Good morning!

If you were forwarded this report or chanced upon it online, welcome! Hit the subscribe button at the top to get this report directly in your inbox.

There’s a lot of activity to cover each week, so for the best viewing experience, you can read the report on your browser here!

Here's what we're covering this week:

New Listing Action --- Ingram Micro expected to make its market debut, Everus Construction spinoff, and Nebius (fka Yandex) to resume trading.

New IPO Filings --- Autonomous driving startup Pony AI leads the pack of new filings.

Listing Plans and Rumors --- Holcim is considering a dual listing for its US unit and Trustly seeks a US IPO.

IPO Candidate News & Raises --- Klarna teams up with Elliott and SandboxAQ is looking to raise at a valuation above $5 billion

Public M&A --- Zuora going private, a PE team-up for Bausch + Lomb, and more regulatory headaches for Novo Nordisk.

Activism, Shorts, & Other Special Situations --- Elliott initiates a proxy fight with Southwest and Jana Partners pushes for Lamb Weston to consider a sale.

IPOs & Other Initial Public Listings

New IPO/ Listing Action

Hit the Market Last Week — 6 new listings

Reverse mergers:

Triller Corp ($ILLR, -36% from listing) — formed from a reverse merger with AGBA Group (Fmr: AGBA)

TuHURA Biosciences ($HURA, -2.2% from listing) — formed from a reverse merger with Kintara Therapeutics (Fmr: KTRA)

Small-Cap IPOs:

Samfine Creation ($SFHG, +124% from IPO)

PTL Limited ($PTLE, +12.5% from IPO)

Springview Holdings ($SPHL, +4% from IPO)

Oriental Rise Holdings ($ORIS, +94% from IPO)

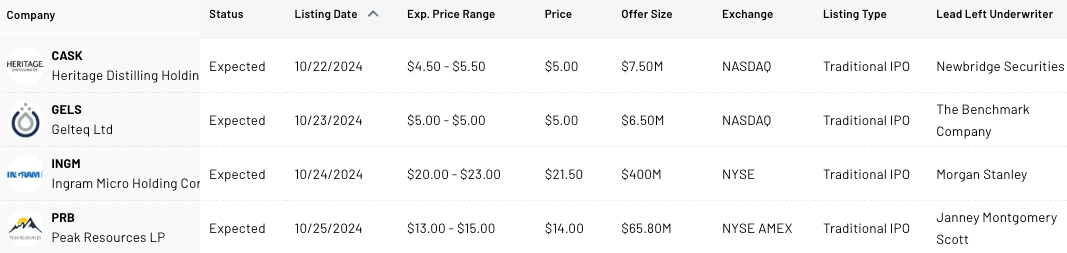

Expected this week

Mid-Cap IPOs:

Ingram Micro (INGM) — a cloud services distributor and Platinum Equity portfolio company.

Spinoffs:

Everus Construction Group (ECG) — a spinoff of MDU Resources Group’s ($MDU) construction services business.

Small-Cap IPOs:

Bonus:

Nebius Group ($NBIS), formerly Yandex, is set to resume trading on Nasdaq today, Oct 21. Once valued at $31 billion, Yandex was halted in Feb 2022 following Russia's invasion of Ukraine. In July, it sold its Russian assets for $5.4 billion to a Russian consortium and pivoted to focus on Nebius AI, Yandex’s Finnish data center and AI cloud unit. Now based in the Netherlands, Nebius’ core business will be AI infrastructure services. — PR / IP / TechCrunch

IPO/ Listing Plans, Rumors, and Other News

Plans/ Rumors

Holcim US: Holcim Considers Dual Listing of $30 Billion US Business — BB

Environment groups call on Holcim to cut carbon footprint ahead of US spinoff — Reuters

Trustly: PE firm Nordic Capital is exploring options for Trustly, a Swedish digital payments company it owns, including a sale or an IPO. If it opts for an IPO it would likely list Trustly in the US. — BB

Wiz: After rejecting Google takeover, cyber firm Wiz says it will IPO ‘when the stars align’ — CNBC

Scilex Pharmaceuticals (Scilex subsidiary): Scilex Holding Company ($SCLX) announced that it might pursue a spinoff of its subsidiary Scilex Pharma, a maker of non-opioid management products. — PR

See the list of Planned IPOs and Rumored IPOs // See the SPAC Hub for all our SPAC coverage

IPO Market Commentary & Post-IPO News

PE firms push forward with IPOs:

