Good morning!

If you are receiving this newsletter for the first time, welcome! You will find the Weekly SPAC Review in the first section below followed by an update on Friday’s SPAC activity.

While Friday's update is included in this Weekly newsletter, the other daily updates (covering Mon-Thurs) are sent in our SPAC Morning Update newsletter to ListingTrack Pro users on the morning of each trading day.

Weekly SPAC Review (Apr 21st - 25th)

Headlines of the Week

De-SPAC M&A

Nano Dimension has completed its acquisition of Markforged (MKFG) for $116 million, or $5.00 per share, strengthening its position in metal and composite manufacturing solutions and expanding its capabilities in AI-enhanced digital manufacturing.

Vacasa (VCSA) shareholders will vote on April 29, 2025, to approve a proposed merger with Casago Holdings, LLC, under which Vacasa shareholders would receive $5.30 per share. If approved, the merger is expected to close before the market opens on May 1, with Vacasa’s stock being halted after-hours on April 30 and suspended from trading effective May 2, 2025.

Coeptis Therapeutics (COEP) has entered into a definitive agreement for a reverse merger with Dogecoin mining company Z Squared. More information in Friday’s news section.

*Covering the notable activity not included in the section below

Key Weekly SPAC Activity

Deal Announcements/ Terminations/ Closings

See more: SPAC Deal Pipeline

Mergers announced:

Cantor Equity Partners (CEP) & Twenty One Capital

Voyager (VACH) & VERAXA Biotech

GSR III (GSRT) & Terra Inovatum

Papaya Growth I (PPYA) & PX Energy

Terminations:

—

Completions:

