Good evening,

Today, we honor those who gave their lives in service to our country.

Per reader feedback we have adjusted this newsletter to be structured by industry and much more concise to give you the full view and then move on with your day! Let us know what you think.

Pro users are able to see any of these stories in full detail along with source links, on our News page. There you can view all our curated updates broken out by news type: Listing (Public listings + Pre-IPO activity), Mergers (including private deals), Situations (activism, bankruptcies, delistings, separations, and more), and SPAC.

Read this newsletter on your browser here.

Tariffs/ Trade War

Read our comprehensive Weekly Trade War Round-Up. Summary below.

Apple and U.S. banks were hit as Trump threatened new tariffs, Moody’s downgraded the financial sector, and bond markets buckled under the weight of deficits and inflation risk. Markets reversed sharply this week as investor focus shifted back to rising long-term yields, elevated tariffs, and a wave of credit downgrades.

Weekly Market Performance (May 16 close):

S&P 500: -2.61% (5802.82), YTD: -1.34%

Nasdaq Composite: -2.47% (18737.21), YTD: -2.97%

Dow Jones: -2.47% (41603.07), YTD: -2.21%

Russell 2000: -3.47% (2039.85), YTD: -8.53%

VIX: +29.29% (22.29), YTD: +28.47%

10Y Treasury Yield: +1.58% (4.51), YTD: -1.38%

Gold: -0.56% (3346.80), YTD: +26.72%

See more: Tariff tracker: our page covering Trade War & Tariff news and the US companies most at risk

IPOs & Other Public Listing Recap

IPO/ Listing Action

Past week

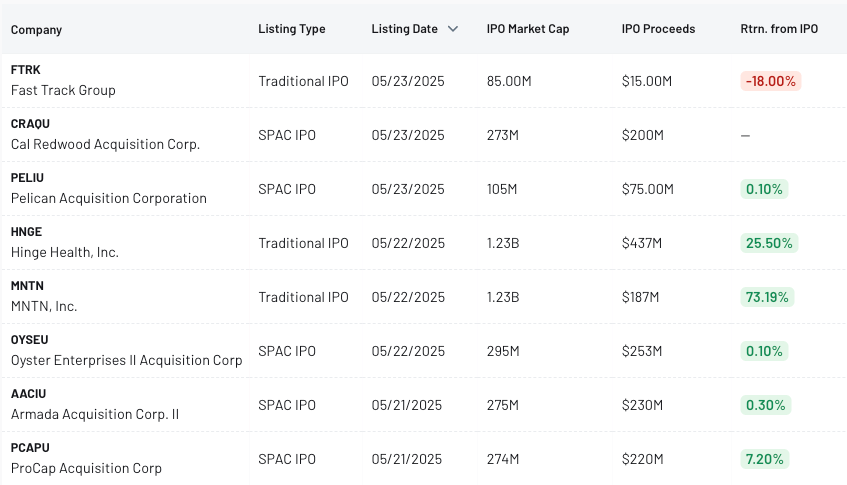

Last week, there were 8 public listings

3 Traditional IPOs featuring 2 over $1 billion market cap with strong showings: MNTN (MNTN) +73.2% and Hinge Health +25.5%

5 SPAC IPOs with top gainer ProCap Acquisition (PCAPU) at +7.2%

See more: Latest Listings

Expected Listings

See more: Upcoming Listings

AI, Robotics, Quantum

Live Coverage: Core AI & Infrastructure theme page, Next Wave AI theme page

Prominent Private/ Non-US Listed M&A:

OpenAI to acquire io Products, the AI hardware firm co-founded by Jony Ive, in a $6.5B all-stock deal, bringing 55 engineers into its new consumer hardware division.

Pre-IPO Financings (Series C+ and Prominent):

Abridge AI reportedly in talks to raise at $5B valuation for its healthcare transcription platform.

Crusoe Energy secured $11.6B in additional funding to expand OpenAI’s largest data center in Texas.

Gravitee raised $60M Series C for API and event stream AI infrastructure; led by Sixth Street Growth.

Humanoid robotics startup Beyond Imagination raised $100 million in Series B funding, valuing the company at $500 million.

Other Situations / Industry Activity / Commentary:

Nvidia’s Jensen Huang called U.S. export controls a "failure" and blamed them for lost China market share.

Intel exploring divestiture of network and edge business to refocus on core chip segments.

Crusoe Energy secured $11.6B in additional funding to expand OpenAI’s largest data center in Texas.

AMD will divest the server-manufacturing operations of ZT Systems (the AI infrastructure company it acquired in March) to Sanmina in a $3 billion transaction.

Google unveiled “Google AI Ultra,” a $249.99-per-month subscription service offering access to the company’s most advanced AI models, early experimental features, and 30 terabytes of storage.

President Trump signed executive orders to streamline U.S. nuclear licensing and boost uranium output to meet AI-driven power demand.

Aerospace & Defense

Live Coverage: New Space theme page; NextGen Defense theme page

Public M&A:

Engineered aerospace components firm Servotronics (SVT) to be acquired by TransDigm for $110M, or $38.50/share.

