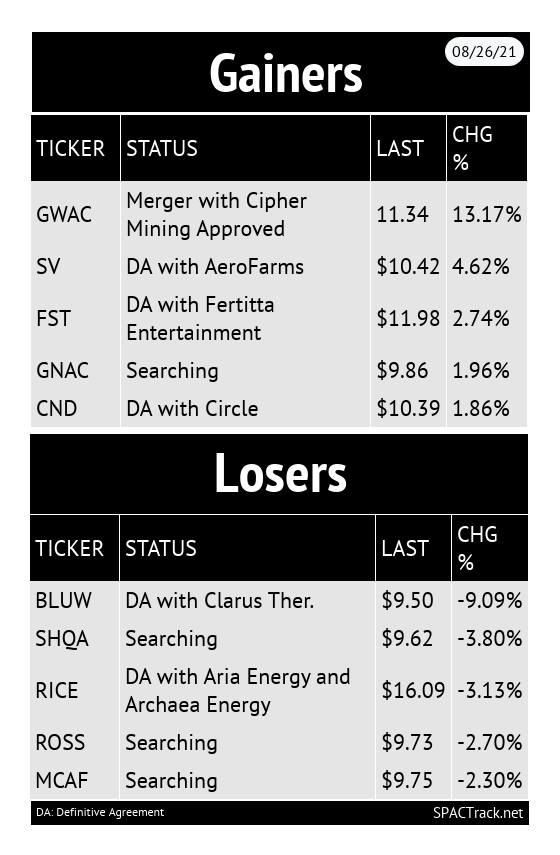

The Stats:

If you haven’t subscribed to this Free nightly newsletter, you can do so below.

The Deals (1):

1) Magnum Opus Acquisition Limited (OPA: $9.85) & Forbes

Merger Partner Description:

Forbes champions success by celebrating those who have made it, and those who aspire to make it. Forbes convenes and curates the most influential leaders and entrepreneurs who are driving change, transforming business and making a significant impact on the world. The Forbes brand today reaches more than 150 million people worldwide through its trusted journalism, signature LIVE and Forbes Virtual events, custom marketing programs and 45 licensed local editions covering 76 countries. Forbes Media’s brand extensions include real estate, education and financial services license agreements. For more information, visit the Forbes News Hub or Forbes Connect.

Valuation: $630M EV

PIPE: $400M PIPE

Great idea, Tut!

Couldn’t find 30 (and to be completely honest, I didn’t really look), but in honor of Forbes joining the SPAC party, here is the “SPAC 3 under 30” for your viewing pleasure:

1) Thomas Healy, 29

Founder & CEO of Hyliion (HYLN: $8.89)

Completed its merger with Tortoise Acquisition Corp (SHLL) in October of last year

2) Austin Russell, 26

Founder & CEO of Luminar Technologies (LAZR $17.00)

Completed its merger with Gores Metropoulos, Inc (GMHI) in December of last year

3) Alex Rodrigues, 25

Co-founder & CEO of Embark Trucks

Announced merger deal with Northern Genesis Acquisition Corp. II (NGAB: $9.89) on June 23rd

There was not a new Forbes article published about Rodrigues after the SPAC merger was announced, unfortunately. But don’t worry, there is one — it’s just a bit dated:

This 23-Year-Old Robotics Prodigy Is Leading The Pack In The Driverless Truck Race (Forbes— who else?)

News:

Lawyers behind Ackman's retreat target dozens more SPACs (Reuters)

The group, which includes former U.S. Securities and Exchange Commissioner Robert Jackson, filed lawsuits last week against three blank-check acquisition firms: GO Acquisition Corp (GOAC: $9.75), E.Merge Technology Acquisition Corp (ETAC: $9.77) and Ackman’s Pershing Square Tontine Holdings (PSTH: $19.77).

…

The three lawsuits were all filed on behalf of George Assad, a shareholder in the SPACs. He has been named as plaintiff in at least 33 other shareholder lawsuits since 2010 against a range of companies, from oil and gas explorer Noble Energy to consumer credit bureau Equifax Inc, a search of legal databases shows.

…

Two lawyers who have not been involved with Assad’s cases said it was common for law firms and their financial backers to enlist nominal shareholders - often referred to in legal circles as “frequent filers” - when they target companies.

Thompson Hine LLP litigation lawyer Riccardo DeBari said courts typically focus on the validity of the claims rather than the people who file them.

The second lawyer, Foley & Lardner LLP corporate partner Louis Lehot, said there is nothing wrong with frequent filers but that it would be ethically problematic for the lawyers involved if Assad was a “straw man” for the shareholder lawsuits without having been substantially harmed himself by the companies involved.

“Our court system relies on actual plaintiffs bringing actual claims that they actually suffered, and having those claims adjudicated,” Lehot said.

INVESTMENT COMPANY ACT

SPACs have traditionally relied on being exempt from registering as investment companies under the Investment Company Act of 1940 so they can make investments and sell stock without restrictions before merging with a company. They typically park the money they have raised from an IPO in U.S. government bonds and money market funds until they find a merger target.

The lawsuits claim that such investments fall outside a SPAC’s primary mission of merging with a company and constitute breaches of the Investment Company Act. They argue that the SPAC sponsors have turned these vehicles into extensions of their hedge funds.

Many Wall Street law firms that work on SPACs say the lawsuits are unlikely to succeed. In a memo to clients sent this week, White & Case LLP said the lawsuits “contain no novel arguments or revelations” and that their thesis “was rejected long ago by the SEC.”

Douglas Ellenoff, a corporate and securities partner at law firm Ellenoff Grossman & Schole LLP, said the lawsuits may be successful in putting off some companies from proceeding with SPAC mergers while the litigation is ongoing.

“It has a very chilling effect on all responsible capital markets, participants who are trying their best to do things in compliance with the securities laws,” Ellenoff said.

Quick News Corner:

Tortoise Acquisition Corp. II (SNPR: $9.30) completed its merger with Volta. Ticker change to VLTA set for tomorrow, the 27th

LGL Systems Acquisition Corp (DFNS: $12.85 +26.9%) announces shareholder approval and the completion of its merger with IronNet. The ticker change to IRNT will be tomorrow, the 27th

IronNet received $136.7M in gross proceeds after 93% of public shares were redeemed, resulting in ~$11.7M left in trust

Alpha Healthcare Acquisition Corp. (AHAC: $10.96) completes its merger with Humacyte. Ticker change to HUMA is set for tomorrow, the 27th

Humacyte has received $245M in gross proceeds

New S-1s (1):

$250M, 1/3 warrant

Focus: Financial services, technology, and blockchain

Upcoming Dates:

This Week’s Announced Shareholder Meetings, Unit Splits, Warrant Redemptions

Fri, August 27

Merger Meetings: Blue Water Acquisition Corp. (BLUW: $9.50) & Clarus TherapeuticsTWC Tech Holdings II Corp (TWCT: $10.17) & Cellebrite

Thanks for reading,