Two brothers who were investors in Digital World Acquisition Corp, the SPAC that took Trump MTG ($DJT) public, were sentenced to 22 months and 28 months in prison by NY federal court. — BB

IPO Candidate News

Planned/ Rumored IPOs — Major Corporate News

Klarna will offload £30 billion of buy-now, pay-later loans to the hedge fund Elliot Investment Management as it looks for ways to free up capital ahead of its public debut. — BB

Prominent Startup News

SpaceX Sues California Regulator, Alleging Political Bias Over Rocket Launches — WSJ

OpenAI and Microsoft have hired Goldman and Morgan Stanley, respectively, to advise them on how much equity Microsoft should get for its $14 billion investment in OpenAI after it converts from a non-profit to a for-profit corporation. — WSJ

Northvolt: Goldman Sachs Unit in Talks to Join Northvolt Rescue Effort — BB

Equity Raises

Prominent Startups, Series D+, and Private Equity Rounds:

SandboxAQ, an AI and quantum physics startup spun out from Google, is seeking a new equity raise that could value it at over $5 billion. — BB

Perplexity, an AI search chatbot, is looking to raise around $500M in a round that could double its valuation to $8 billion. — WSJ

Group One, the owner of the MMA brand and UFC rival, One Championship, raised at least $50M from investors, including Qatar Investment Authority, at a $1.35 billion valuation. — BB

Oshi Health, a virtual digestive care company, raised a $60M Series C led by Oak HC/FT with participation from existing investors, including Bessemer Venture Partners and CVS Health Ventures. — PR

X-Energy, a small modular nuclear reactor startup, raised a $500M Series C-1 from investors, including Amazon’s Climate Pledge Fund, Ken Griffin (Citadel CEO), and Ares Management. — PR

Capacity, a customer support automation platform, raised a $26M Series D. — PR

Lightmatter, an AI infrastructure startup, raised a $400M Series D at a $4.4 billion valuation from investors including Google Ventures, T. Rowe Price, and Fidelity. — PR

DataBank, a data center operator that was acquired by DigitalBridge in 2016, raised $2 billion, of which $1.5 billion was committed by AustralianSuper. — PR

Path Robotics, a welding robotics firm, raised a $100M Series D from investors including Tiger Global and Yamaha Ventures. — PR

See our list of IPO Candidates and the most recent prominent rounds here.

Public M&A

Public M&A Activity

Definitive Announcements (Live definitive deals in blue highlight)

Longboard Pharmaceuticals ($LBPH) + Lundbeck: Longboard, a clinical-stage biotech focused on neurological diseases, will be acquired by Lundbeck, a Danish neuroscience pharmaceutical company. — PR / Reuters

Terms: All-cash deal at $60.00 per share (54% premium to the closing price before the announcement) or a total equity value of appx. $2.6 billion.

Zuora ($ZUO) + Silver Lake & GIC: Zuora, a provider of monetization software for subscription-based businesses, will be acquired by PE firm Silver Lake and GIC, Singapore’s sovereign wealth fund. — PR

Terms: All-cash deal at $10.00 per share (6.16% premium to prev. closing price), or a total enterprise value of appx. $1.7 billion.

Universal Stainless ($USAP) + Aperam: Universal Stainless, a U.S. manufacturer of specialty and stainless steel products for aerospace, will be acquired by Aperam, a Luxembourg-based global player in stainless, electrical and specialty steel and recycling. — PR

Terms: All-cash deal at $45.00 per share (3.62% premium to the closing price prior to announcement), or a total enterprise value of appx. $539M.

Merger Closings

Squarespace (SQSP): Permira closed its acquisition of Squarespace for $46.50 per share in cash or $6.4 billion. — PR

Upcoming Expected Closings

Sharecare ($SHCR) + Altaris: The acquisition of Sharecare is expected to close prior to market open on Tuesday, Oct 22.