SatixFy Communications (SATX) shareholders approved all-cash acquisition by MDA Space.

Motorola (MSI) in talks to acquire Silvus Technologies, an electronics maker for military and law enforcement, for $4.5B.

Prominent Private/ Non-US Listed M&A:

Leonardo DRS (DRS) is nearing the acquisition of an unnamed U.S. predictive analytics firm to enhance AI capabilities in defense operations.

Other Situations / Industry Activity / Commentary:

Short seller Culper Research targeted eVTOL Archer Aviation (ACHR) with a critical report.

Logistics, Transportation, Autos

Live Coverage: Logistics theme page

Listings - Launches/ Plans / Rumors:

Einride, a Swedish autonomous truck firm, appointed new CEO as part of IPO prep.

Public M&A:

E2open (ETWO) to be acquired by WiseTech Global for $2.1B in all-cash deal.

Prominent Private/ Non-US Listed M&A:

Stord to acquire Ware2Go from UPS to expand e-commerce logistics capabilities.

Toyota Motor (TM) reportedly preparing to acquire Toyota Industries via tender offer.

Other Situations / Industry Activity / Commentary:

FedEx (FDX) announced leadership and governance changes ahead of LTL spin-off, FedEx Freight, in 2026.

Pitney Bowes (PBI) appointed Kurt Wolf as CEO and launched strategic review.

Bankruptcies / Delistings:

Electric motorcycle maker Damon Inc. (DMNIF) and Zapp Electric Vehicles (ZAPPF) delisted to OTC.

Assisted driving software firm LeddarTech (LDTC) is exploring strategic options after layoffs and financial stress.

Electric bus maker Lion Electric (LEVGQ) restructured via Quebec court-approved reverse vesting.

Energy, Materials, Industrials, Electronics

Public M&A:

TXNM Energy (TXNM) to be acquired by Blackstone Infrastructure for $11.5B; $61.25/share.

SigmaTron (SGMA) to be acquired by Transom Capital for $83M or $3.02/share.

Other Situations / Industry Activity / Commentary:

Nippon Steel proposed a $14 billion investment in U.S. Steel (X) operations to secure approval for its $15 billion acquisition; the U.S. Steelworkers called on Trump to block the deal. CFIUS split on recommending approval of Nippon Steel’s bid, though Trump ultimately endorsed and approved it, touting 70,000 jobs.

President Trump signed executive orders to streamline U.S. nuclear licensing and boost uranium output to meet AI-driven power demand.

Phillips 66 (PSX) proxy battle sees partial win with Elliott nominees elected.

Qorvo (QRVO) settled activist pressure with Starboard by adding Peter Feld to board.

Mexican President Sheinbaum urged removal of U.S. steel/aluminum tariffs in a call with Trump, while noting FDI rose 5.4% in Q1 2025 despite recession fears.

Bankruptcies / Delistings:

Vast Renewables (VSTE) delisted to OTC.

Healthcare

Listings - Launches/ Plans / Rumors:

Hinge Health (HNGE) priced its $437 million IPO at $32/share (62% primary), valuing it at $2.6 billion.

Phytanix Bio will reverse-merge with Protagenic (PTIX) to form Phytanix Inc., with 65%/35% share split.

Public M&A:

Vigil Neuroscience (VIGL) will be acquired by Sanofi (SNY) for up to $600 million—$8.00/share upfront plus $2.00 CVR—closing Q3 2025.

Acelyrin (SLRN) and Alumis (ALMS) completed their merger

OptiNose (OPTN) merger approved and Paratek closed its $90.5 million acquisition of OptiNose.

Akoya Biosciences, Inc. (NASDAQ: AKYA) received an unsolicited all-cash acquisition proposal offering $1.40 per share, which its board is now reviewing alongside its previously announced merger with Quanterix.

Quipt Home Medical Corp. (QIPT) confirmed receipt of a non-binding unsolicited proposal from Forager Capital Management to acquire the company at $3.10 per share.

Other Situations / Industry Activity / Commentary:

Medtronic (MDT) announced plans to spin off its Diabetes business into a standalone IPO-focused entity within 18 months.

Bankruptcies / Delistings:

23andMe (MEHCQ) will sell assets to Regeneron (REGN) for $256 million in an auction under Chapter 11, closing Q3 2025 after a June 17 hearing.

Affimed (AFMDQ) and Petros Pharmaceuticals (PTPI) were delisted and moved OTC.

Fintech & Financial Services, Insurance, Real Estate

Listings - Launches/ Plans / Rumors:

Armada Acquisition Corp. II (AACIU), a fintech and AI-focused SPAC, priced a $200M IPO. Lead UW: Cohen & Co.

OFA Group (OFAL), an architectural design firm, priced $15M IPO at $4/share; est. market cap: $53.4M.

President Trump said he is giving “very serious consideration” to taking Fannie Mae and Freddie Mac public after more than 16 years under government conservatorship.

