Good Afternoon,

There were 4 deals announced this week, however, a flurry of terminations and a couple of IPOs resulted in an increase in the number of SPACs searching for a dance partner.

Another liquidation announcement- this one from Sam Zell's SPAC. According to SeekingAlpha, the billionaire real estate titan said back in November that he thinks 80% of SPAC sponsors will "disappear and will go do something else."

This liquidation makes Zell the 2nd billionaire to back out of the SPAC game this year. The first being Bill Ackman, as he opted to liquidate PSTH. It also marks the 17th SPAC to announce liquidation this year.

The deals included an exporter of potassium owner of oil and gas assets in Kazakhstan and an industrial blue laser company.

We also now have a 3rd De-SPAC match on the year: CarLotz is set to merge with Shift Technologies. Earlier this year DraftKings closed its acquisition of Golden Nugget Online Gaming and just last week Nikola announced it was acquiring Romeo Systems.

Let's begin.

Where Are They Now:

De-SPAC Over $10: ChargePoint [$CHPT] — $18.86 (completed its merger in Feb 2021)

De-SPAC Under a Dollar Club: Dave [$DAVE] — $0.65 (completed its merger in Jan 2022)

The Stats

SPAC Market Snapshot

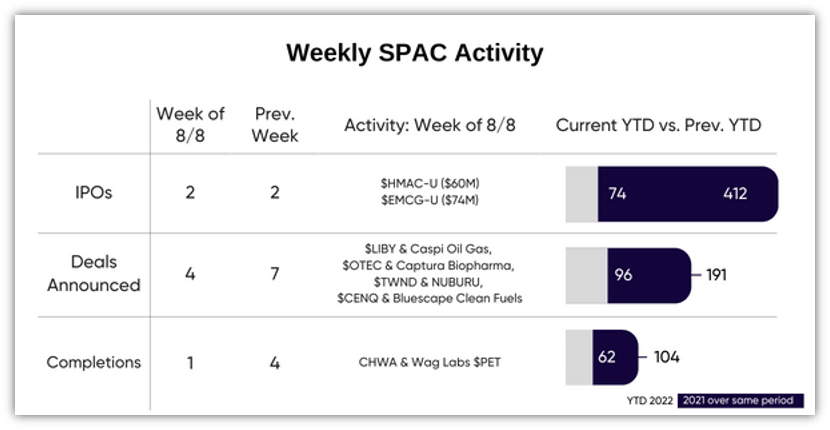

Activity last Week: 4 Mergers Announced, 1 Merger Completed, 2 IPOs, 5 Terminations, 1 Liquidation Announced (17 Announced YTD)