—

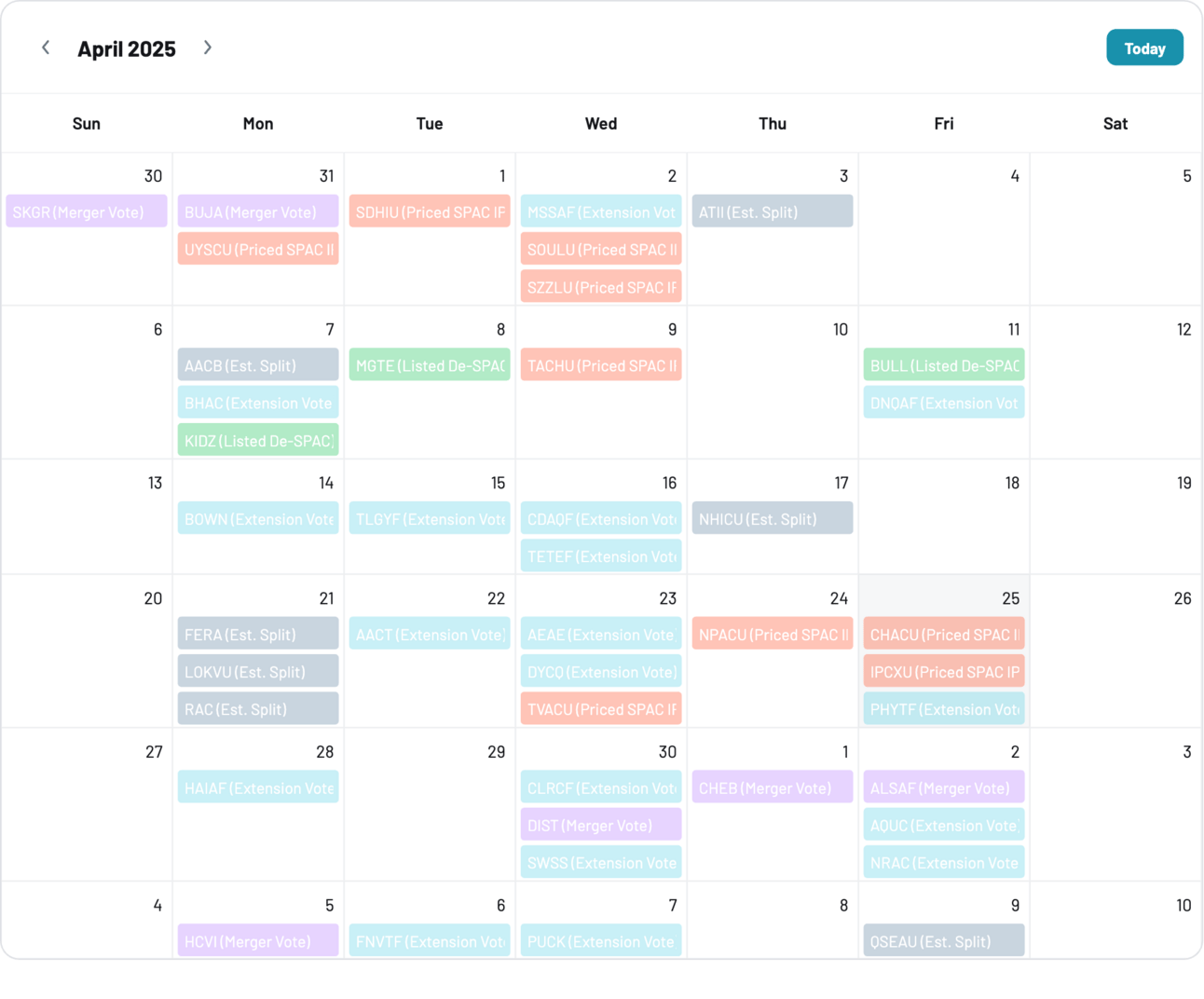

Merger Votes

See more: Merger Votes Calendar

Merger votes set:

—

11 Deals in limbo (merger approved & pending closing):

Focus Impact BH3 (OTC: BHAC) & XCF Global

ShoulderUp Technology (OTC: SUAC) & SEE ID

Bowen (BOWN) & Shenzhen Qianzhi BioTech (Emerald)

Global Star (OTC: GLST) & K Enter

Rigel Resources (OTC: RRACF) & Aurous

Iris (OTC: IRAA) & Liminatus Pharma

Perception Capital IV (OTC: RCFAF) & Blue Gold

Aimfinity I (AIMAU) & Docter

Integral 1 (OTC: INTE) & Flybondi

Finnovate (OTC: FNVTF) & Scage

Bukit Jalil Global 1 (BUJA) & Global IBO Group

Extensions

See more: Extension Votes Calendar

Approvals:

—

Votes set:

IPOs and New S-1s

See more: IPO Calendar & Pre-IPO Dataset

New IPOs:

Texas Ventures Acquisition III Corp (TVACU) priced its IPO. – PR

$200M, 1/2 Warrant

Focus: Industrial technology

UW: Cohen & Company

New Providence Acquisition Corp. III (NPACU) priced its IPO. – PR

$261M, 1/3 Warrant

Focus: Consumer

UW: Cantor

Crane Harbor Acquisition Corp. (CHACU) priced its IPO. – PR

$200M, 1 R (1/10 sh)

Focus: Technology, real assets, and energy

UW: Cohen & Company

Inflection Point Acquisition Corp. III (IPCXU) priced its IPO. – PR

$220M, 1 R (1/10 sh)

Focus: North America, Europe

UW: Cantor

New registrations:

Liquidations

See more: Liquidations Dataset

Announcements/ Delistings

—

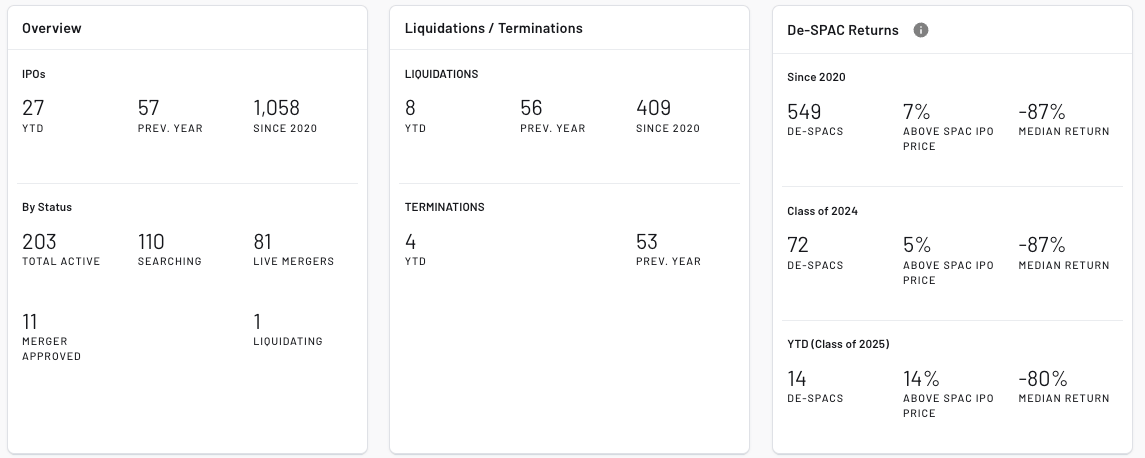

8 SPACs have liquidated YTD 2025, and 1 (CNGL - active litigation) is in the process of liquidating.

SPAC Update

The section below is the format for the SPAC Morning Update newsletter sent to ListingTrack Pro subscribers on the morning of each trading day. You can sign up for ListingTrack Pro here.

