Good evening,

Quick reminder: The weekly newsletter summarizes key market events—IPOs, fundraising, M&A, activist campaigns, and more. This Free edition offers condensed highlights, while the Pro edition—an added benefit for ListingTrack Pro subscribers—includes complete coverage, deeper context, and direct source links in addition to the premium data and advanced features on ListingTrack.io.

We note which companies are excluded from any sections with limited news or coverage in this Free version. Additionally, the “…” next to a bullet means there's more detail available in the Pro version—clicking it will take you to the upgrade page.

Save 20% on ListingTrack Pro plans with the promo code ‘RECAP20’. Last week we launched a new feature for Pro users: Dark Mode is now live!

Enjoy this week's recap!

Theme News Coverage

Tariffs/ Trade War

After the Nasdaq’s worst week since 2020, markets rebounded hard. Trump paused tariffs (excluding China), and stocks responded with historic gains.

Key numbers from the week:

S&P 500: +5.70% (previous week: -9.08%)

Nasdaq: +7.29% (previous week: -10.02%)

VIX: -17.11% (after +109% the week before)

10Y Treasury yield: +12.81% — the sharpest rise since 2001

We put together a comprehensive recap of one of the most volatile trading weeks in years—complete with daily performance, market records, policy shifts, and emerging risks. Read the full Weekly Trade War Recap.

See more: Tariff tracker: our page covering Trade War & Tariff news and the US companies most at risk

AI

(1 additional update: GOOG)

Space & Defense

President Trump announced plans for a forthcoming defense budget “in the vicinity” of $1 trillion, marking what would be the first-ever trillion-dollar allocation for the Pentagon. …

Additionally, President Trump signed an executive order initiating a comprehensive review of the Pentagon’s weapons acquisition programs, targeting those exceeding cost or schedule benchmarks by more than 15% for potential cancellation. …