Total SPACs Searching: 574

Total Live Deals: 113

Total Active SPACs: 692

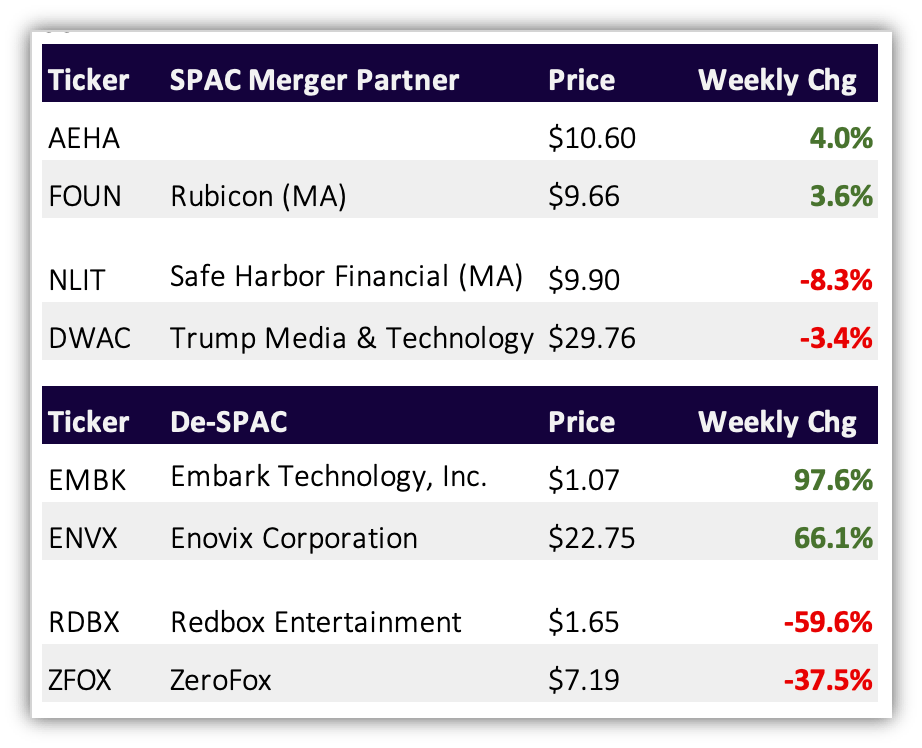

Weekly Gainers & Losers*

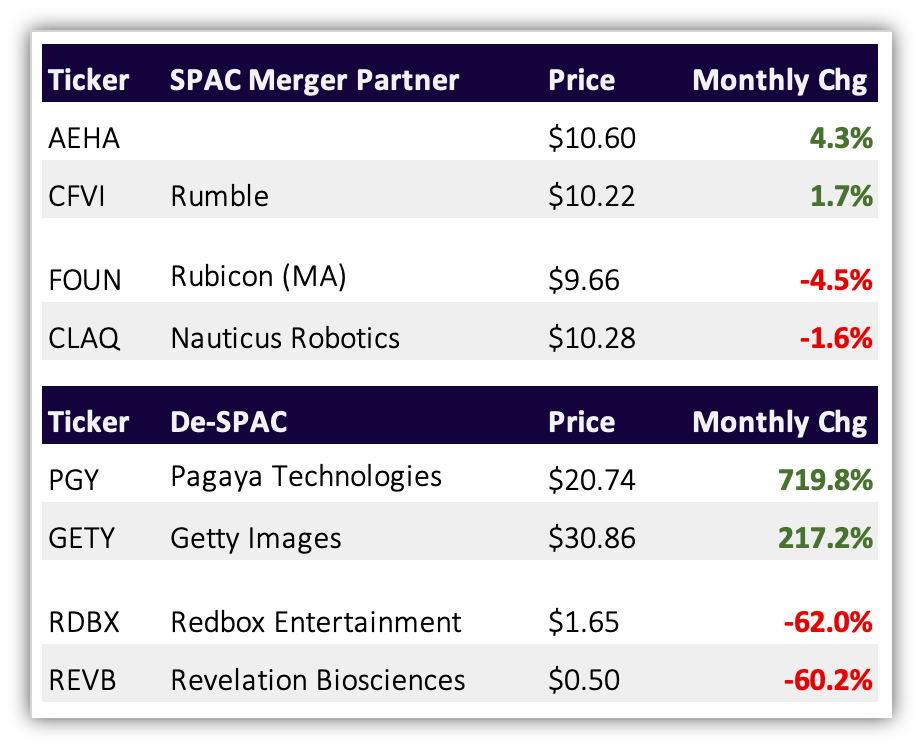

Monthly Gainers & Losers*

*prices as of close on Aug 12th

SPAC Track Pro

SPAC Track Pro subscribers get access to the premium SPAC dataset on spactrack.io and receive the premium morning newsletter in their inbox each trading day that covers the important SPAC activity in detail.

The premium dataset and the premium SPAC + De-SPAC screener include hundreds of data points including ex-redemption dates, De-SPAC redemption stats & standard lock-up information that can be useful regardless of SPAC investing/ trading strategy. View the full list of data points available to Pro users here.

Some recent features include a Rumors & Terminations screener, a filter for De-SPACs that have issued a “Going Concern” warning (30+), a filter for De-SPACs approaching 180 days from closing, and more. You can browse the screeners and filters that are available to Pro users here.

Sign up for Pro using the code, ‘August22’, before the end of August to receive 25% off the first year of the annual plan or the first quarter of the quarterly plan.

News & De-SPAC Updates

Redbox [$RDBX] is delisted following the closing of its acquisition by Chicken Soup for the Soul Entertainment (PR)

Special Opportunities Fund (SPE) announces it has filed a class action lawsuit filed against FAST [$FST] in the Delaware Court of Chancery for its handling of the settlement associated with the termination of the Fertitta Entertainment deal (PR)

FAST responded in a press release

De-SPAC Merger: CarLotz [$LOTZ] to merge with Shift Technologies [$SFT] in a stock-for-stock merger with an expected exchange ratio for CarLotz holders (actual will be adjusted at closing) of 0.692158 shares of Shift common stock for each share of CarLotz common stock. The Merged company will continue to trade as SFT. (PR)

Arrival [$ARVL] slashes production targets to just 20 EV vans as part of restructuring (TC)

Judge approves Asurion's $110 million purchase of Enjoy Technology [OTC: $ENJYQ] (RTS)

The Deals

The Newsletter Platform Built for Growth

When starting a newsletter, there are plenty of choices. But there’s only one publishing tool built to help you grow your publications as quickly and sustainably as possible.

beehiiv was founded by some of the earliest employees of the Morning Brew, and they know what it takes to grow a newsletter from zero to millions.

