Discover and track all of the SPACs at spactrack.net.

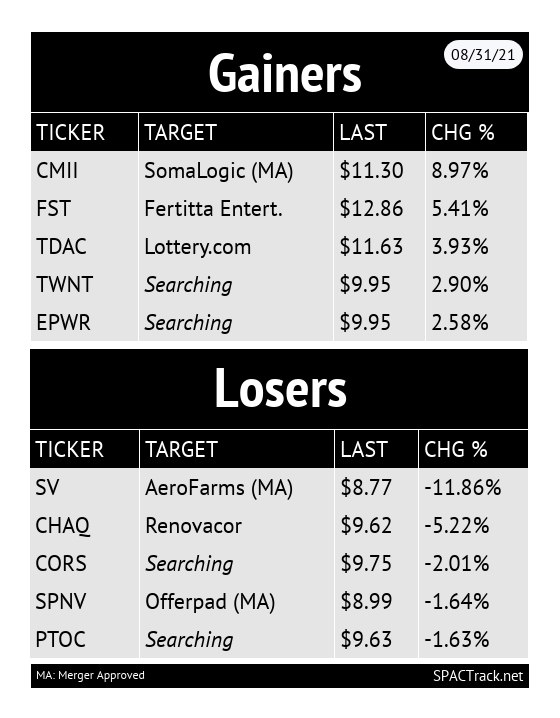

The Stats:

If you haven’t subscribed to this Free nightly newsletter, you can do so below.

The Deals:

No deals today.

News:

Vice Raises $85 Million as SPAC Talks End, Smith Yields Control (The Information—paywalled)

Vice Media is raising over $85 million in fresh capital from existing investors, as talks to go public via a special purpose acquisition company have ended for now, according to people familiar with the situation. As part of the fundraising, Vice’s co-founder, Shane Smith, has agreed to give up his voting control, said the people. He remains chairman of the board.

The media firm had been hoping to raise money by going public through a merger with a SPAC backed by 7GC & Co. [7GC & Co. Holdings Inc. (VII: $9.75)], but a slowdown in the once-hot SPAC market has ended those discussions for now, one of the people said. The existing investors, which include James Murdoch’s Lupa Systems, TPG, TCV and Sixth Street Partners, agreed to invest in Vice to help it get to profitability. The valuation of the latest round couldn’t be learned. Vice raised money at a $5.7 billion valuation in 2017, but it has fallen significantly since then.

Moelis SPAC Shareholders Advised by ISS to Vote Down Archer Deal (Bloomberg—paywalled)

Investors in Ken Moelis’s Atlas Crest Investment Corp. (ACIC: $10.00) should vote against a merger with a Archer Aviation Inc. and instead redeem their holdings in the blank-check company for cash, an influential shareholder adviser said in a report.

The proposed merger with Archer, a developer of vertical take-off and landing electric aircraft that is mired in a legal battle over trade secrets, poses risk without the prospect of material gains for Atlas investors, Institutional Shareholder Services Inc. said in its report. The combined company will be valued at about $1.7 billion, a reduction of $1 billion from its enterprise value when the deal was announced in February, ISS said.

“Shareholders appear to be better off if they choose to forgo the deal, face no operational risk, and select the relatively riskless redemption option that will deliver $10 in cash per share,” ISS said.

Discussions with Atlas are ongoing, a spokeswoman for Archer said. The company responded to concerns about reducing the number of shares, she said, referring to a revised proxy statement in which Atlas said it would cut Class A Common Stock shares from 1 billion to 700 million.

Advent Is Said to Explore Taking Payments Firm Xplor Public (Bloomberg—paywalled)

Advent International is considering taking payments company Xplor Technologies public, according to people familiar with the matter.

The private equity firm is working with Goldman Sachs Group Inc. and Citigroup Inc. to weigh an initial public offering for Atlanta-based Xplor or a merger with a special purpose acquisition company, said the people, who asked to not be identified because the matter isn’t public.

The company could be worth at least $4 billion and perhaps more than $6 billion, the people said.

A final decision hasn’t been made and Boston-based Advent could opt to keep Xplor private, the people said.

Representatives for Advent, Goldman Sachs and Citigroup declined to comment. A spokesperson for Xplor didn’t immediately respond to a request for comment.

Xplor was valued at $3 billion, including debt, in the merger that formed the company earlier this year, Bloomberg News reported in February.

Dubai's Emaar considers sale of e-commerce business Namshi (Reuters)

Dubai's Emaar is weighing options to sell fashion e-commerce business Namshi that may include a listing abroad via a SPAC, three sources familiar with the matter said.

An outright sale of Namshi may generate $600 million to $700 million in proceeds, while a listing through a special purpose acquisition company (SPAC) could be more lucrative, said one of the sources.

Emaar, which declined to comment, has approached some banks for potential advice on the deal, the sources said.

Emaar Malls, the retail arm of Dubai's biggest developer, Emaar Properties, bought a 51% stake in Namshi from Global Fashion Group for $151 million in 2017 shortly after Amazon.com bought Dubai-based e-commerce website Souq.com.

It bought the remaining 49% in 2019 for about $130 million.

Namshi posted revenues of 685 million dirhams ($187 million) in the first half of the year, up from 664 million dirhams in the same period one year earlier.

Quick News Corner:

Centricus Acquisition Corp. (CENH: $9.95) shareholders approve the merger with Arqit Limited

CENH previously reported that 32,351,570 shares were redeemed (~93.8%) and Heritage Assets intends to backstop up to 2.2M shares at $10 per share. As an incentive, Heritage will receive up to 2M shares and up to 3.76M sponsor warrants. The closing cash is expected to be at least $100M. The $150M minimum cash condition will not be met, thus the company is expected to waive it

Supernova Partners Acquisition Company (SPNV: $8.99) shareholders approve the merger with Offerpad

CM Life Sciences II Inc. (CMII: $11.30) shareholders approve the merger with SomaLogic

Tracking De-SPAC S-1s:

S-1s that went effective today:

REE Automotive (REE: $6.00 -33.7%) (F-1)

Lucid Motors’ (LCID: $19.96 -3.25%) PIPE lock-up period is set to end tomorrow

New S-1s:

None today.

Upcoming Dates:

This Week’s Announced Shareholder Meetings, Unit Splits, Warrant Redemptions

Wed, Sep 1

Merger Meetings:Chardan Healthcare Acquisition 2 Corp (CHAQ: $9.62) & RenovacorGenesis Park Acquisition Corp. (GNPK: $10.16) & Redwire

Fri, Sep 3

Merger Meeting: Sustainable Opportunities Acquisition Corp (SOAC: $9.97) & DeepGreen Metals

Thanks for reading,