See more: New Space theme page; NextGen Defense theme page

IPOs & Other Initial Public Listings

IPO/ Listing Action

Past week

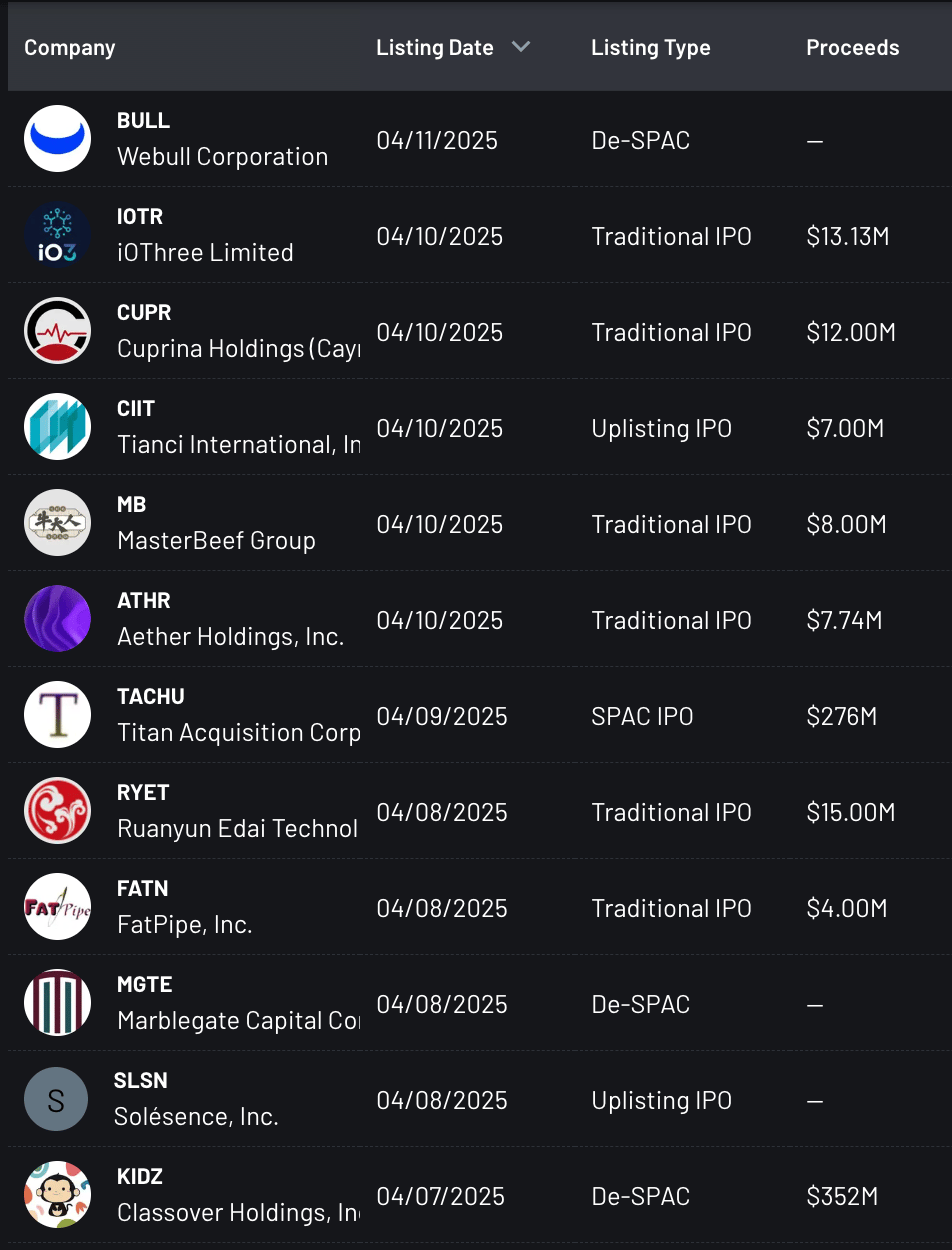

See more: Latest Listings

Prominent Listings

Expected Listings

Airo Group (Pre-listing: AIRO), a U.S.-based aerospace and defense technology company focused on urban air mobility and drones, is seeking to raise up to $80 million in its IPO by offering 5 million shares priced between $14 and $16. …

Chinese tea chain Chagee Holdings (Pre-listing: CHA) is proceeding with a U.S. IPO to raise up to $411 million by offering 14.68 million ADS at $26–$28 each, targeting a valuation of approximately $3.3 billion. …

See more: Upcoming Listings

Listing Plans Rumors

See more: Listing Plans & Rumors

IPO Market Commentary & Post-IPO Coverage

Silicon Valley’s long-anticipated IPO pipeline has stalled amid global market turmoil triggered by President Donald Trump’s sweeping tariff announcements. Key IPO candidates like StubHub, Klarna, and eToro have paused their listing plans, with some unlikely to proceed in 2025. …

IPO Candidates

See more: IPO Candidates

Series C+ and Prominent Fundraising

AI, Autonomous, Drones

Mira Murati, former CTO of OpenAI, is reportedly raising over $2 billion in venture funding for her new AI startup, Thinking Machines Lab, doubling the $1 billion target reported two months prior. The valuation being sought is at least $10 billion. …

Rescale, a digital engineering platform focused on advanced computing and AI for R&D, raised $115 million in Series D funding, bringing total funding to over $260 million. …

BRINC, a U.S.-based emergency response drone manufacturer, raised $75 million in a new funding round led by Index Ventures, with participation from Motorola Solutions (forming a strategic alliance), Mike Volpi, and Figma CEO Dylan Field. …

Autonomous driving company Nuro has raised $106M to date in its ongoing Series E round, valuing the firm at $6B. …

Energy

Texas-based residential battery startup Base Power Inc. has raised $200M in Series B funding to support national expansion and the construction of its first manufacturing facility in Texas. The round was led by Addition LP (Lee Fixel) and included Andreessen Horowitz, Lightspeed Venture Partners, Thrive Capital, Valor Equity Partners, Altimeter, and others. …

