Discover and track all of the SPACs at spactrack.net.

Tonight’s newsletter is sponsored by I-OnAsia.

Get accurate and reliable cross-border background checks completed quickly. De-SPAC due diligence from the deep-dive specialist for the APAC region. Red Flag checks of strategic, political, operational, and team-specific risks on Asia companies.

The Stats:

If you haven’t subscribed to this Free nightly newsletter, you can do so below.

The Deals (1):

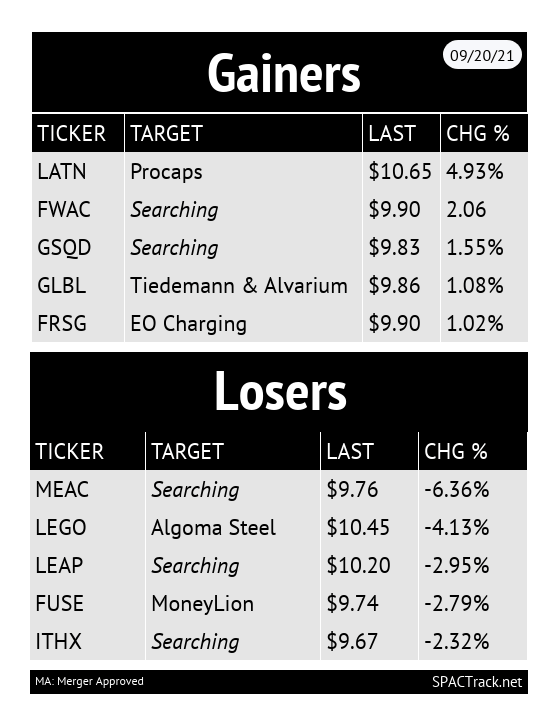

1) Cartesian Growth Corp (GLBL, warrants +25.37%) & Tiedemann Group and Alvarium Investments

Merger Partner Description:Alvarium Investments:Alvarium is an independent investment firm, global multi-family office and merchant banking boutique providing tailored solutions for families, foundations and institutions across the Americas, Europe and Asia-Pacific. Alvarium offers direct and co-investment opportunities from specialist alternative managers and real asset operating partners in real estate and the innovation economy. Alvarium has over 220 employees and 28 Partners in 14 locations in 10 countries, advising on circa $22 billion of assets across four service lines — investment advisory, co-investments, merchant banking and family office services. Tiedemann Advisors: Tiedemann Advisors is an independent investment and wealth advisor for high-net-worth individuals, family offices, trusts, foundations and endowments. Founded in 1999, Tiedemann Advisors has nine offices across the US and provides trust services through Tiedemann Trust Company, a state-chartered trust company located in Wilmington, Delaware. Tiedemann’s international operations, Tiedemann Constantia, is headquartered in Zurich Switzerland. Together, Tiedemann Constantia, Tiedemann Advisors and Tiedemann Trust Company currently oversee $25 billion in assets under advisement.

Valuation: $1.087B EV

PIPE: $165M

News:

Two years after its IPO fail, WeWork will go public (The Real Deal)

WeWork announced Monday that its merger with a special purpose acquisition company, floated in January and announced in March, will be completed a month from now.

The news, like the announcement six months ago about its SPAC merger, comes with far less fanfare and controversy than WeWork’s initial bid to become a public company. Two years ago, under then-CEO and co-founder Adam Neumann, the firm prompted a business drama of the first order by unveiling plans for an IPO and then nearly collapsing in the span of a few months.

The firm’s rise to a $47 billion valuation (by its star-struck private investors, in any case) on the charismatic Neumann’s promise of revolutionizing office work with shared spaces, followed by a stunning fall, prompted books, a documentary and thousands of stories that evolved from breathless to smug.

When the smoke cleared, the self-dealing and swashbuckling Neumann had been bought out for an ungodly sum by chastened main investor SoftBank and replaced by Sandeep Mathrani, who set about stabilizing the once high-flying firm before it burned bridges the way it had burned cash. Still, it lost about $3 billion last year and would have ceased to exist if SoftBank had not bailed out its wayward son with cash infusions.