SPAC & De-SPAC Daily Trading (prev. session)

SPAC Gainers & Losers

Ticker | DA Target | Price | Daily % Chg. |

|---|---|---|---|

Twenty One Capital | $31.50 | 27.02% | |

Global IBO Group | $12.41 | 14.91% | |

$13.10 | 8.80% | ||

$11.45 | 3.71% | ||

Kyivstar | $12.00 | 2.56% | |

$10.19 | -0.10% | ||

$10.27 | -0.29% | ||

$12.05 | -0.41% | ||

World Media and Entertainment Universal | $10.20 | -0.49% | |

Shenzhen Qianzhi BioTech | $10.76 | -0.83% |

SPAC Volume Leaders

Ticker | DA Target | Volume |

|---|---|---|

Twenty One Capital | 27.43M | |

GrabAGun | 1.96M | |

1.67M | ||

Kodiak Robotics | 1.57M | |

1.05M | ||

0.97M |

De-SPAC Gainers & Losers

Ticker | IPO Return | Price | Daily % Chg. |

|---|---|---|---|

-95% | $6.90 | 27.78% | |

-97% | $8.47 | 27.37% | |

-96% | $0.41 | 21.82% | |

-65% | $3.53 | 21.31% | |

-99% | $0.55 | 19.00% | |

-99% | $0.13 | -14.75% | |

-99% | $12.33 | -15.84% | |

-70% | $3.05 | -17.34% | |

-99% | $0.89 | -19.81% | |

-96% | $7.70 | -38.25% |

De-SPACs listed from 2019-

De-SPAC Volume Leaders

News & De-SPAC Updates

Cantor Equity Partners (CEP), a SPAC set to merge with TwentyOne Capital—a MicroStrategy competitor backed by Tether and SoftBank—has surged 197% to $31.50 since the merger announcement, marking a rare SPAC rally reminiscent of 2021. The stock jumped 55% on the merger news, followed by gains of 50% on Thursday and 27% on Friday, reflecting heightened investor enthusiasm for crypto-linked public market plays. —ListingTrack

Coeptis Therapeutics (COEP) has entered into a definitive agreement for a reverse merger with Dogecoin mining company Z Squared Inc., under which Z Squared will become a wholly-owned subsidiary in exchange for 9,000 U.S.-based Dogecoin mining machines. Coeptis plans to spin out its biopharmaceutical operations post-merger, with the combined entity focusing on digital asset mining and operating under the Z Squared name. —PR

SPAC Updates

Deal Updates

GSR III (GSRT) & Terra Innovatum filed the BCA for the deal. —SF

Extensions

DT Cloud (DYCQ) was approved to extend up to Aug 2026. ~6% of the public SPAC shares were redeemed. Remaining in trust: ~$50.3M / 4,704,729 shares. —SF

Listings

New Issues: IPOs, New S-1s

IPOs

New Providence III (NPACU) closed its $300.15M IPO, including the full exercise of the $39.15M greenshoe. —SF

Filings

Registration Withdrawals

—

Listing Warnings / Transfers:

—

Key Filings

Extensions:

S-4 Filings*:

AlphaVest (ATMV) & AMC Corporation – S-4/A

Welsbach Technology Metals (OTC: WTMA) & Evolution Metals – S-4/A

Globalink Investment (OTC: GLLI) & Alps Global Holding Berhad – F-4/A

Black Spade II (BSII) & World Media and Entertainment Universal – F-4/A

Integrated Rail and Resources (OTC: IRRX) & Tar Sands Holdings II – S-4/A

Post-Merger S-1 Filings**:

Rain Enhancement Technologies (RAIN) — EFFECT

*The latest S-4 filings can be found in the Announced Mergers dataset.

**Includes PIPE resale registrations where applicable — the latest post-merger S-1 filings can be found in the De-SPAC Screener in the column group “De-SPAC Profile”.

Thanks for reading,

The team at ListingTrack (listingtrack.io)

Abbreviations: BC: Business Combination, BCA: Business Combination Agreement, DA: Definitive Agreement, PR: Press Release, SF: Company SEC filing

DISCLAIMER: The information provided in this newsletter is for your convenience only and is not intended to be treated as financial, investment, tax, or other advice. ListingTrack, SPAC Track, and the parent, CommonFi, do not make any guarantees, representations, or warranties as to, and shall have no liability for, the timeliness, truthfulness, sequence, quality, completeness, or accuracy of any of the information or data provided in this newsletter or on the ListingTrack or SPAC Track websites.