Cybersecurity / Enterprise Software

AI-driven staffing platform Jobandtalent raised €92 million ($103 million) in a Series F round at a post-money valuation of €1.3 billion ($1.5 billion), down from $2.35 billion in its 2021 Series E. …

Toronto-based security startup Tailscale has raised $160M in a new funding round led by Accel, with participation from CRV, Insight Partners, Heavybit, Uncork Capital, and CrowdStrike CEO George Kurtz. …

Healthcare

Caris Life Sciences raised $168 million in a growth capital round led by existing investor Braidwell LP, with participation from new investors Perceptive Advisors, Woodline, and Ghisallo, as well as existing backers Millennium Management and First Light Asset Management. …

Featured ListingTrack Tool

Tariff Tracker

After last Wednesday’s tariff announcement from the Trump administration, markets saw one of the steepest selloffs since the COVID crash—marking one of the most volatile weeks in recent memory. This week the market bounced back aggressively in one of the market’s most volatile weeks on record.

To help investors navigate these developments, we launched the Tariff Tracker on ListingTrack: 🔗 listingtrack.io/theme/tariffs

The Tracker offers a curated overview of the sectors and companies most affected by tariff shifts, with filters to drill down by industry and country of import exposure. It includes:

Summarized, curated tariff news

Deal activity and earnings updates for impacted companies

Sector and country-level filtering for focused discovery

We’re actively updating it as new developments unfold. Take a look and let us know what you think.

Screenshot of our Tariff tracker theme page

Public M&A

Merger Announcements

See more: Active M&A

Closings

Expected Closings

(1 additional update: GOOG)

See more: Closed M&A

Live Deal Coverage and Updates

President Donald Trump ordered a new review of Nippon Steel’s proposed $14.1 billion acquisition of US Steel (X), reopening a deal previously blocked by the Biden administration on national security grounds. … Deal Page

Potential M&A News

(3 additional updates: ConnectM, PureTech Health, Keros Therapeutics)

See more: Potential M&A

Post-M&A Coverage

Elon Musk failed to appear for a scheduled deposition on April 3, 2025, related to an investor lawsuit alleging his 2022 bid to acquire Twitter (X Corp. (fka Twitter) - acquired by XAi) was intended to manipulate the stock price. …

Prominent Private Deals (private targets, including public subsidiaries)

TikTok US Updates

President Donald Trump confirmed that a potential deal to spin off

TikTok’s U.S. operations remains under consideration, following a brief pause. …

Announcements/ Closings

A group led by Ari Emanuel and backed by Apollo Global Management and RedBird Capital Partners has won the auction to acquire Endeavor’s tennis assets, including the Miami Open and Madrid Open, for more than $1 billion. …

Live Deal Coverage

DSV has received EU antitrust clearance for its €14.3 billion ($15.8 billion) acquisition of Schenker, the logistics arm of Deutsche Bahn. …

SC Capital Partners, backed by CapitaLand Investment, has emerged as the sole potential bidder for British data center operator Global Switch, according to Reuters sources. …

Activism, Shorts, & Other Special Situations

Bankruptcies/ Delistings

Gritstone bio (OTC: GRTSQ) shares were canceled worthless as its bankruptcy became effective.

(8 additional updates: Marin Software, Vincerx Pharma, First Financial Northwest, Mondee Holdings, Nxu, ClimateRock, Global Lights, Metal Sky Star)

Thanks for reading,

The team at ListingTrack

If you found this summary helpful, consider sharing the newsletter with a friend or colleague!

Market Data and Coverage: All market data presented is based on the stock prices at the close of the previous trading day. We cover the US market only at this time.

Abbreviations: PR: Press Release, SF: Company SEC filing, IP: Investor Presentation, BB: Bloomberg.

DISCLAIMER: The information provided in this newsletter is for your convenience only and is not intended to be treated as financial, investment, tax, or other advice. ListingTrack and its parent, CommonFi, do not make any guarantees, representations, or warranties as to, and shall have no liability for, the timeliness, truthfulness, sequence, quality, completeness, or accuracy of any of the information or data provided in this newsletter or on the ListingTrack website.