The all-in-one publishing suite comes with built-in growth tools, customization, and best-in-class analytics that actually move the needle - all in an easy-to-use interface.

If you’ve considered starting a newsletter, there’s no better place to get started and no better time than now

SPAC Updates

Merger Votes / Completions

Completed: CHW (CHWA) & Wag Labs! [$PET] (PR)

Vote Date Set:

Liquidations / Terminations

Terminations:

Liquidations:

New Liquidation 1: Equity Distribution [$EQD] announces it will liquidate effective Sep 19th with a $10.01 redemption price (PR)

NYSE has suspended trading of EQD warrants (PR)

Liquidation Update: FAST [$FST] announces that it expects the redemption price to be $10.02 with the liquidation effective as of Aug 26th (PR)

SCVX [$SCVX] liquidated Aug 11th

Deal Updates

The PIPE That Keeps Giving: East Stone [$ESSC] reported it has added $200M to its PIPE in connection with its merger with ICONIQ. The SPAC previously reported that it raised $200M in PIPE financing in April and another $200M in June, bringing the new total PIPE proceeds to $600M (SF)

Outside Date Extended: Golden Path [$GPCO] and MC Hologram amend the merger agreement to, among other things, extend the outside date to Dec 31st (SF)

PIPE Check: Digital Health [$DHAC] reports it has added PIPE financing in connection with its merger with VSee Labs & iDoc Telehealth Solutions: at least $100M in convertible notes and warrants (SF)

Notable Extensions

Digital World [$DWAC], has reported a tentative meeting date to extend its deadline from Sep 8th of this year to Sep 8th, 2023. The official meeting date will be reported in the definitive proxy when filed (SF)

Chamath's SCH IV [$IPOD] and SCH VI [$IPOF] file preliminary proxies to extend the deadline from October to an undisclosed date in 2023

More

Departures: Simon Property Group Acq. [$SPGS] reported that David Simon, the CEO of Simon Property Group, resigned from his position as Chairman of SPGS. Eli Simon, the CEO of SPGS and son of David Simon, was appointed to replace David as Chairman. (SF)

If you find this newsletter useful, consider sharing it with a friend so they can get it directly to their inbox:

Key Filings

SPAC S-4 Filings

BOA [$BOAS] & Selina

Health Sciences Acquisitions Corporation 2 [$HSAQ] & Orchestra BioMed

Alpine [$REVE] & Two Bit Circus

Jack Creek Investmenti [$JCIC] & Bridger Aerospace

Larkspur Health [$LSPR] & ZyVersa Therapeutics

*Latest S-4 filings can be found by SPAC Track Pro subscribers in the “Deal Details” view under the column “S-4 Link”

De-SPAC/ Post-Merger S-1s

S-1s

ProKidney [$PROK]

S-1 Effective:

Senti Biosciences [$SNTI]

MSP Recovery [$MSPR]

Global Business Travel Group [$GTBG]

SpringBig [$SBIG]

*including PIPE resale registrations where applicable — latest post-merger S-1 filings can be found by SPAC Track Pro subscribers in the “De-SPAC" view under the column “Post-Close S-1”

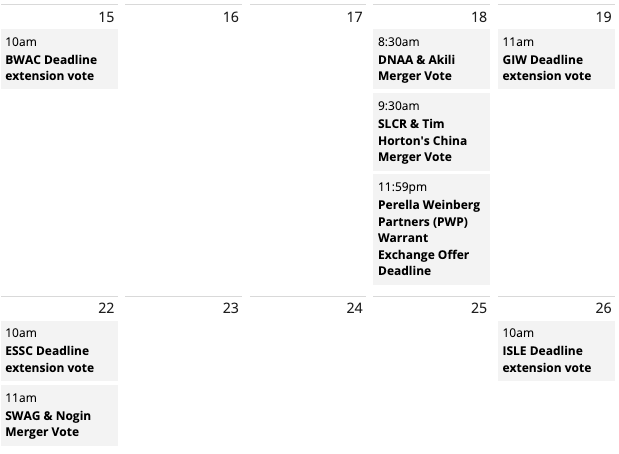

Upcoming Dates:

See the full calendar with proxy links here.

Thanks for reading,

The team at SPAC Track (spactrack.io)