Public M&A:

Clearlake Capital has secured $5.5 billion in private credit financing to support its acquisition of Dun & Bradstreet (DNB), one of the largest private debt financings on record.

Douglas Elliman (DOUG), a luxury real estate brokerage, received $4/share takeover offer from Anywhere Real Estate.

Global Blue (GB) extended Shift4’s (FOUR) $GB tender offer to June 5; 96.66% of shares tendered.

REIT Paramount Group (PGRE) launched strategic review with BofA.

United Homes Group (UHG) formed special committee to review sale or refinancing.

Star Equity Holdings (Nasdaq: STRR; STRRP) and Hudson Global (Nasdaq: HSON) announced a definitive merger agreement under which Star will merge with a wholly owned subsidiary of Hudson in a stock-for-stock transaction.

Pre-IPO Financings (Series C+ and Prominent):

Airwallex raised $300 million in Series F at a $6.2 billion valuation with investors including Square Peg and Salesforce Ventures.

Acrisure, a digital insurance and services firm, raised $2.1B at a $32B valuation.

Other Situations / Industry Activity / Commentary:

Klarna (Klarna) reported Q1 2025 net loss of $99 million amid rising delinquencies; paused NY IPO.

Moody’s downgraded long-term ratings for major American banks including JPMorgan Chase, Bank of America, and Wells Fargo from Aa1 to Aa2, following its recent downgrade of the U.S. sovereign credit rating.

Short seller J Capital Research published a report targeting credit card processor Marqeta (MQ).

Bankruptcies / Delistings:

AppTech (APCX) delisted to OTC.

Crypto

Listings - Launches/ Plans / Rumors:

Anthony Pompliano’s SPAC ProCap Acquisition (PCAPU) priced its $220M IPO.

KindlyMD (NAKA) changed tickers from KDLY/KDLYW to NAKA/NAKAW ahead of merger with bitcoin treasury firm Nakamoto Holdings; shareholders approved the deal to close Q3 2025.

Prominent Private/ Non-US Listed M&A:

Circle (CRCL) has held informal talks with Coinbase and Ripple for sale at a $5 billion target valuation despite its IPO filing.

Enterprise Software & Services, Cybersecurity

Public M&A:

Data management software firm Informatica (INFA) is in renewed acquisition talks with Salesforce; market cap ~$6.8 billion.

HireQuest (HQI) criticized TrueBlue’s (TBI) rejection of its $7.50 takeover proposal.

Pre-IPO Financings (Series C+ and Prominent):

Acrisure (Acrisure) raised $2.1 billion in convertible preferred at $32 billion valuation (led by Bain).

Awardco (Awardco) closed $165 million Series B at unicorn valuation.

RevenueCat (RevenueCat) extended Series C by $50 million to $100 million total.

Other Situations / Industry Activity / Commentary:

Victoria’s Secret (VSCO) enacted a poison pill after BBRC’s 13% stake increase.

Bankruptcies / Delistings:

iCoreConnect (ICCT) delisted and began OTC trading.

Consumer & Retail

Listings - Launches/ Plans / Rumors:

Entertainment event management company Fast Track Group (FTRK) priced $15 million IPO at $4/share.

Public M&A:

Nordstrom (JWN) sold to Nordstrom family & Liverpool (LIVEPOL) at $24.25/share and stub dividend; NYSE delisting May 21.

Prominent Private/ Non-US Listed M&A:

PepsiCo (PEP) completed acquisition of Poppia for $1.95 billion (net $1.65 billion + earnout).

Pre-IPO Financings (Series C+ and Prominent):

Strava raised a new round at $2.2 billion valuation led by Sequoia.

Other Situations / Industry Activity / Commentary:

Kraft Heinz (KHC) reviewing strategic options; Berkshire Hathaway board seats cut.

Apple faces potential 25%+ tariff on non-U.S. iPhones starting end of June—Trump directive.

Global retailers, including Birkenstock and Pandora, are weighing strategies to offset the cost of newly imposed U.S. tariffs by spreading price increases across international markets.

Bankruptcies / Delistings:

Benson Hill (BHIL) sale approved as exit from Chapter 11 to Confluence Genetics.

Media, Telecom

Listings - Launches/ Plans / Rumors:

AdTech MNTN (MNTN), backed by Ryan Reynolds, raised a $187.2 million IPO at $16/share (72% primary).

Prominent Private/ Non-US Listed M&A:

OnlyFans’ Fenix International in talks to sell at ~$8 billion or pursue IPO; generated $6.6 billion revenue in 2023.

Thanks for reading,

The team at ListingTrack

Market Data and Coverage: All market data presented is based on the stock prices at the close of the previous trading day. We cover the US market only at this time.

DISCLAIMER: The information provided in this newsletter is for your convenience only and is not intended to be treated as financial, investment, tax, or other advice. ListingTrack and its parent, CommonFi, do not make any guarantees, representations, or warranties as to, and shall have no liability for, the timeliness, truthfulness, sequence, quality, completeness, or accuracy of any of the information or data provided in this newsletter or on the ListingTrack website.