Active M&A Deal Updates

Catalent ($CTLT) + Novo Nordisk:

Catalent announced it is selling its oral solids development and manufacturing facility In New Jersey (which also houses its corporate HQ) to CDMO Ardena. Last week Senator Elizabeth Warren called on the FTC to scrutinize Novo Nordisk’s planned acquisition of CTLT, stating the deal would give Novo an unlawful advantage in the obesity drug market. — PR

U.S. consumer groups and two large labor unions urged the U.S. Federal Trade Commission on Thursday to block Novo Holdings, the controlling shareholder of Novo Nordisk from acquiring contract drug manufacturer Catalent — Reuters

R1 RCM ($RCM) + TowerBrook, CD&R: "A group of banks led by Deutsche Bank AG launched a $3.3 billion leveraged loan package on Tuesday to help finance the buyout of hospital billing and payment company R1 RCM” — BB

Frontier Communications ($FYBR) + Verizon: Glendon Capital Management, owning nearly 10% of FYBR, plans to vote against Verizon's $38.50 per share acquisition at the Nov 13 shareholder vote, deeming the offer too low. Cerberus Capital Management, with a 7.3% stake, has also privately expressed that the offer undervalues Frontier, though their voting intentions remain unclear. — Reuters

Potential M&A News

Talks / Rumors and Other Potential Deals

Bausch + Lomb ($BLCO): PE firms TPG and Blackstone have teamed up to work on a joint acquisition bid for eyecare company Bausch + Lomb that could value it between $13-14 billion, or up to $25 per share. Bausch Health, BLCO’s parent company, is pursuing a sale process of BLCO to allow it to pay down its $21 billion debt load. The initial plan to spin off BLCO was opposed by Bausch Health’s creditors, including Apollo and Elliott Management. — FT

Expedia ($EXPE): Uber is in early talks to acquire travel booking company Expedia. — CNBC

23andMe ($ME) CEO Anne Wojcicki has been pitching numerous VCs on investing in a take-private deal that would “redefine 23andMe as a healthcare subscription business and a provider of genetic data.” Additionally, she told investors that the company would focus its efforts on marketing its database to pharmaceutical companies and researchers. — FT

Altus Power ($AMPS) launched a formal review of strategic alternatives, including exploring alternative ownership structures. AMPS has retained Moelis to assist with the review. — PR

Intel ($INTC): Qualcomm Said to Wait for US Election to Decide Intel Move — BB

Forward Air ($FWRD): Forward Air has retained two prominent investment banking firms to lead a formal sales process after a group of activist investors, including Clearlake Capital, Irenic, Ancora, and Alta Fox pushed the company to pursue a sale in the wake of its widely panned acquisition of Omnia Logistics early this year. — Freightwaves

Humana ($HUM): Cigna Group ($CI) and Humana resumed informal discussions recently about a potential deal after merger talks fell apart late last year. The talks are in the early stages. — BB

Offers

Kezar Life ($KZR), a biotech focused on immune-mediated diseases, rejected a non-binding acquisition proposal it received from Concentra Biosciences, which is controlled by Tang Capital — a 10% owner of KZR. The offer was $1.10 per share in cash plus a CVR to receive 80% of the net proceeds from licensing deals or asset sales. — Offer PR / Rejection PR

PHX Minerals ($PHX): WhiteHawk Energy reiterated its $4 per share all-cash acquisition proposal. — PR

Vanda Pharmaceuticals ($VNDA): Vanda rejected Cycle Pharmaceuticals’ reiterated $8 per share all-cash acquisition proposal. — Reuters

Territorial Bancorp ($TBNK) + Hope Bancorp ($HOPE): Territorial Bancorp warned investors that it has no faith in Blue Hill Advisors ability to execute its offer to acquire the company. Blue Hill issued a PR reaffirming their offer and urging shareholders to vote against TBNK’s acquisition by Hope. — TB PR / BH PR

GSE Systems ($GVP) + Pelican Energy Partners: GSE Systems rejected a non-binding offer from a third party as it was not superior to its current Pelican deal at $4.10 per share. — SF

Quick break to introduce ListingTrack.io!

ListingTrack.io is a follow-up to our former site, SPAC Track. ListingTrack features a radically improved user experience and access to a significantly broader dataset covering public listing events, including IPOs, SPACs, Spinoffs, and pre-IPO companies. There is also much more coverage in the pipeline, including Public M&A.

Here's a quick rundown of the site's coverage: Our Listing/IPO Hub covers all initial public listings (IPOs, Spinoffs, de-SPACs, and more) and delistings. The SPAC Hub is the new and improved home for SPAC Track’s SPAC and De-SPAC data.

