Good evening!

Thanks for reading the Nightcap by SPAC Track. You can always discover and track all of the SPACs at spactrack.net.

In another edition of wacky, wild, super high-redemption, low float De-SPAC action… Locust Walk Acquisition Corp. (LWAC) reported a 97% redemption rate upon approval of its merger with eFFECTOR Therapeutics yesterday.

LWAC stock closed at $8.76 yesterday.

Today, the stock hit an intraday high of $29.20 and closed at $16.98 or up a whopping 92.6% on the day.

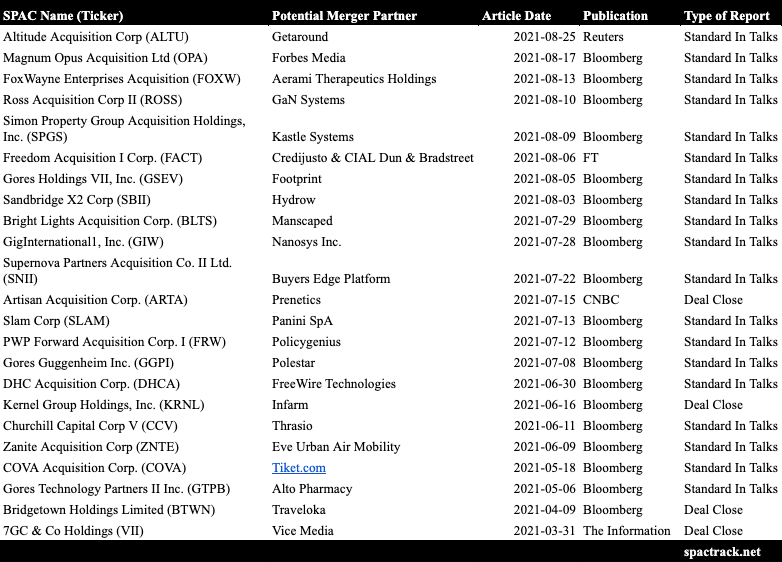

In Talks/ Rumor Report Update:

There have been 18 deals announced so far this month, down from July’s total of 29.

Below is the list of SPACs that have been reported (“rumored”) as in talks with a particular target and have yet to announce a merger agreement (or we have yet to hear of the talks falling through).

The Stats:

If you haven’t subscribed to this Free nightly newsletter, you can do so below.

The Deals (1):

1) Ace Global Business Acquisition (ACBA: $10.00) & DDC Enterprise Limited

Merger Partner Description:

DDC is a private company incorporated in the British Virgin Islands (BVI) in 2012, which started its business in Hong Kong and expanded its business to Shanghai, PRC in 2015, whereupon it registered by the way of continuation in the Cayman Islands in the same year. DDC and its subsidiaries, i.e. the Group, is a digital publisher and merchandiser for Asian cooking based in Hong Kong and Mainland China. The Group mainly runs the leading content-driven lifestyle brand, DayDayCook for young food lovers, who are seeking quality food and convenience from ready-to-heat (RTH), ready-to-cook (RTC) and plant-based food products. Omni-channel approach is adopted by the Group to promote and sell their products, including online, offline and social commerce channels. The Group also continuously builds brand recognition and fan base through online video contents, such as recipe video, product evaluation, live streaming and advertising videos.

Valuation: “Base enterprise value of US$300M”

PIPE: No PIPE currently, but the SPAC aims to raise a $30-40M PIPE

No Investor Presentation

Deal News:

Softbank-backed Getaround in SPAC merger talks (Reuters)

Getaround, a car-sharing startup backed by SoftBank Group Corp, is in talks to go public through a merger with special purpose acquisition company (SPAC) Altitude Acquisition Corp (ALTU: $9.83), people familiar with the matter said.

The company has confidentially sought investors to participate in the deal through a private placement in public equity, or PIPE, at a valuation of around $1.7 billion, one of the sources said.

The sources cautioned that terms could change and said there was no certainty of a deal. They asked not to be identified because the negotiations are not public.

Altitude Acquisition Corp declined to comment. Getaround did not immediately respond to requests for comment.

Founded in 2009, San Francisco-based Getaround operates a peer-to-peer car-sharing marketplace that allows vehicle owners to rent out their cars on an hourly or daily basis. It operates in over 100 U.S. cities and more than 170 European locations, with 6 million users globally. One of its major competitors, Turo Inc, registered for an initial public offering this month.

Getaround has raised more than $800 million in previous fundraising rounds from investors including Softbank and Menlo Ventures, and was last at more than $1 billion in September 2020, according to PitchBook data.

Like many other travel businesses, Getaround suffered when the COVID-19 pandemic spread last year. It saw customer demand drop by as much as 75%. Its business has recovered as pandemic restrictions eased and travel resumed.