Given the mess he inherited — and the onset of the worst pandemic since the Spanish flu a century ago — the turnaround under Mathrani has gone as well as the company could have expected.

To go public, WeWork will merge with BowX Acquisition Corp (BOWX). The special purpose acquisition company was formed by the venture fund Bow Capital’s management team, including Vivek Ranadivé and Murray Rode. BowX stockholders will meet Oct. 19 to approve the merger.

Universal Music valued around $39 billion ahead of stock market debut (Reuters)

Several high-profile investors have also already snapped up large Universal stakes, banking in part on the group’s back catalogue, which includes the likes of Bob Dylan and the Beatles. They also hope deals with ad-supported software and social media platforms such as Alphabet Inc’s YouTube and TikTok will sustain its performance and valuation.

U.S. billionaire William Ackman suffered a setback when his attempt to invest in Universal via a special purpose acquisition vehicle (SPAC) [Pershing Square Tontine Holdings, Ltd. (PSTH)] hit a snag with regulators and investors. However, Ackman still got a 10% stake via his Pershing Square hedge fund. China’s Tencent owns 20% of Universal.

One winner in the listing will be Vincent Bollore, the French media tycoon who is Vivendi’s controlling shareholder. He will receive Universal shares worth 6 billion euros at Monday’s price.

Bollore has been an aggressive consolidator in France’s media and publishing landscape, and he has a long-held ambition to build up a southern European media powerhouse.

Vivendi itself may suffer in the short run, however, and shares are expected to fall Tuesday as they begin trading without Universal.

Virgin Orbit Enters AI Software Agreement with BigBear (Via Satellite)

Commercial launch service provider Virgin Orbit [merger partner of NextGen Acquisition Corp. II (NGCA)] will now be able to provide AI-powered insights and data to its government and commercial customers under the terms of a new software agreement the company reached with BigBear.ai (BigBear) [merger partner of GigCapital4, Inc. (GIG)].

BigBear operationalizes artificial intelligence and machine learning at scale through its end-to-end data analytics platform, Decision Dominance. Its customers include the U.S. intelligence community, the U.S. Department of Defense, and various other the U.S. federal government agencies.

The AI software company announced is new contract with Virgin Orbit on Sept. 17 and said it has already begun working to support Virgin Orbit and its customers through the real-time deployment of AI-powered software for mobile assets in the field. BigBear is also developing applications that can identify objects, analyze ground material, map land and monitor climate in space, and fuse data from multiple intelligence data sources, including the satellites launched by – and, in some cases, owned by – Virgin Orbit.

“By combining our launch capability, satellite constellation partners, and the unparalleled technology of BigBear.ai, we can give the end-users of space systems the means to interpret rich data, identify changes, make well-informed decisions quickly, and to take action,” Virgin Orbit President and CEO Dan Hart said in a statement. “The powerful combination of rapid launch, low-cost satellite technology, and powerful AI is hugely impactful, and allows us to transform capabilities that have been dreamed about for decades into a practical and achievable reality for our civil, national security, and commercial customers.”

Tracking De-SPAC S-1s (PIPE Registrations):

Airspan Networks (MIMO: $9.25 +2.78%) filed its 424B3 (meaning S-1 is likely to go effective tomorrow)

IPOs to Begin Trading Tomorrow:

1) HHG Capital Corporation Prices $50 Million Initial Public Offering (HHGC-U)

*Priced at the time of this writing

New S-1s:

None today.

Upcoming Dates:

This Week’s Announced Shareholder Meetings, Unit Splits, Warrant Redemptions, and Expected Ticker Changes

Tues, Sep 21

Merger Meeting: Fusion Acquisition (FUSE) & MoneyLion

Expected Ticker Change: TPG Pace Tech Opportunities (PACE) → Nerdy (NRDY)

Wed, Sep 22

Merger Meetings:Union Acquisition Corp II (LATN) & ProcapsCerberus Telecom Acquisition Corp (CTAC) & KORE

Fri, Sep 24

Unit Split: AMCI Acquisition Corp. II (AMCI-U)

Thanks for reading,