Activism, Shorts, & Other Special Situations

Activism, Investor Disputes & Shorts

Activist Investors/ Disputes

Southwest Airlines ($LUV): On Monday, Activist Elliott Investment Management called for a shareholder meeting, formally launching a proxy fight. Elliott, which has amassed an 11% stake in LUV, wants shareholders to vote on 8 board candidates it has proposed to replace existing directors on the 15-person board (which LUV agreed to drop to 12 in 2025), including the former CEOs of Virgin America and WestJet. The airline will review the request as required but questions Elliott's motives, citing the "extreme nature" of its demands. — PR / CNBC

Later in the week, Elliott and Southwest began discussing a potential settlement that would avoid a proxy fight for control of the airline’s board. — BB

Air Products and Chemicals ($APD): Former Linde executives team up with Mantle Ridge in push for changes at Air Products — Reuters

Red Robin Gourmet Burgers ($RRGB): Activist investors, JCP Investment Management and Jumana Capital, take a stake in Red Robin — Restaurant Business

Lamb Weston (LW): Jana Partners has built a stake of roughly 5% in Lamb Weston and plans to push the struggling french fry maker to explore a sale. — WSJ

Kenvue ($KVUE): Activist investor Starboard Value has a sizable stake in Kenvue, the consumer-products company spun out of Johnson & Johnson last year that makes Tylenol and Listerine. — WSJ

GSE Systems ($GVP): Bradley Radoff issued an open letter to GVP’s Board urging it to reconsider its take-private acquisition by Pelican Energy Partners as the deal significantly undervalues the company. Radoff believes that GVP is starting to materially benefit from the nuclear industry resurgence and that the company should issue customary disclosures regarding the company’s projections so shareholders can make the most informed decision on the transaction. — PR

Shorts and Non-Investor Activism

Stride ($LRN): New short report from Fuzzy Panda Research titled ‘The Last Covid Over Earner – Hiding That Est >25% of EBITDA Came from Covid Funds’ — Fuzzy Panda

EOS Energy ($EOSE): New short report from Iceberg Research titled ‘Beware the Cerberus’ — Iceberg

Renovaro ($RENB): After Hindenburg’s February short report titled ‘A Worthless AI Shell Game With A Murderous Magician Past’, tweeted that RENB filed an update reporting that its CEO, Chairman, and 7 members of the Board have resigned. — X (fka Twitter)

Separations, Restructurings, and Other Special Sits

PE firm CD&R is close to acquiring a 50% controlling stake Sanofi's ($SNY) consumer health unit Opella after signing commitments with the French government. — BB

Additional coverage over the past week: CD&R is preparing safeguards for French operations. The French government, scrutinizing the deal, will require commitments on jobs and local manufacturing, and it may be required that state-owned investment firm Bpifrance takes a stake. Beyond the economic concerns, the French government is especially attentive to the deal due to Opella's sales of over-the-counter medications in France, including Doliprane, the country's most-used pain reliever. — BB

CD&R close to finalizing €8.65 billion buyout debt with 22 banks including Goldman and Citi. — BB

Levi Strauss’ ($LEVI) CFO Sees a Dockers Sale Happening in Six to Nine Months — BB

Boeing ($BA) is exploring asset sales that could bring in much-needed cash while shedding noncore or underperforming units — WSJ

Bankruptcies/ Delistings

Fisker (FSRNQ) shareholders were wiped out as its bankruptcy plan became effective.

Shift Technologies’ (SFTGQ) existing shares were canceled worthless as its bankruptcy plan became effective.

Others downlisted to OTC:

IX Acq. Corp (IXAQ —> $IXAQF), Focus Impact BH3 Acq. Corp ($BHAC), Seelos Therapeutics ($SEEL), Orange American (ORAN —> $ORANY), Alpine 4 Holdings ($ALPP), Orgenesis ($ORGS)

Click here to view the Delisted & Downlisted companies that launched their initial public listings in 2020.

If you found this summary helpful, consider sharing the newsletter with a friend or colleague!

Thanks for reading,

The team at ListingTrack

Market Data and Coverage: All market data presented is based on the stock prices at the close of the previous trading day. We cover the US market only at this time.

Abbreviations: PR: Press Release, SF: Company SEC filing, IP: Investor Presentation, BB: Bloomberg.

DISCLAIMER: The information provided in this newsletter is for your convenience only and is not intended to be treated as financial, investment, tax, or other advice. ListingTrack and its parent, CommonFi, do not make any guarantees, representations, or warranties as to, and shall have no liability for, the timeliness, truthfulness, sequence, quality, completeness, or accuracy of any of the information or data provided in this newsletter or on the ListingTrack website.