Landa Digital Printing heading for Nasdaq SPAC merger at $2 billion valuation (Calcalist)

Serial Israeli entrepreneur Benny Landa is in the process of merging his digital printing company with a Nasdaq-traded SPAC, Calcalist has learned. Landa Digital Printing (LDP) has hired Bank of America to lead the move. Landa is targeting a $2 billion valuation, 20 times the company's annual revenue of around $50 million. The negotiations regarding the merger already began 2-3 months ago.

LDP has raised $700 million over two funding rounds to date. The company raised $300 million at a $1.8 billion valuation in its most recent round in June 2018. That round was led by investment company SKion and the Altana chemicals company.

LDP, which was spun out of Landa Labs a decade ago and currently employs approximately 550 people, named Arik Gordon as its new CEO in June. Gordon joined LDP after 18 years at Orbotech. In the past two years, he served as Executive VP of Strategy and Growth at Orbotech. He held several executive management positions in the company’s operations in Asia Pacific, and upon returning to Israel in 2013, was appointed President of Orbotech's PCB (Printed Circuit Board) division.

Landa is the majority shareholder of LDP with a 54% stake, with Altana holding a 33.3% share and SKion the remaining 12.7%.

Quick News Corner:

Clover Health Investments, Corp. (CLOV: $8.73) Announces Extension of Redemption Date for Outstanding Warrants to September 9th

Rocket Lab USA (RKLB: $10.43) completes business combination with Vector Acquisition Corporation (VACQ). The company started trading today as RKLB.

Rocket Lab has received $777M in proceeds before transaction expenses

Good Works Acquisition Corp. (GWAC: $10.02) shareholders approve merger with Cipher Mining with closing expected on the 26th with ticker change to CIFR on the 27th

12,836,682 redemptions (~76% of public shares) resulting in ~$128M removed from the trust

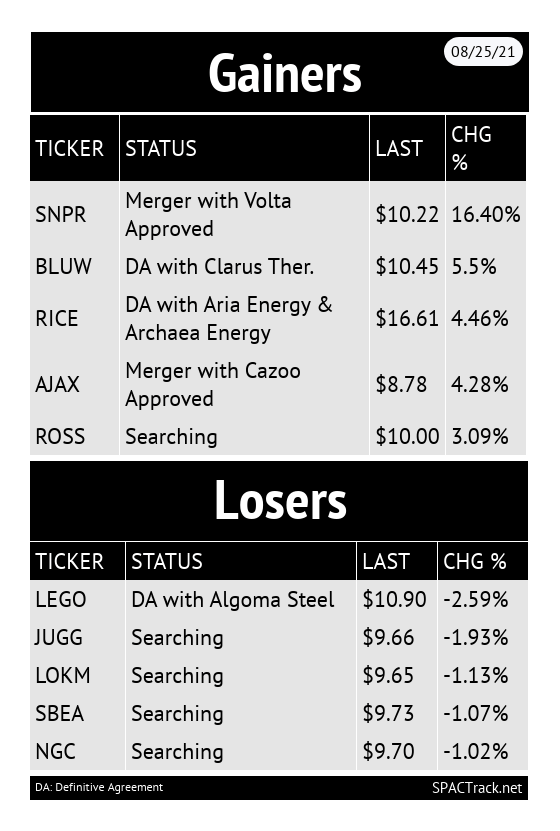

Tortoise Acquisition Corp. II (SNPR: $10.22) shareholders approve merger with Volta with closing expected on the 26th and ticker change to VLTA on the 27th

24,222,287 redemptions (~70% of public shares) resulting in ~$242M removed from the trust

Mountain Crest Acquisition Corp. II’s (MCAD: $9.96) merger partner, Better Therapeutics, Secures $50 Million Debt Facility From Hercules Capital

SPACs are Not Investment Companies (White & Case)

Tracking De-SPAC S-1s:

S-1s that went effective today:

Owlet (OWLT: $6.55 -27.38%)

Wheels Up Experience (UP: $6.97 -11.99%)

Lucid Motors (LCID: $21.81 -4.47%) — PIPE unlock is set for 9/1

Katapult (KPLT: $3.63) filed its S-1/A

IPOs to Begin Trading Tomorrow (2)*:

1) Springwater Special Situations Corp. (SWSS-U) Announces Pricing of $150M IPO

2) Cascadia Acquisition Corp. (CCAI-U) Announces Pricing of $150M IPO

*Priced at the time of this writing

New S-1s:

None today.

Upcoming Dates:

This Week’s Announced Shareholder Meetings, Unit Splits, Warrant Redemptions

Thurs, August 26

Merger Meeting: LGL Systems Acquisition Corp (DFNS: $10.13) & IronNet

Fri, August 27

Merger Meetings: Blue Water Acquisition Corp. (BLUW: $10.45) & Clarus TherapeuticsTWC Tech Holdings II Corp (TWCT: $10.04) & Cellebrite

Thanks for reading,