Weekly SPAC Review (Sep 16-20)

Headlines of the Week

De-SPAC M&A

Complete Solar ($CSLR) is the Winning Bidder in SunPower Chapter 11 Proceedings — PR

Other De-SPAC News

Bird Global’s (BRDSQ) existing shares were canceled worthless as its bankruptcy plan became effective.

All of the independent directors of 23andMe ($ME) resigned from the Board of the company in a joint statement due to the CEO Wojcicki not submitting “an actionable'“ proposal to take the company private 5 months after she put the initial take-private proposal forward. (PR). Wojcicki then responded in a memo to employees saying she was committed to taking the company private. — BB

Trump SPAC Founder Orlando Wins 800,000 More Shares in Trump Media & Technology ($DJT) — BB

ANEW Medical, Inc. (WENA) performed a name and symbol change to Klotho Neurosciences, Inc. ($KLTO). — PR

Short seller Wolfpack Research publishes a short report on SWVL ($SWVL) titled, ‘SWVL, a “Transportation-as-a-Service” Start-up Appears to Be a Few Breaths Away from Bankruptcy’ — Wolfpack Report

HNR Acquisition Corp (HNRA) changed its name and symbol to EON Resources Inc. ($EONR) — PR

SPAC Coverage*

Aura FAT Projects ($AFAR), which hasn't traded since its halting by Nasdaq on July 19, reported it has started the process of moving its listing to OTC and advises it is committed to an uplisting after closing its merger with Allrites. — SF

*Covering the notable activity not included in the section below

Key Weekly SPAC Activity

Deal Announcements/ Terminations/ Closings

See more: SPAC Deal Pipeline

Mergers announced:

Terminations:

Vaso (OTC:$VASO) issued a termination notice to $AVHI

$BACA & Custom Health

Completions:

Plum I (PLMI) & Veea [$VEE]), +9.8% from IPO

Pono Capital Two (PTWO) & SBC Medical Group [$SBC], -45% from IPO

Merger Votes

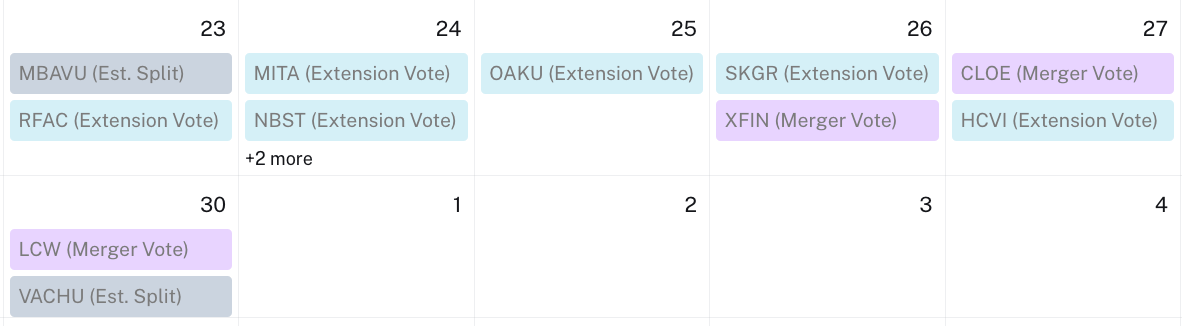

See more: Merger Votes Calendar

Merger votes set:

Insight [$INAQ] & Alpha Modus: Oct 14. — SF

Deals in limbo (merger approved & pending closing):

Acri Capital [$ACAC] & Foxx Development

Nova Vision [$NOVV] & Real Messenger

Focus Impact [$FIAC] & DevvStream

Extensions

See more: Extension Votes Calendar

Approvals:

BAYA: June 2025

Votes set:

$OAKU: Sep 25

IPOs and New S-1s

See more: IPO Calendar & Pre-IPO Dataset

New IPOs:

New registrations

Liquidations

See more: Liquidations Dataset

Last week, no new liquidations were announced

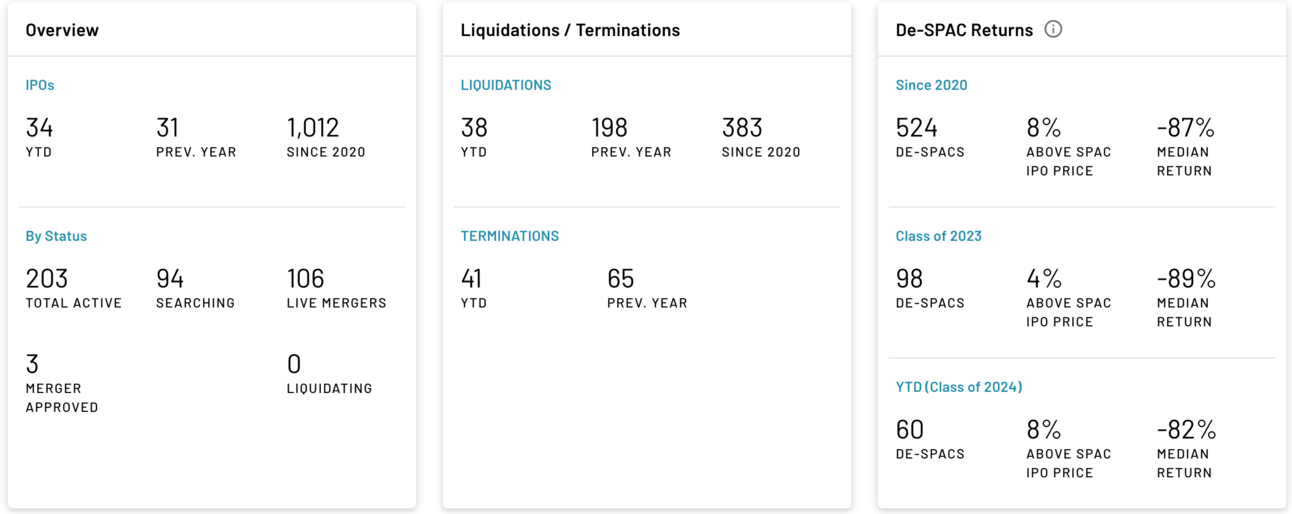

38 SPACs have liquidated in 2024

Friday’s SPAC Update

The section below is the format for the SPAC Morning Update newsletter sent to ListingTrack Pro subscribers on the morning of each trading day. You can sign up for ListingTrack Pro here.

SPAC & De-SPAC Daily Trading (prev. session)

SPAC Gainers & Losers

Ticker | DA Target | Price | Daily % Chg. |

|---|---|---|---|

Foxx Development | $13.48 | 17.22% | |

Baird Medical | $11.50 | 4.74% | |

$12.50 | 4.08% | ||

$11.47 | 2.59% | ||

Abpro Corporation | $11.57 | 2.21% | |

Linqto, Inc. | $11.14 | -0.71% | |

XDATA | $11.68 | -0.76% | |

$11.70 | -1.52% | ||

$11.32 | -1.65% | ||

DevvStream Holdings Inc | $10.04 | -10.38% |

SPAC Volume Leaders

De-SPAC Gainers & Losers

Ticker | IPO Return | Price | Daily % Chg. |

|---|---|---|---|

-43% | $5.69 | 97.57% | |

-99% | $0.12 | 36.78% | |

-73% | $2.73 | 33.82% | |

-45% | $5.54 | -19.88% | |

122% | $22.20 | -21.55% | |

-99% | $0.08 | -43.96% |

De-SPACs listed from 2019- in descending order with the 3 Gainers followed by the 3 Losers

News & De-SPAC Updates

The Deals

Target Description: Longevity Biomedical is a biopharmaceutical company focused on advancing technologies across therapeutics, health monitoring and digital health solutions to restore tissue form and function in order to increase and improve health span. Longevity’s mission is to become a consolidator and a leading provider of products and services designed to help people live longer, healthier lives. Longevity is acquiring a differentiated therapeutic pipeline of late-stage clinical technologies across ophthalmology, cardiovascular disease and soft tissue reconstruction and repair. Building on this platform, Longevity intends to acquire and/or partner with other health technology companies to become a leading provider of products and services designed to increase and improve health span amongst the rapidly growing aging patient population.

Valuation: $100M Pre-money equity value

Additional Deal Notes: Longevity Biomedical was in a BCA with Denali Capital (DECA), which was terminated in June.

SPAC Updates

Liquidations / Terminations

Berenson I [$BACA] & Custom Health terminated the BCA. — SF

Merger Votes / Completions

Clover Leaf Capital Corp. [$CLOE]: adjourned the merger vote to Sep 27. – SF

Extensions

Atlantic Coastal II [$ACAB] was approved to extend up to Nov 2024. ~19% of the public SPAC shares were redeemed. Remaining in trust: ~$6.2M / 541,269 shares. — SF

Metal Sky [$MSSA] stated that it filed the preliminary proxy for extension after its termination date (Aug 5) as it didn’t realize the deadline was approaching. Per the filing, it was preoccupied with preparing financial statements and changing its legal counsel. It has deposited $50,000 into the trust (~$0.015 per public share) each month for August and September and believes that is fair compensation for the delay. MSSA also reported that it is in talks with a “potential target in the telecommunications industry located in Armenia.” –SF

Listings

New Issues: IPOs, New S-1s

Filings

Listing Warnings / Transfers:

Key Filings

Extensions:

S-4 Filings*:

Rigel Resource [$RRAC] & Aurous – F-4/A

*The latest S-4 filings can be found in the Announced Mergers dataset.

Thanks for reading,

The team at ListingTrack (listingtrack.io)

Abbreviations: BC: Business Combination, BCA: Business Combination Agreement, DA: Definitive Agreement, PR: Press Release, SF: Company SEC filing

DISCLAIMER: The information provided in this newsletter is for your convenience only and is not intended to be treated as financial, investment, tax, or other advice. ListingTrack, SPAC Track, and the parent, CommonFi, do not make any guarantees, representations, or warranties as to, and shall have no liability for, the timeliness, truthfulness, sequence, quality, completeness, or accuracy of any of the information or data provided in this newsletter or on the ListingTrack or SPAC Track websites.